|

| By Bruce Ng |

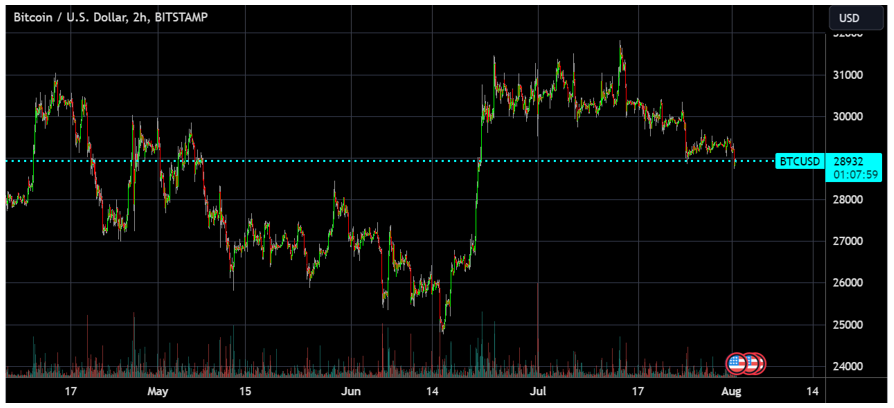

In last week’s issue, I predicted that Bitcoin (BTC, “A-”) could either head to $28,000 or head back above $30,000 after a temporary short squeeze.

Well, the short squeeze never materialized. So, we are approaching the $28,000 support level.

Now, this is most likely due to the fear, uncertainty and doubt swirling around DeFi heavyweights Curve Finance (CRV, “B-”) and Aave (AAVE, “B”).

If you didn’t already know, Curve — the most established decentralized exchange for borrowing, lending and trading stablecoins and other similar assets — was recently hacked. The gist of it is that bad actors were able to find a weakness in the programming language Curve uses for its smart contracts.

On top of the losses on Curve, this event also raised concern over potential liquidations on the Aave platform.

For further details, I recommend checking out my colleague Marija Matić’s detailed breakdown of the hack.

Looking forward, I personally believe these projects will bounce back with strength. So, they could potentially be good buying opportunities at this point.

You see, hacks are typically short-term FUD. That’s why we need to look at the bigger picture to see where the market is going.

On that note, let’s look at our usual BTC dominance chart:

Similar to last week, the past seven days have shown little activity for BTC.D. It continues to trade within a tight range, so once again, it has yet to choose a direction.

Next, let’s consider another piece of data to get a better picture of where BTC is headed.

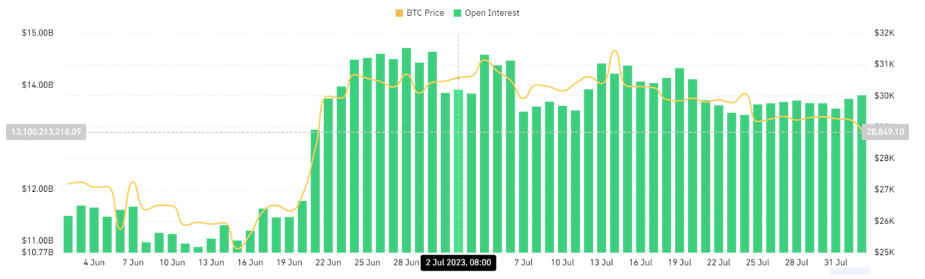

In the chart above, the open interest for futures across all centralized exchanges is displayed in green.

Over the past week, OI traded within a small range without any significant liquidations, much like BTC.D.

Currently, it sits at $13.8 billion, which is only a slight increase from last week’s $13.7 billion figure. In other words, there was hardly any change to the OI.

Since BTC.D and BTC futures OI aren’t providing many answers, let’s look at the Ethereum (ETH, “B”) to BTC ratio, which represents altcoin strength.

Right now, ETH/BTC is looking good. It’s steadily climbing up to approach the green uptrend line. And if ETH/BTC goes up, altcoins are also more likely to go up.

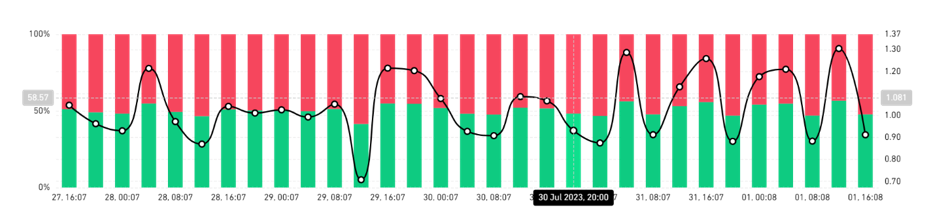

Finally, let’s look at the long/short ratio before we summarize the market situation.

Right now, the long/short ratio sits at 47.7% to 52.3%, with shorts piling up more now compared to last week.

Overall, this past week was marked by record low volatility. But whenever there are long periods of low volatility, the upcoming move is usually quite explosive.

So, for now, I’m thinking of two possibilities for Bitcoin’s near-term future:

- We continue to head to $28,000 support, with the DeFi FUD assisting in this move. But once we hit $28,000, we could have a strong rebound due to a short squeeze. In this case, BTC could head upward above $30,000.

- We get a short squeeze from the current level of $28,9000 and head above $30,000.

Either way, I’m leaning bullish for BTC at the time of writing.

As always, stay safe and remain patient as we wait for BTC to make a decisive move.

And if you would like a more in-depth analysis of high-quality alts to invest in for the long term, I suggest checking out my colleague Juan Villaverde’s Weiss Crypto Investor.

Best,

Bruce