|

| By Bruce Ng |

Two weeks ago, I said that price action would be heavily dependent on the Consumer Price Index data released on Aug. 10.

However, nothing eventuated from the publication of the CPI figures.

Then, the spot Bitcoin (BTC, “A-”) exchange-traded fund approval was pushed back by the Securities and Exchange Commission … and the market overreacted.

So, this leads me to believe that the pending spot BTC ETF approval by the SEC will play a more prominent role than CPI figures for the time being.

If you haven’t already, I recommend checking out my colleague Alex Benfield’s summary of this topic.

Now, in that same article from two weeks ago, I also said that Bitcoin’s price would sink down to the $28,000 support level if we were to see any dip.

What we got instead was a plummet to $25,000, which has proven to be strong support in the past. Again, I think the market overreacted to the delayed ETF news here.

Although my price prediction wasn’t perfectly accurate, I was right about one thing: After a low period of volatility, the ensuing price action will be violent.

This is demonstrated by the overreaction of the dip, plunging below $28,000 support and hitting $25,000. We are currently teetering on $26,000.

Click here to see full-sized image.

Right now, BTC is seeing where it can go from here. And the direction it picks will be heavily dependent on the spot Bitcoin ETF news.

Looking ahead, the crypto analysts here at Weiss believe there’s a strong likelihood that the SEC will delay the ETF approval. The good news is that they can only delay the decision until March 2024.

Indeed, this interview from Yahoo Finance discusses the likelihood of a spot ETF approval in the near term, and they aren’t too optimistic.

One running theory is that big financial institutions like BlackRock (BLK) are causing this delay to accumulate more BTC at lower prices. So, we might expect price to move even lower before the SEC approval.

Either way, murky regulatory waters should clear up when we get the approval.

And once that happens, BTC could skyrocket to heights never seen before, which could coincide with the Bitcoin halving next year.

In the meantime, these are lifetime buying opportunities for both BTC and, of course, alts. In fact, ETH and alts have demonstrated remarkable potential in the recent nuke.

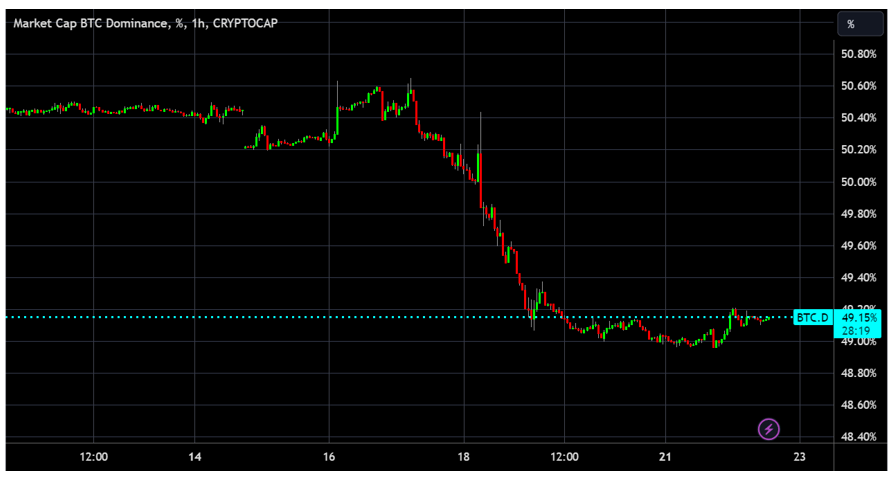

To illustrate this, let’s take a look at BTC dominance:

Click here to see full-sized image.

For ages, BTC.D was teetering near the 50% level and didn’t show too much activity.

After the nuke on Aug. 18, BTC.D dropped to 49%. As a result, alts have acquired a larger percentage of the total crypto market cap.

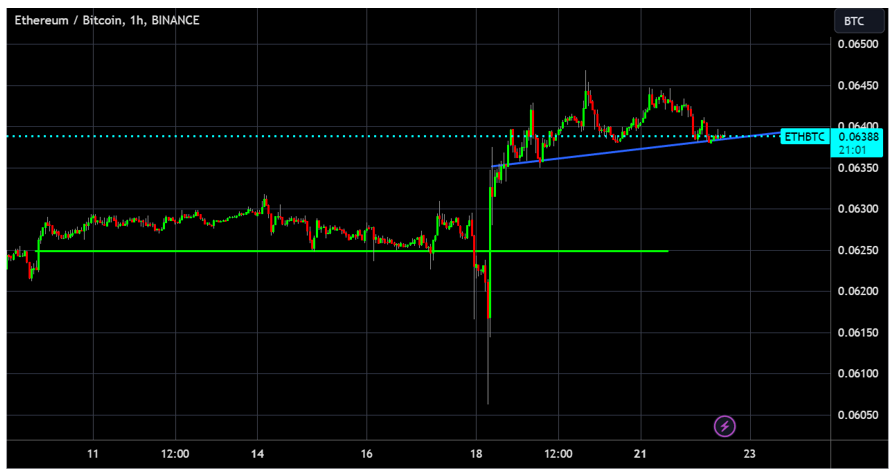

To strengthen this assessment, let’s consider the ETH/BTC ratio:

Click here to see full-sized image.

Prior to the Aug. 18 drop, ETH/BTC also exhibited record low volatility, hovering around 0.0625 support (green line).

But with the recent nuke, it has climbed higher instead, riding the blue uptrend line. This is bullish for alts.

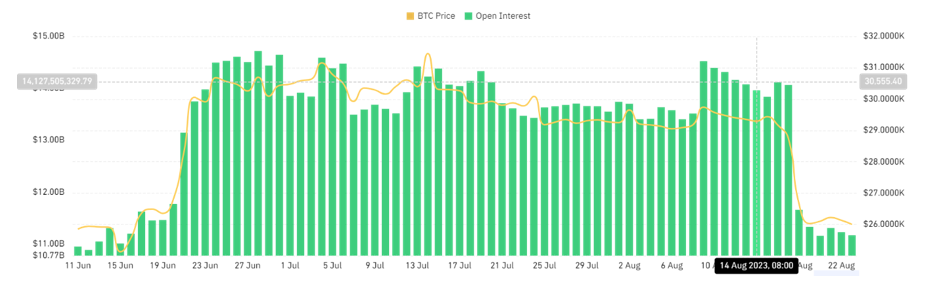

Next, let’s look at the open interest to get a better picture of where BTC is headed.

Prior to Aug. 18, the total OI was $14 billion. After the nuke, it plummeted to $11.6 billion.

So, OI is back to more reasonable levels, leading us to believe that more violent moves won’t occur anytime soon.

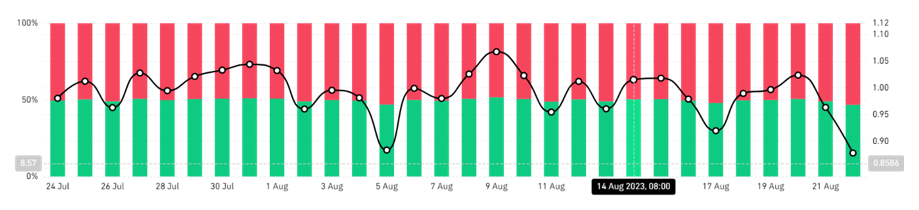

Now, let’s consider one last piece of information before we summarize the market situation:

In the chart above, we are looking at long/short ratio of 46.8% to 52.2%. In other words, there’s more shorts than longs.

So, it’s probably time for a short squeeze if any move were to occur.

Based on all the data above, I’ve come to three conclusions:

- After the recent nuke, I think BTC will exhibit low volatility. However, if any move were to occur, I would be leaning on the short squeeze side. And in this case, BTC should shoot up back to the high $26,000 range. This is only for the short term, though. In the long term (i.e., a one-to-three-month timeframe) I’m leaning bearish if the spot ETF decision continues to be delayed.

- The Ethereum (ETH, “B”) and altcoin dominance which is showing resilience could mean that this may be a good time to buy alts. In fact, certain subsectors like SocialFi, trading bots and memecoins did outperform the entire market during and after the recent BTC nuke.

- I’m leaning long in the short term (i.e., one to two weeks), so now is likely a good time to buy BTC, ETH and alts.

If you’re interested in finding out which quality alts can be held for the long term, I recommend checking out my colleague Juan Villaverde’s Weiss Crypto Portfolio.

I’ll be back next week with more market updates, so I’ll see you then.

Best,

Bruce