|

| By Sam Blumenfeld |

As my colleague Marija Matić pointed out earlier this week, the one bit of potentially bearish news that could throw a wrench in the market's recent bullish momentum — as Bitcoin (BTC, Tech/Adoption Grade "A-") had been holding strong near $47,000 early this week — was the EU vote.

The proposal on the table was to crack down on crypto transfers and self-hosted wallets. The vote took place yesterday, and the proposal passed despite industry criticism.

While this did cause a small pullback, it was temporary. Bitcoin didn't even test its 21-day moving average, near $43,000, and it's already moving higher again — up about 2% so far today.

Of course, nothing goes up in a straight line, and BTC will likely face selling pressure after major upward swings. But if it can continuously find support between $44,000–$45,000, the broad market is likely to continue to building momentum.

Here's Bitcoin's price in U.S. dollars via Coinbase Global (COIN):

Ethereum's (ETH, Tech/Adoption Grade "A") recent price action has outperformed Bitcoin's, as the No. 2 crypto by market cap is up 16% over the last month compared with the latter's 5% gain. Unlike Bitcoin, Ethereum has already erased the pullback caused by the EU tightening up its crypto regulations.

It was critical for ETH to reverse its trend of setting lower highs, which it was able to decisively overturn with its recent run of 15 green candles in the past 19 days. ETH now eyes the critical $3,500 level, which could result in another big move toward $4,000 if it's able to break through.

Ethereum is also trading well above its 21-day moving average, which sits at $3,000. It hasn't tested the level since March 16. While Ethereum would pull back if the market corrected further, it's a positive sign that the asset quickly found support above $3,200.

Here's Ethereum's price in U.S. dollars via Coinbase:

Index Roundup

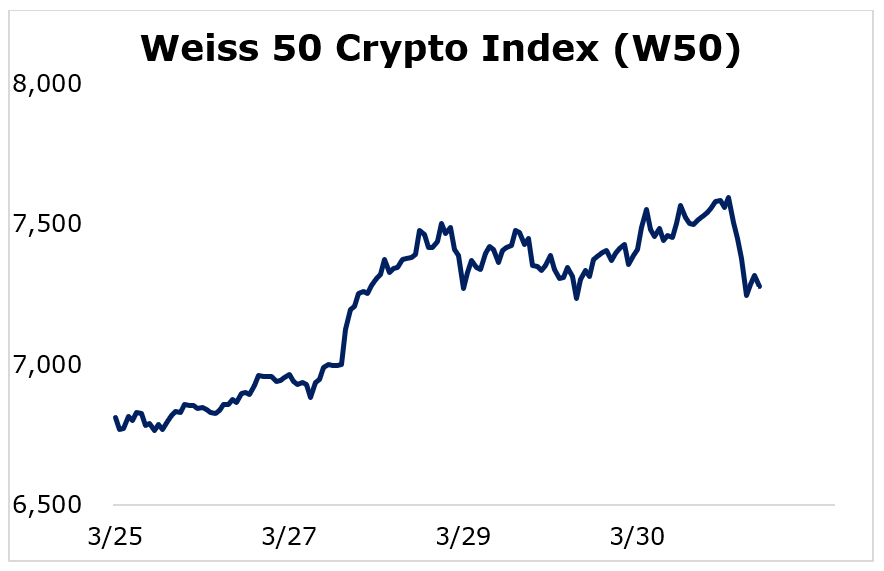

The broad crypto market logged a positive week despite the eleventh-hour pullback.

The Weiss 50 Crypto Index (W50) gained 6.82%, as most cryptocurrencies managed to finish the week higher.

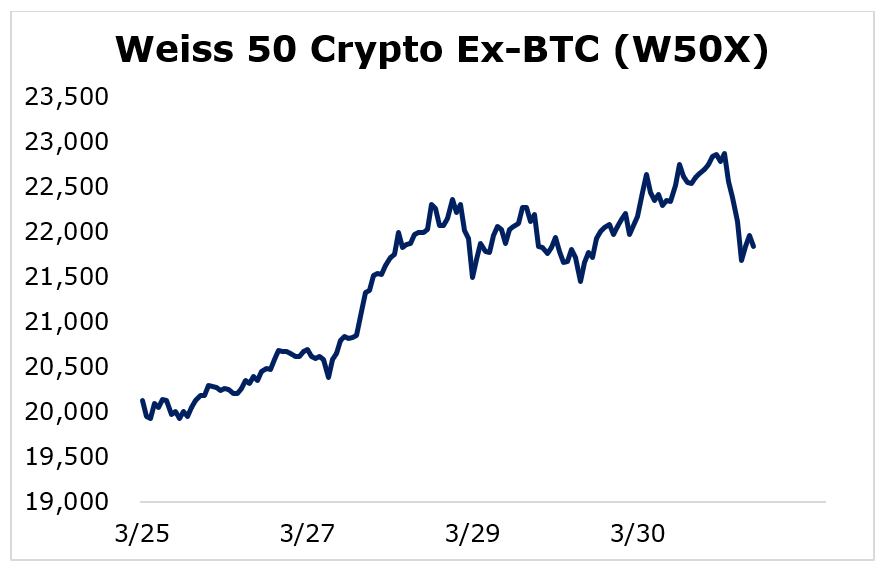

The Weiss 50 Crypto Ex-BTC Index (W50X) rose 8.49%, highlighting how Bitcoin underperformed relative to altcoins.

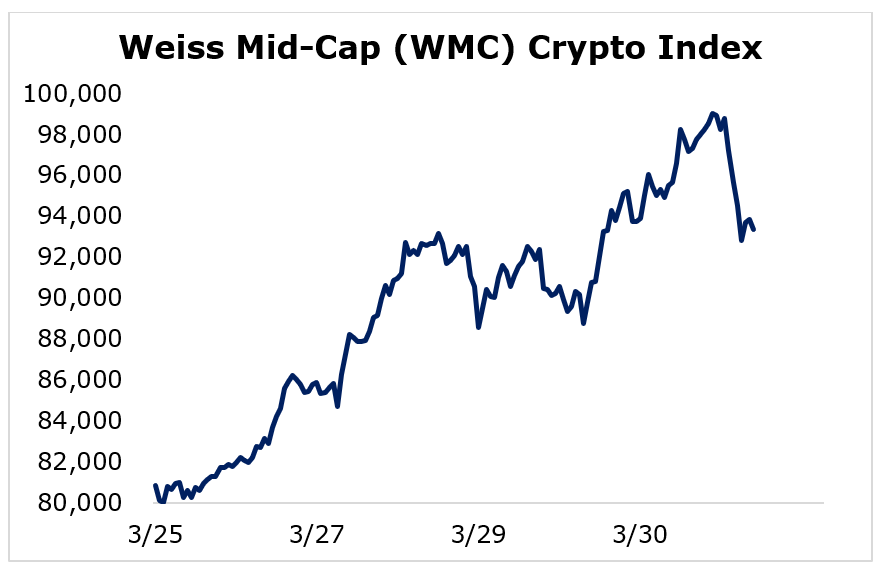

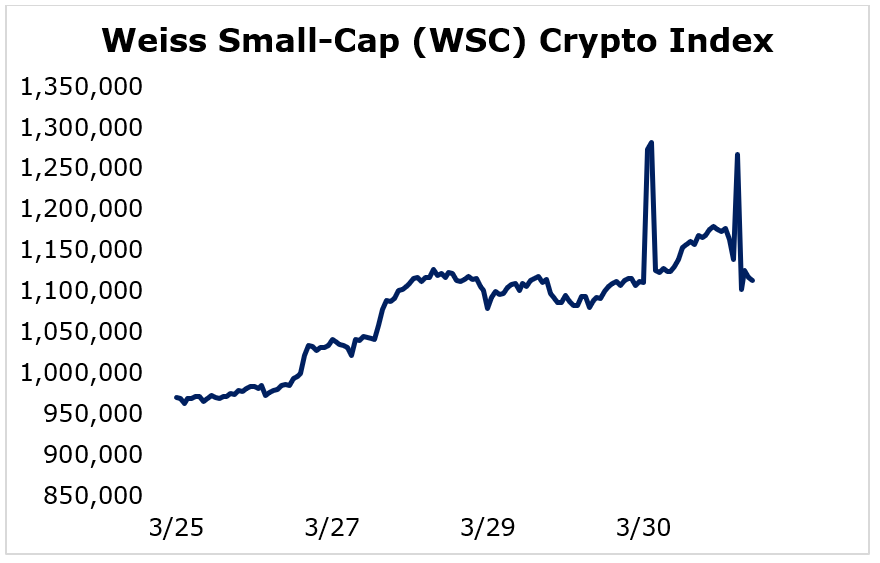

While the biggest players were able to maintain momentum, the gains were mostly seen in smaller and midsized projects, as you can see when we break things down by market cap.

The large-caps were held back by Bitcoin's underperformance, with the Weiss Large-Cap Crypto Index (WLC) increasing the least by only 4.18%.

The mid-caps managed to take the top spot this week, jumping an impressive 15.48%, according to the Weiss Mid-Cap Crypto Index (WMC).

The small-caps followed closely behind midsized cryptocurrencies, with the Weiss Small-Cap Crypto Index (WSC) rising 14.77%.

Due to its slight underperformance, Bitcoin's market dominance fell by 70 basis points to 42.1%. It now looks to test the lower bound of its sustained 42%–44% range.

Yet while altcoins have taken the lead this week, BTC's future movements will be critical for the altcoins that rely on the positive overall market direction.

Notable News, Notes and Tweets

- Pomp commemorates the milestone of the 19 millionth Bitcoin's being mined and points out its scarcity with only 2 million remaining.

- Some Ukrainian refugees are relying on crypto to safeguard their assets during a time of significant turmoil.

- An NBC News poll found that 21% of Americans traded or used cryptocurrency, with half of the male population between 18 and 49 turning to crypto.

What's Next

That the market is rebounding quickly following the EU's intention to tighten up its regulations is a positive sign. As is usually the case, the market initially overreacted to news about crypto regulations, but is quickly correcting.

That means recent bullishness isn't just driven by sentiment. There's some real momentum behind the climb.

Regulations are inevitable in the crypto space — an important stepping-stone on the path to crypto becoming fully mainstream. We're already seeing the effects of crypto's steady adoption, with more individuals than ever seeking exposure during uncertain times.

It's still too early to say how long this rally will run, or if it can reignite the bull market. But bullish prospects are much stronger now that the market staged a significant breakout during a period of neutral consolidation.

Volatile swings will happen, but early crypto adopters should be rewarded over the long term.

Best,

Sam