|

| By Bruce Ng |

In last week’s issue, I said that there were two possible ways Bitcoin’s (BTC, “A-”) price action would play out in the near term … either:

- It would pull back to test support at $28,000 as fear, uncertainty and doubt in DeFi dragged the broad market down. That would open the door to a BTC short squeeze that could send the price north of $30,000.

OR …

- We get the short squeeze from the current level of $28,900 and head above $30,000 anyway.

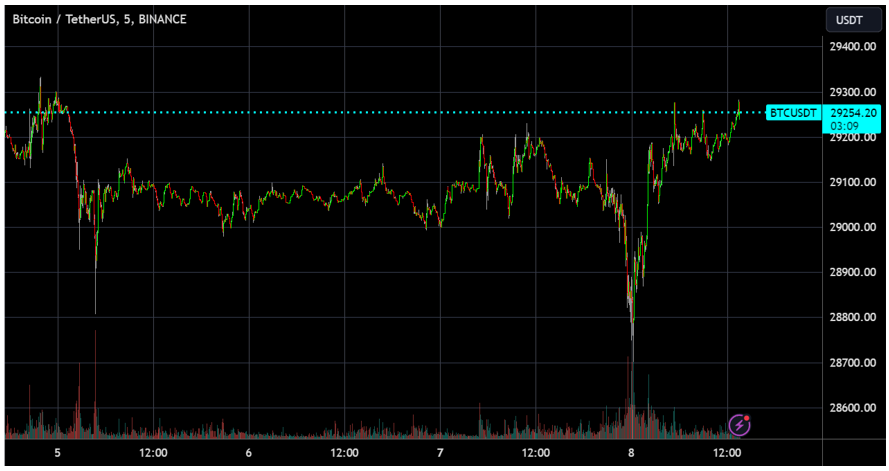

Well, we got our dip to $28,700 yesterday. And now, we are getting a rebound back up above $29,000.

So far, it looks like the first prediction is playing out … though it hasn’t been confirmed. According to our Crypto Timing Model, BTC still has not picked a side in this quagmire of low volatility.

Click here to see full-sized image.

The good news is that the fear in the market from the Curve hack is mostly over now that Curve has recouped 73% of lost funds. As I said last week, the negative sentiment was temporary. Panicked individuals let it get the best of them and traded the news. However, long-time HODLers and traders knew that the larger DeFi ecosystem would be fine in the long run.

What is more important to consider now is the low volatility and trading volume over the past week.

Now, summer doldrums are expected in the traditional market as people take time for themselves and step away from the markets. And though crypto doesn’t sleep … it certainly has seasons of quiet.

On the one hand, this means that it’ll take a lot more than a headline to push Bitcoin out of its latest trading range to the downside as support is holding strong.

On the other hand, however, it also means that we’ll need a strong catalyst to propel BTC above its current range, as well.

And at this point, we still are looking to Bitcoin to lead the market. Its market dominance hasn’t grown, but it’s holding steady in the 50%-50.5% range.

Click here to see full-sized image.

The next anticipated headline that could impact crypto will come later this week, when the July Consumer Price Index data is released on Aug. 10. It’s possible that market participants are waiting for the inflation data before they make a move.

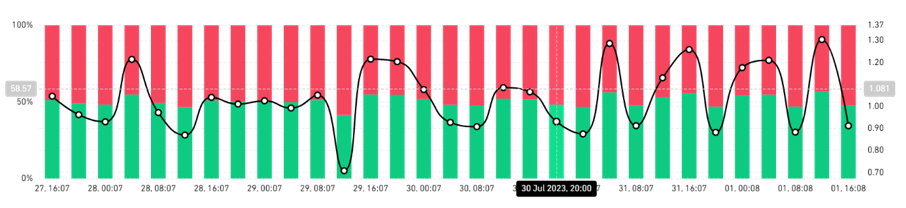

We can see that based on the fact that the Open Interest for futures across all centralized exchanges traded within a small range over the past week with no significant liquidations and hardly any change to the OI.

However, the long/short ratio did change slightly. Last week showed slightly more shorts — those betting on BTC going down — than longs — those betting on it going up. This week, that switched, with the long/short ratio sitting at 51.7% longs to 48.3% shorts.

Now let’s form our conclusions: We are still in a period of sustained low volatility. And again, whenever there are long periods of low volatility, the upcoming move is usually quite explosive.

But patience is the name of this game. Especially with the upcoming CPI data release. Over the next two days, we may see a long squeeze considering the long/short ratio, which could pull the price of BTC down.

After the inflation data is published, I see one of three scenarios playing out …

- If inflation is higher than anticipated: This would be bearish for BTC and the broad market. It could even prompt discussions over whether the Federal Reserve will raise interest rates again, tightening liquidity and making market conditions more difficult for a breakout. If this happens, we may test support at $28,000.

- If inflation comes in lower than expected: This is bullish for BTC and could spark a push to and maybe even above $30,000.

As you can see, trying to time the short-term price action in the market is a fool’s errand, even in periods of low volatility. It leaves too much room for error and not enough potential reward for the risk.

So, what should you do, or not do, while we wait for the market to wake up?

First, make sure you’re following our daily updates to stay informed on what’s happening in the market.

Second, shore up your security. Keep your cryptos in your own, self-custody wallet and off centralized exchanges. Remember, not your keys, not your crypto.

Third, look for opportunities to keep your crypto working for you even in low-volatility environments and for opportunities to earn crypto for free.

My colleague Juan Villaverde, for example, added a strategy to his Weiss Crypto Portfolio that involved selling ProShares Bitcoin Strategy ETF (BITO) contracts. Using it, his members were able to go for multiple rounds of 100% gains, keeping all the income from selling the contracts … during a bear market!

And that strategy doesn’t just work on BITO contracts. Our founder, Dr. Martin Weiss, recently recorded an emergency briefing breaking down this strategy and how you can use it to potentially take home $1,000 or more each week.

We won’t have this online for long, so I suggest you watch it now.

And finally, I’ll end this section with one last recommendation, but it’s what not to do: Don’t let emotion — FUD, FOMO or excitement — manage your trading.

It’s hard to “hurry up and wait.” It’s hard to see minor fluctuations in price and not act in such a quiet summer.

That’s why it’s so important to let the data lead your investing destiny, not your heart.

Best,

Bruce