|

| By Bruce Ng |

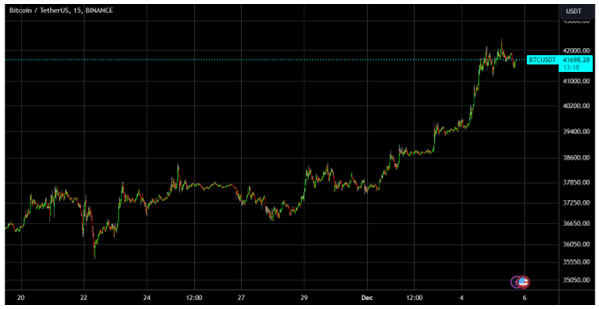

I told you last week that the lull we were seeing was a buying opportunity.

I’m glad I did, and I hope you took that to heart. Because this weekend, Bitcoin crossed resistance at $40,000 and has held there since.

Indeed, it even touched $42,000 before retreating only slightly. Now, $40,000 is acting as support.

If we break above $42,000, the next resistance will likely be at $45,000.

To the downside if $40,000 doesn’t hold, BTC is likely to land in the $37,000 to $38,000 range, but further correction from there is unlikely given the current market conditions.

And it wasn’t just Bitcoin that woke up from its nap. In true altcoin fashion, the alts followed suit and saw a generous pump across the board.

As I said, buying opportunity.

Trying to get a glimpse into the future, let’s look at Bitcoin derivatives.

Bitcoin’s current open interest is $18.2 billion — the highest value of the year. Still, that’s not by much, so I wouldn’t say that the derivatives market is overheated. In fact, with the recent price increase, I’d say the increase in OI is to be expected.

That means this small move up is healthy and not a sign of an overbought market.

In the coming week, we expect some macroeconomic forces to hit, namely the November CPI data and the next FOMC meeting. But I doubt either affect the price of BTC much.

Really, the only macro tailwind I consider worth watching is the potential approval for a Bitcoin ETF, for which there is an exciting update: According to James Seyffart of Bloomberg, the approval is highly likely to occur between Jan. 5 and 10, 2024.

You can listen to his full statement here.

If this is true, we won’t have much room for a breather this Christmas as I anticipate investors are going to try and load up before the ETFs get the green light to buy.

I much prefer we trade sideways for these next few weeks, as that sort of activity would give investors like you the best chance to finalize your portfolio before the bull market gets truly underway. But with the ETF approval imminent, there is a strong possibility it gets front run in a spectacular fashion.

If news leaks out of a confirmed ETF approval, anything above $50,000 for Bitcoin is a strong possibility. And with Ethereum spot ETF applications already circulating, I wouldn’t be surprised to see ETH surge on Bitcoin news, as well.

Alts will continue to do well in the meantime, so don’t miss this chance to load up on your favourites.

And if you need help sorting through the seemingly endless crypto projects, I suggest you check out my colleague Juan Villaverde’s Weiss Crypto Investor.

This easy-to-follow monthly newsletter breaks down the narratives driving the crypto markets and utilizes Juan’s proprietary Crypto Timing Model to identify the top assets in each sector and the best times to act.

You can learn more on our site here.

Best,

Dr. Bruce