|

| By Sam Blumenfeld |

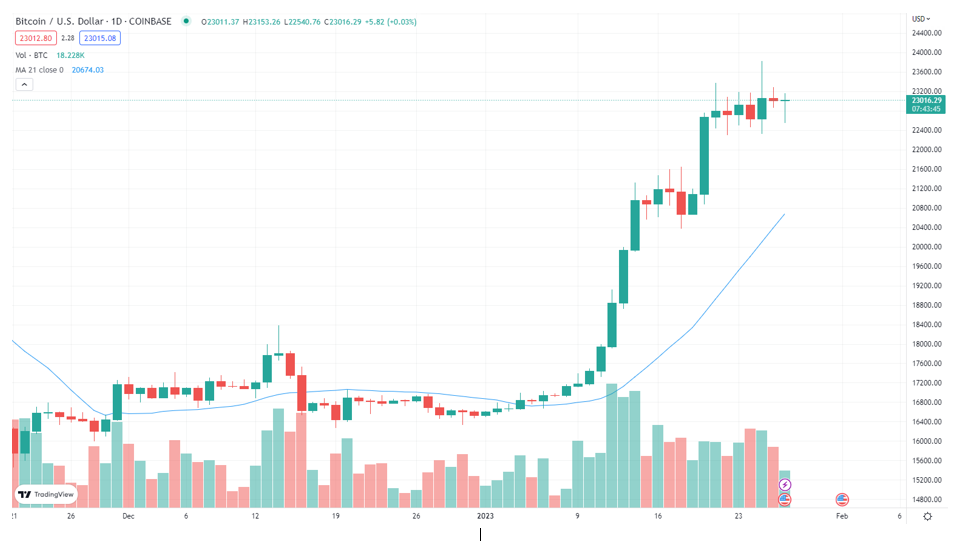

Earlier this week, Bitcoin (BTC, Tech/Adoption Grade “A-”) broke above its previous 80-day-cycle high.

That was the second signal we were watching to confirm that the crypto winter is finally in the rearview mirror. That means the bear market lows are likely in for most major cryptos.

However, the crypto market still faces several headwinds from the current macro environment, regulatory uncertainty and geopolitical instability.

As my colleague Alex Benfield said on Wednesday, this should not be a source of discouragement. Healthy corrections are to be expected and welcomed. They shake out the weak hands and set a strong foundation for the next move up.

A key component in navigating the ups and downs of the crypto market cycles is understanding the timing. That’s why, in anticipation of this event, Juan Villaverde and Dr. Martin Weiss held a Zoom conference. In it, they carefully explain not only the 80-day cycle, but how to trade it.

The recording of the conference won’t be available for long, so I suggest you watch it now.

Now, let’s turn to the recent action. Looking over at our market leader, Bitcoin, it is up less than a percentage point today as it sits near $23,000, well above its 21-day moving average.

Today’s gains bring BTC’s total since the start of January to 39%.

Its 9% positive weekly move could point to more upside if it can keep up momentum, though the potential of a correction on the horizon should still be kept in mind. We’ll be watching the $20,700 level to make that determination. If BTC breaks below, that would be enough to disrupt the rally.

Click here to view full-sized image.

In a switch from its performance earlier this month, Ethereum (ETH, Tech/Adoption Grade “B”) has been lagging behind Bitcoin this week as it struggles to gain the momentum needed to break past $1,600.

It is up about 2% compared with BTC’s 9% weekly gain. However, it’s down roughly 1% on the day. If daily price action continues on this track, ETH will post its fifth red candle in a seven-day period.

This is the latest sign that perhaps Ethereum is losing momentum in its rally sooner than Bitcoin.

While Bitcoin’s price action was decisive enough to call the end of its bear market, Ethereum has yet to sustainably overtake its early-November high. And while ETH’s prices have been stable so far, the divergence from Bitcoin could point to future weakness.

Still, it has plenty of room before retesting its bear market low of $880, and it is up 32% year to date.

Click here to view full-sized image.

Notable News, Notes and Ratings

- Another flurry of upgrades brings the total number of cryptos with a rating of “B-” or better to 15, bringing four more cryptos into “Buy” territory. Five cryptos are rated “B” or better, but Bitcoin remains the only crypto rated “B+” or better.

1. Bitcoin (BTC, Overall Grade “B+”)

2. Chainlink (LINK, Overall Grade “B”)

3. Ethereum (ETH, Overall Grade “B”)

4. OKB (OKB, Overall Grade “B”)

5. Polygon (MATIC, Overall Grade “B”)

- On-chain data is consistent with past bear market bottoms and could signal a strong buying opportunity. Among other technical indicators, major players are accumulating Bitcoin similarly to previous bear market lows in 2018 and 2020.

- A judge has denied multiple motions from Celsius users looking to regain control of their lost assets. The development follows a previous ruling that declared customers forfeited control to $4.2 billion in deposits.

High-profile failures of centralized exchanges and lending platforms like this reemphasize the importance of self-custody for crypto assets.

If you haven’t set up your own wallet yet or are interested in learning more about the various kinds of wallets, I suggest reading our “Weiss Guide to Crypto Wallets.”

- Tesla (TLSA) held on to its crypto stockpile of 9,720 Bitcoin in the fourth quarter. The automaker sold 75% of its Bitcoin in the second quarter for a $64 million gain, but it hasn’t made any adjustments since then. As of Dec. 31, Tesla’s Bitcoin was worth $184 million.

- Visa (V) CEO Al Kelly believes that stablecoins and central bank digital currencies could become an important part of the future of payments. The company explored an initiative that would enable blockchain interoperability in 2021, but its progress is unclear.

What’s Next

The crypto market has gained significant ground since the beginning of the new year, but a pullback can be expected once momentum dies down.

Nothing goes up in a straight line, and risk assets are still dealing with a higher interest rate environment and a potential looming recession.

The Federal Reserve’s next interest rate policy decision will follow the conclusion of its two-day policy meeting on Feb. 1. While the market fully expects a 25-basis-point rate hike, its forward-looking statements will shed more light on policy moving forward.

As the market grows increasingly optimistic for a pivot, a hawkish Fed could cause short-term downside. Regardless, the crypto market is in an excellent place to succeed as adoption grows and it moves past this latest bear market cycle.

Crypto’s constantly improving fundamentals are laying the groundwork for the next major uptrend.

Best,

Sam