Balance Risk & Reward If You Plan to Restake

|

| By Jurica Dujmovic |

Ethereum (ETH, “A-”) already has plenty of hype. And for good reason!

More than just being the second-largest crypto by market cap, Ethereum is the largest smart-contract blockchain. That makes it a large part of the core infrastructure for decentralized finance, or DeFi.

And one DeFi offering — restaking — is turning that buzz into something more concrete. And controversial.

That’s because while it allows users to free up liquidity and earn even more yield on their existing tokens … it can be incredibly risky.

Let’s peel back the layers …

What Exactly Is Restaking?

To understand restaking, we first have to start with staking.

Staking is the process of locking up your digital assets on a blockchain network to help maintain its security and validate transactions in exchange for rewards.

As a proof-of-stake blockchain, Ethereum relies on stakers/validators to lock their ETH on its network.

But many people have a problem with the locking part. Understandably so, because it means they can’t access that liquidity any longer. And since the rewards you get for staking vary, users may feel their crypto can do better elsewhere.

That’s where restaking comes in.

It lets people use already staked ETH be reused to secure other protocols or services.

These other services are often called actively validated services, or AVS for short. Restakers pledge their staked ETH (or use liquid staking tokens) to back these AVSs to earn more rewards.

So instead of ETH sitting idle when staked, restaking says: “Let’s put that same collateral to work multiple places.”

It’s similar in spirit to financial “re-hypothecation.” The main difference here is that restaking is transparent and built into protocol designs.

Benefits: What Makes Restaking So Alluring

By reusing staked ETH as a shared security layer, restaking delivers more than just extra yield.

In fact, it has three big benefits beyond additional rewards for users:

-

Shared Security: Normally, a new blockchain or protocol has to recruit its own group of validators. With restaking, they don’t need to.

Instead, they can “tap into” Ethereum’s existing security network. This makes it much faster and cheaper for new projects to launch safely.

- Capital Efficiency: Staked ETH already does one job; restaking lets it do two (or more). Instead of locking ETH and letting it wait, restakers can extract additional yield.

- Faster Innovation & Experimentation: With security available off-the-shelf, builders can focus on features, user-experience, composability, etc. Restaking essentially creates a security marketplace, where projects can pick and choose the protection they need.

What the Numbers Say: Adoption & Scale

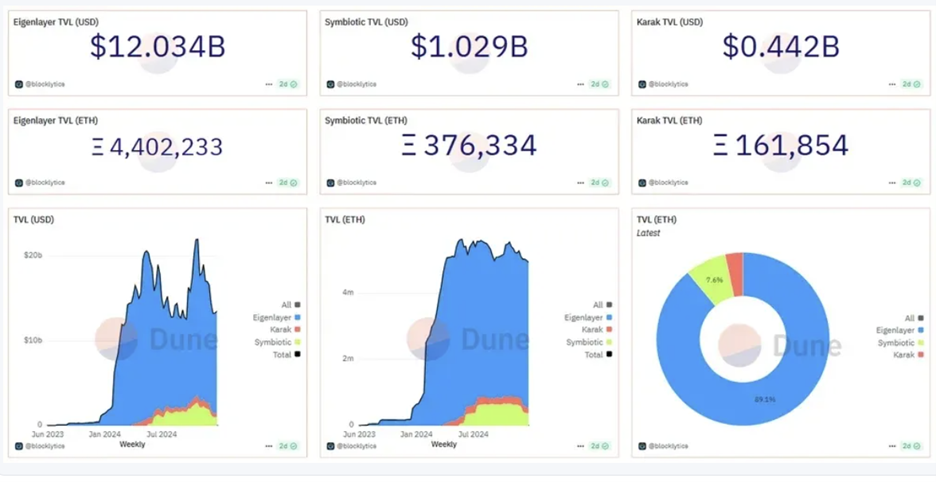

EigenLayer — which I wrote about previously — remains the dominant restaking protocol.

As of mid-2025, it holds approximately 4.4 million restaked ETH. That’s about 89.1% of all restaked ETH.

Its Total Value Locked sits around $12.0-12.1 billion, far ahead of competitors like Symbiotic which has a TVL of ~US$1.03 billion, or Karak with roughly $442 million in TVL.

Across the restaking ecosystem more broadly, TVL has recently hit an all-time high of near $28.6 billion.

Even though we’re still in the early days, it’s obvious restaking is more than a niche: It’s on its way to becoming a structural piece of Ethereum’s economic security.

Risks: What Could Go Wrong

If you’ve been following my updates for a while, you’ll know that I always look at both sides of the coin.

Because while I want to bring you all the cutting-edge opportunities only found in crypto, I also want you to be prepared for the risks.

When it comes to restaking, here are the most salient danger zones to be aware of:

- Smart Contract Risk & Protocol Fragility: Restaking adds more moving parts — more smart contracts, additional logic, new dependency relationships, etc. A single bug or exploit in the restaking layer or in an AVS could ripple through the rest.

-

Slashing & Contagion Risk: If a validator cheats or a service they’re backing breaks down, part of their staked ETH can be taken away — this is called slashing.

Because the same ETH can be pledged to multiple services at once, one failure could ripple outward, hurting not just that service but potentially Ethereum’s base layer or other projects tied to the same stake.

- Centralization & Concentration: Big validator operators or services that manage restaking may become dominant. If many restakers funnel through a few operators (or use the same AVSs), risk of a single point of failure or undue influence increases.

- Complex Incentives & Liquidity risk: Because rewards and penalties may differ across services, restakers must evaluate risk versus return carefully. Also, lock-ups, and withdrawal delays may be longer if the restaked ETH is tied up in multiple layers.

So where does all this lead?

In the best-case scenario, restaking matures into a well-oiled machine:

- Standards emerge,

- Risk is shared transparently,

- And new tools make it easier for validators to avoid getting blindsided by slashing.

These features would ensure that Ethereum’s validator set stays broad and decentralized while AVSs multiply without piling on too much systemic risk.

In that world, Ethereum’s staking economy scales smoothly, and new chains or protocols can launch with the confidence that they’re backed by battle-tested security.

Rather than just a chain you build on, Ethereum could become the security backbone for web3. With a mature and reliable restaking structure, Ethereum could secure multiple layers, middleware, rollups, oracles, data-availability layers, etc.

In short, it could evolve into a “security provider as a service” model.

But the worst-case scenario is harder to ignore.

Picture a major AVS blowing up, or a critical bug in a restaking contract that drains billions. With so much ETH cross-pledged, the failure of one piece could ripple through the system like falling dominoes to damage Ethereum’s own credibility.

The risks are significant even without the worst case happening.

Centralization could quietly creep in, with a handful of giant validators dominating the restaking game. That would undermine Ethereum’s decentralization ethos. And it could also draw the attention of regulators who see too much risk concentrated in too few hands.

And then there’s the gray area in between.

Does restaking ultimately unify Ethereum’s ecosystem by creating a single dominant security layer? Or does it fragment things further, with rival restaking protocols competing and potentially diluting Ethereum’s security?

There’s also the question of leverage: At what point does stacking too many promises on the same pile of ETH tokens turn the foundation itself into something fragile?

To Restake, or Not to Restake

Restaking isn’t just a technical upgrade; it’s a political and economic shift.

It changes the bargain between builders, validators and users.

For developers, it promises plug-and-play security that lowers the cost of experimentation.

For validators, it offers juicier rewards but with a heavier sword hanging overhead.

And for Ethereum itself, it raises the stakes: Successful restaking could find itself entrenched as the backbone of web3. But failure could turn its greatest strength — its massive pool of staked ETH — into a systemic liability.

That tension is exactly why restaking has become one of the most debated experiments in crypto. And the truth is, we won’t know what will happen until the stress tests arrive — whether that’s from a major AVS meltdown, a black-swan bug or simply the slow creep of centralization pressures.

If you’ve been looking to add staking to your crypto strategy and top off your capital gains with yields, you’ll definitely find plenty of opportunities.

In fact, my colleague Marija Matic has helped her Crypto Yield Hunter members do exactly that with great success!

Three of their positions are solely in stablecoins and earning double-digit APYs. And two of their more volatile positions have brought in over triple-digit returns.

But if you are interested in restaking, I urge some additional caution in these early days.

Never risk more than you can afford to lose … no matter how juicy the potential rewards.

Best,

Jurica Dujmovic