|

| By Bruce Ng |

Decentralized finance, or DeFi, is the true frontier of crypto.

DeFi is a sector within crypto that aims to remove third parties and centralized institutions from financial transactions.

All the platforms and projects in DeFi are currently, or are working to become, noncustodial. For a new DeFi project to even have a hope of succeeding, it must embrace the core crypto ideology of “not your keys, not your crypto.”

In short: DeFi allows you access to financial platforms — that offer lending, borrowing, trading, insurance and interest on your crypto — without you ever needing to give your crypto to a third party.

How?

Through smart contracts — algorithms of “if/then” code that run on a blockchain when certain conditions are met. Basically, “if” a condition is met, “then” the code is enacted. The action is then recorded and verified on the blockchain.

For example, let’s say you’ve got some Ethereum (ETH, “B+”) sitting in your crypto wallet.

You’re not planning on selling anytime soon. So, you decide to lend your ETH to a reputable DeFi platform in return for a reward, an act called liquidity providing.

When you connect your soft wallet (e.g., MetaMask) and lend your ETH, you enact a smart contract. One that says if there’s an Ethereum transaction on the platform, then you get a percentage of the fees received by that transaction. This happens because you provided the liquidity (your ETH) that allowed the platform to function.

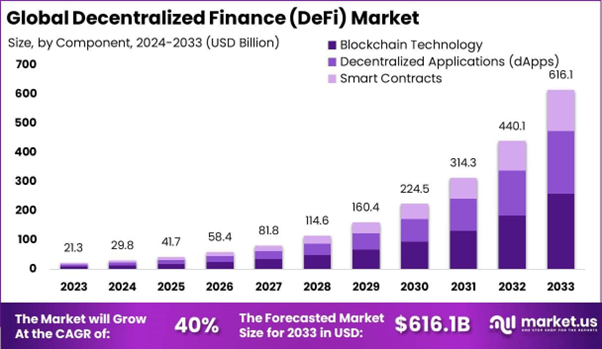

The DeFi sector was valued at $29.8 billion in 2024. And that’s expected to grow to $616.1 billion by 2033.

This surge represents a robust CAGR of 40% over the decade from 2024 to 2033.

That means there is more opportunity ahead for DeFi projects.

You could target those individually. Or, you can take a “pick and shovel” approach and invest directly in the blockchains that are pushing the limits for what DeFi can do.

And in this bull market, one of the most notable winners has been Solana (SOL, “B”), a Layer-1 built for DeFi.

Thanks to its speed and low transaction fees, Solana quickly soared in popularity … and in price. From September 2023 to its all-time high established on Jan. 19, 2025, SOL soared 1,416.6%! And even in this correction, it is still 539% higher than at the start of this bull market.

Solana now stands next to Bitcoin (BTC, “A”) and Ethereum as a leader of the broad crypto market.

If you missed the Solana train, don’t worry. There’s another Layer-1 out there that, while new, has big potential.

The New Bear on the Block(chain)

Berachain (BERA, Not Yet Rated) is an EVM-compatible Layer-1 blockchain built on the Cosmos SDK. That means it can interact with both the Cosmos and Ethereum ecosystems … and attract developers from both.

Additionally, it uses a proof-of-liquidity (PoL) consensus. PoL means investors in the platform’s liquidity pools can participate in validating transactions — and collect the fee for doing so.

Berachain’s tri-token system boasts fast transactions, low fees and scalability with a focus on DeFi applications.

Specifically, its value lies in enhancing DeFi efficiency. It offers modular blockchain development through BeaconKit and supports a robust ecosystem of dApps, including …

- The decentralized exchange BEX,

- DeFi platform Apiarist Finance, which offers yield farming, staking and lending services, and

- Boink, a Berachain-native blockchain game where players can earn BERA.

The founding team is pseudonymous, with names like Dev Bear, Man Bera, Smokey the Bera and Papa Bear.

But don’t let that confuse you. This team brings extensive DeFi experience.

Combined, the team’s background in investing and participating in DeFi ecosystems has shaped Berachain’s focus on liquidity and governance innovation. And they’ve received support of over $100 million from notable VCs like Polychain Capital and Outlier Ventures.

The Bear Facts

Over the past month, posts on X (formerly Twitter) indicate sustained hype after Berachain’s official mainnet launch on Feb. 6 as sentiment was buoyed by a strong total value locked at $3.5 billion and PoL’s real-world activation.

Remember, total value locked is a measure of how much liquidity is locked on a platform or blockchain. And it also acts as a measure of active usership.

The community, rooted in early NFT projects like Bong Bears, remains engaged, though price volatility may have tempered some enthusiasm.

Overall sentiment appears bullish … but cautious due to the volatility we’ve seen recently in the broad market.

In terms of fundamentals, Berachain has one of the best total value locked/market cap ratio in the game. (When it comes to this ratio, lower is better.)

Berachain is ranked sixth in the table below, coming in at 0.2 — one of the best numbers compared to the other top nine chains.

This chart also shows Berachain’s TVL over the past month has grown a phenomenal 116%! That would be impressive on its own, but doubly so when compared to negative values across the board for all the other chains.

Not too shabby for a newly launched chain!

Berachain’s market cap sits at $677 million, with only 108 million BERA tokens currently in circulation. Its fully diluted supply is 500 million tokens, which makes its fully diluted valuation $3.14 billion.

Potential Red Flags

No crypto is flaw-proof, and that includes Berachain.

The trick when it comes to investing is knowing what flaws are fixable … and what could kill a project.

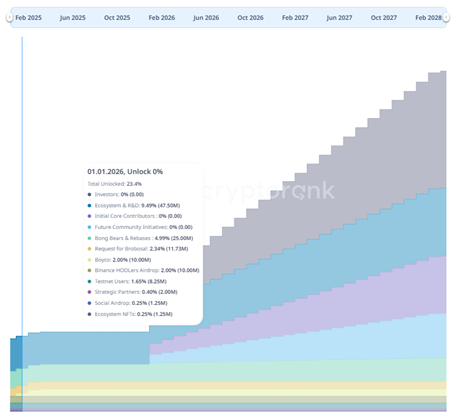

For example, Berachain has solid tokenomics right now. However, that could be because it has a one-year cliff. That means coins bought by early investors — including venture capital firms, seed investors and early retail investors — are locked up for a year from the Token Generation Event (TGE).

As we can see in the chart above, the circulating supply jumps from 23.4% to 38.1% on Jan. 1, 2026, and again from 38.1% to 67.5% the following year.

This flood of supply could severely impact the price of BERA once this unlock period comes.

Other concerns include:

- Price Volatility: Significant drop from $14.83 to $6.24 post-launch suggests risk of further corrections.

- Regulatory Uncertainty: DeFi-focused L1s face potential scrutiny, which could impact operations.

- Competition: Established L1s like Ethereum and Solana pose adoption challenges.

- Pseudonymous Team: Lack of transparency may concern some investors.

To be honest, I don’t think most of these red flags will stay for long. Price volatility, for example, is something to note. However, you should also consider the broad market conditions BERA launched into on Feb. 6 — a time when the market was already correcting.

And, as my colleague Mark Gough has noted in the past, the Trump administration is taking noted steps to clarify the current regulatory crypto policy and create a more crypto-friendly environment in the U.S.

Even competition from established chains, while a serious headwind, isn’t an impossible challenge. After all, we saw how easily SOL was able to carve out its niche. And as an EVM-compatible blockchain, Berachain has made itself welcoming to Ethereum-based developers.

I believe the biggest drawback is Berachain’s pseudonymous team.

As crypto becomes increasingly regulated, known teams are a must to generate trust and target mainstream adoption.

If Berachain can address this issue, it stands to become a competitive DeFi focused L1.

If you’re a growth investor with a little more tolerance for risk, Berachain may be one to keep on your watchlist. Especially as DeFi continues to grow.

Best,

Dr. Bruce Ng