|

| By Marija Matic |

Bitcoin (BTC, “A”) is experiencing a global surge today!

While it’s still under its all-time high when valued in USD, BTC has already shattered its ATH when valued in the currency of other major economies like China, Russia, South Korea, India, Denmark and Poland.

Bitcoin has even surpassed its all-time when valued in euros! This is due to the euro's depreciation since November 2021, when Bitcoin last reached its peak.

So, how long do we have to wait until BTC breaks above its all-time high in USD near $69,000 (according to CoinGecko)?

Of course, we can’t know for sure. But the excitement is almost at its peak as BTC is sitting only $1,500 away. I can see it potentially breaking that barrier today or in the coming days.

If it does, it would be historic.

That’s because it would be the very first time Bitcoin established a new all-time high before its bullish halving event — which is still 47 days away.

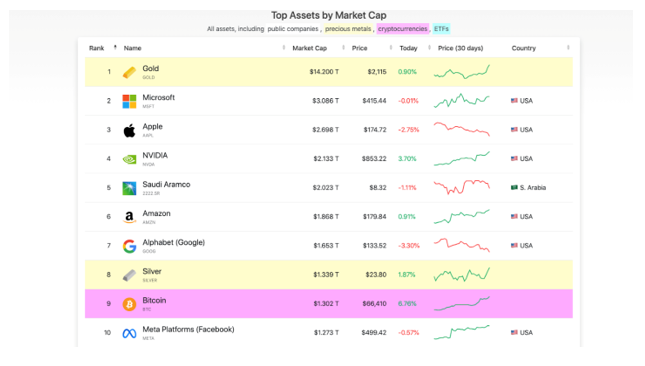

Bitcoin's market capitalization has also reached a record high, pushing past its previous $1.26 trillion peak with gusto to exceed $1.3 trillion. This means the price growth outpaces the increase in circulating BTC, which is very bullish.

But if that isn’t clear enough, I’ll explain it this way: Bitcoin’s meteoric rise today has pushed Bitcoin past Meta — Facebook’s parent company — as the world's ninth largest asset.

Just as incredible is that BTC also has potential climb to surpass even silver — yes, the precious metal silver — in the coming days.

With Bitcoin surpassing $66,000, all significant resistance levels have been broken.

The path forward to $69,000 and beyond has officially been cleared, which would usher in a phase of price discovery:

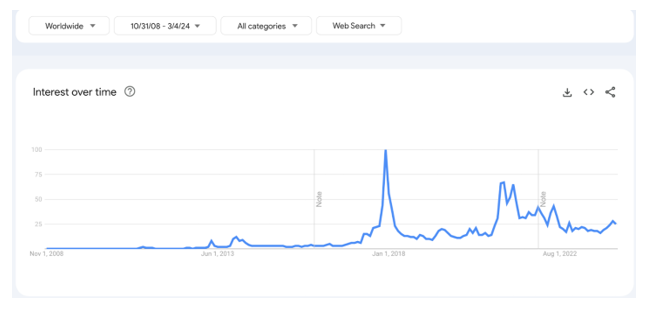

Interestingly, up to a few days ago, there was little notable retail interest, as indicated by Google search trends:

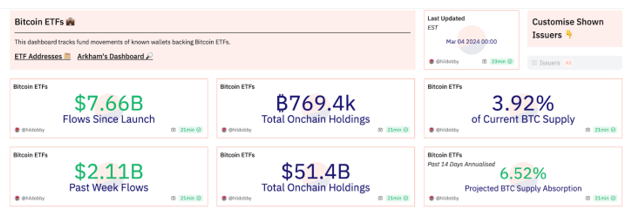

This suggests that the rally was primarily driven by traditional finance (TradFi) players, and strongly related to growing ETF demand.

Right before the ETF approval was announced, I reiterated that the spot ETFs would usher in a wave of adoption and would be an incredible bullish force on the market.

This is what I and the rest of the Weiss crypto team were anticipating. Though, even we are impressed by the speed and strength of this first bullish push.

In fact, digital asset investment products last week saw the second largest weekly inflows on record, totaling $1.84 billion. Weekly trading volumes reached a new record of over $30 billion, according to CoinShares data … with $1.2 billion coming from the spot ETFs alone.

As you can see, almost 4% of all Bitcoin in circulation is now held by ETF funds:

Not to be left behind, we’ve seen tremendous growth in select altcoin sectors, too. Namely memecoins, though that rally is being driven by retail, not institutional, investors.

The market capitalization of memecoins has now surpassed an astonishing $50 billion, as the market gets driven by changing, and sometimes ridiculous, narratives.

Clearly, retail investors are starting to knock crypto’s door again. And notable indicators from Google search trends show certain terms — including "ETH/BTC" chart, "crypto AI" and "DePIN" — are experiencing unprecedented levels of interest.

Adding to the fervor, centralized exchange giant Binance achieved a milestone last week, surpassing $100 billion in total assets.

I believe that in the coming weeks, we’ll continue to see retail interest rise. According to CryptoQuant data, the percentage of new investors holding assets from one day to one week has now skyrocketed to a remarkable 10.62%.

This level is reminiscent of October 2020 at the outset of the previous bull rally. Hopefully, this marks the beginning of another bullish trend.

Notable News, Notes & Tweets

- Top stablecoin Tether (USDT), which is approaching a $100bn in supply, has enhanced its resilience by introducing a recovery migration tool that preserves vital owner addresses and transaction histories in case any of the 15 supporting blockchains encounter issues.

- South Korea launches probe on Worldcoin as privacy concerns mount.

- The trader who spent only $310 to buy 2.58 million dogswifhats (WIF, Not Yet Rated) on Nov. 26, 2023 (currently worth $4.1 million) started to sell WIF for profits.

What’s Next

Data suggests that, with Bitcoin reaching $67,413, all BTC addresses would be profitable.

This means, going forward, sizable corrections stemming from overheating are not only possible but also beneficial and healthy.

In English, that level represents a selling opportunity, so don’t be surprised if we see scary pullbacks as well as crazy wicks to moon-heights in both BTC and altcoins.

That is the volatility crypto is known for. But if you can steady your stomach and ride it out, there’s more opportunity on the other side ... including the possibility of a $100,000 Bitcoin.

If your portfolio is already set for this run, hold on tight.

If it isn’t, you may want to take care of that soon. Ethereum (ETH, “B+”) and the altcoins will follow Bitcoin before long.

And if you’re looking for guidance on how to navigate this bull market and the narratives that drive it, I suggest looking into our Weiss Crypto Investor newsletter. My colleague Juan Villaverde uses our Weiss Crypto Ratings to target the best opportunities in each narrative. Then, his Crypto Timing Model flashes alerts to help you target the best time to act.

If you’re interested, you can read more here.

Best,

Marija