|

| By Bruce Ng |

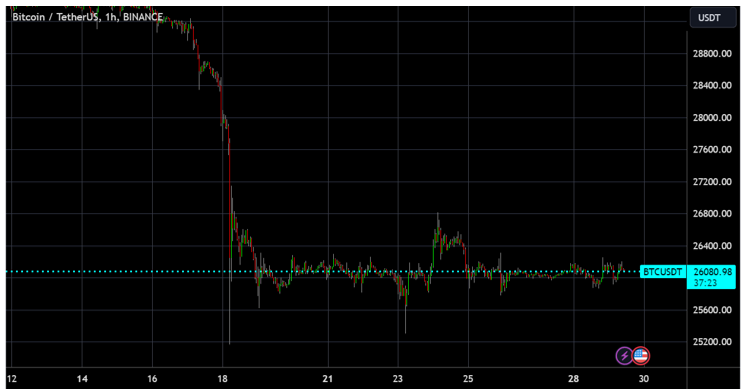

Last week, I predicted that Bitcoin (BTC, “B+”) would exhibit low volatility, and that if any move were to occur, BTC would shoot back up to the high $26,000s in the short term.

Now, if you look at Bitcoin’s chart below, we got that rise to the high $26,000s on Aug. 24:

Click here to see full-sized image.

But for the long term, I speculated that we are leaning bearish if the spot Bitcoin ETF decision continues to be delayed.

During the past two weeks, it’s been mostly a sideways chop. The main reason for this is that the market has not yet picked a side, as it awaits the news of the BTC ETF application dates:

Currently, it looks like most of these decisions will occur on Sept. 2. And there are only three possible outcomes: delay, approval or rejection.

For now, I believe the most likely outcome is still a delay.

Interestingly, one running theory is that financial giants like BlackRock (BLK) are causing this delay to accumulate more Bitcoin at lower prices. So, BTC’s price could go lower before the Securities and Exchange Commission’s potential approval of the ETF.

Either way, murky regulatory waters should clear up once we get the approval.

And once that happens, BTC could skyrocket to heights never seen before, coinciding with the BTC halving next year.

In the meantime, these are lifetime buying opportunities for both BTC and, of course, alts.

Now, looking at the short-term outlook (i.e., one to two weeks), I believe Bitcoin might head up to the $27,000 to $28,000 region if any rally occurs. So, if I had to pick a side, I’m leaning slightly bullish.

Then, in the medium term, I suspect there will be more downside.

If you look at Bitcoin’s history, August and September have been historically bearish months for this cryptocurrency. Just look at monthly returns for each year below:

With this in mind, I can envision two possible scenarios going forward:

- We could experience more sideways chop until the ETF decision on Sept. 2. If any rally were to occur, then we might see BTC go up to the $27,000–$28,000 range. But this rally will be temporary, only lasting about one to two weeks.

- In the medium term (i.e., one to three months), I’m expecting more downside. So, BTC might hit $25,000 again, as that is a strong support level. This could happen before the end of September.

Overall, if BTC experiences more downside, then that would be a good time to load up on Ethereum (ETH, “B”) and alts.

This should allow us to take advantage of the typically bullish months at the end of the year, as it’s usually bullish from November to January.

Best,

Bruce