Bitcoin Is Flying High; Be Careful Borrowing Against It

|

| By Mark Gough |

Bitcoin (BTC, “A”) is soaring once again.

At the time of writing, it’s knocking at the door of $110,000. And this time, it's not just fueled by retail frenzy.

Something has shifted for Bitcoin. And it’s happening on the institutional level.

You’ve likely heard that MicroStrategy (MSTR) has amassed over 580,0000 BTC. But it’s not alone.

An increasing number of companies are now adopting a "BTC treasury strategy." And they’re not just hoarding Bitcoin; some are even adding Solana (SOL, “B”), Ethereum (ETH, “B+”) and XRP (XRP, “B-”) to their balance sheets.

All this points to one thing: The tide has turned.

Add to that the ETF wave — which has unlocked billions in fresh inflows — and you get a crypto market with real momentum.

But with such momentum comes a familiar temptation. One we've seen play out in every previous cycle: leverage.

Sure enough, Cantor Fitzgerald and countless other companies have begun to offer BTC-backed loans.

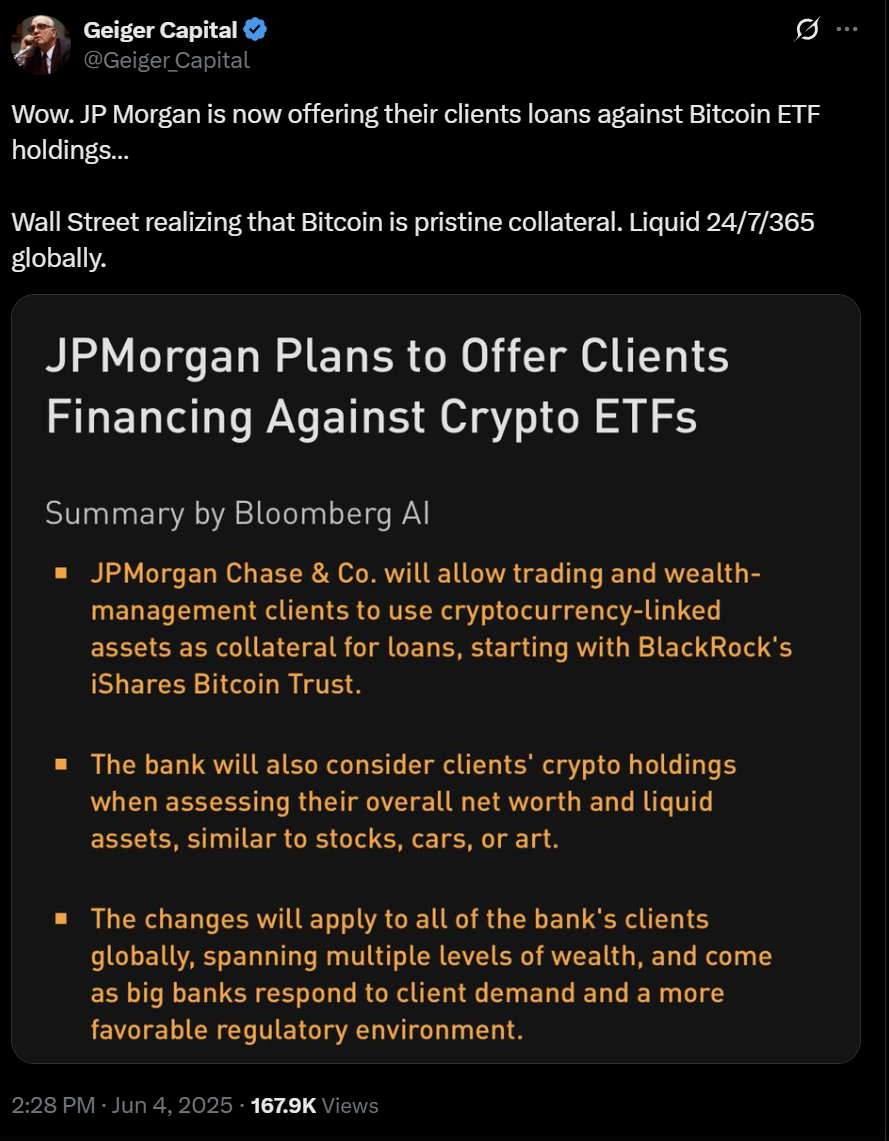

Even Jamie Dimon of JPMorgan Chase — who once called BTC a "pet rock" — has agreed to offer loans against BTC ETF shares, starting with iShares Bitcoin Trust ETF (IBIT).

Now, I’m not here to scare the "shite" out of you, as we say in Ireland.

But I do want to ring the bell when it comes to leveraging your Bitcoin. Because while it does offer opportunity, it also comes with a fair share of risk.

Leveraging Bitcoin’s Ethos

I will admit, part of my hesitancy around TradFi institutions accepting Bitcoin as collateral is based on principle.

As a libertarian at heart, I’ve always seen Bitcoin as a hedge against the old financial order — central banks, institutional control, government overreach, etc.

That’s why Satoshi created crypto in the first place. Bitcoin was a rebellion, born from the ashes of the 2008 financial meltdown.

It was designed as a tool for financial sovereignty.

So, while this wave of institutional adoption is undeniably bullish — and in many ways validates Bitcoin as a legitimate asset class — it also introduces a paradox.

On one hand, Bitcoin is finally earning the respect it deserves.

On the other, it’s edging away from its original ethos.

But in a more practical way, this shift could ultimately become the trigger for the next significant downturn.

Here’s how … and how to avoid getting caught in the mess.

The True Cost of BTC Loans

Lending desks are now offering Bitcoin-backed loans with APRs pushing 14%.

And it’s not just institutions diving in. Retail investors are being targeted too.

The pitch is smooth: Borrow against your BTC, stay exposed to upside and "let your assets work for you."

Sounds savvy on paper. But let’s break it down.

If you take a BTC-backed loan, you …

- Owe the entire borrowed amount.

- Pay a steep 14% interest rate.

- Still hold a volatile asset that can drop sharply.

- May face a margin call or forced liquidation if the price of BTC falls too far.

This matters most when Bitcoin is near its peak. That’s when confidence is at its highest, and euphoria blinds caution.

When leverage feels smartest … is also when it’s the most dangerous.

History Has a Message: The Leverage Gets Wiped First

I’m not sounding the alarm for a crash. As Juan Villaverde broke down in his latest update and I in mine, Bitcoin’s bullish outlook in the medium-term is shining bright.

We still expect more upside for the No. 1 crypto and select others in 2025.

But I do see a pattern in how the financial system reacts to this bullish environment. And how investors like us can get crushed the moment the tide begins to change.

With Bitcoin eyeing $150,000 this cycle, if not higher, I don’t want you in the path of danger.

So, here’s the pattern: Every cycle, overleveraged players get washed out.

That’s not fear-mongering. That’s a historical fact.

It happened in 2018. Again in 2020. And 2022? Well, we all saw the carnage.

Even stronger-than-expected corrections in bull rallies can do their damage. This past December saw $1.5 billion in leveraged positions liquidated when BTC pulled back.

Again, that was a normal, healthy bull market pullback.

Now think of when the bears take over. When that happens and sentiment shifts to fear, Bitcoin doesn’t just dip; it plunges.

And when it does, the first to go are those who borrowed heavily.

This cycle might be different … until it isn't.

Until Bitcoin proves it has outgrown extreme volatility, it remains a high-risk investment.

And using it as collateral? Now that’s even riskier.

So before you fall for the allure and borrow against your Bitcoin, here are three questions you should ask yourself …

- Can I cover my loan plus +14% interest … even in a bear market?

- Do I have enough liquidity outside my crypto to avoid forced liquidation.

- What happens if Bitcoin pulls a crypto and drops 40% in a week?

If the answers to any of these questions give you pause, borrowing may not be your best bet.

When it doubt, your default should be to protect your capital.

Stay Liquid, Stay Smart

Yes, crypto has powerful tailwinds this year. Institutional capital is flowing. Market narratives are aligned. Bitcoin is breaking into the mainstream.

But risk never sleeps.

Now is the time to think clearly, not emotionally.

If you're a long-term believer in Bitcoin, don't let a short-term liquidity squeeze unravel a 10-year thesis.

Protect your core.

Stay liquid.

And to find out which strategies our team of experts does recommend, I encourage you to watch our Crypto All-Access Summit.

It’ll go offline tomorrow night, so this could be your last chance.

Best,

Mark Gough