Crypto’s Bullish Trend Still on Track, Despite Volatility

|

| By Beth Canova |

The market-wide correction has intensified in the lead up to the halving, which is now just two days away.

Due to the fear, uncertainty and doubt flooding the market in light of this pullback, I’ll spoil the end of this analysis right now: This is near-term volatility, but the long-term bullish outlook for this year remains intact.

Let me explain …

Bitcoin (BTC, “A”) has shown impressive resilience in the face of downside pressure until today. Typically, BTC drops between -20% and -40% in the lead up to every halving, and usually pulls altcoins down with it.

Compared to price action leading to previous halvings, though, BTC has only dropped a much shallower 18% from its recent all-time high this time.

But that strength can prove a double-edged sword: It means an additional drop is still possible ahead of the halving.

Especially since we’re seeing a higher-than-expected correlation between Bitcoin and the TradFi markets, as this pre-halving correction has definitely been amplified by a major sell-off in the S&P 500.

It seems both the traditional and crypto markets are now cooling off after the overheated performance and record highs reached in Q1.

That’s why, despite the positive news that Hong Kong has, in principle, approved both a spot Bitcoin and Ethereum (ETH, “B+”) ETF, the crypto market remains subdued.

The initial excitement from two days ago fizzled out due to speculations of lower-than-expected inflows for these ETFs compared to their U.S. counterparts.

Analysts' predictions for Asian inflows vary widely, ranging from $500 million to a much higher $25 billion.

My colleague Mark Gough explained on Friday the massive impact that could have on the crypto market in the near future.

However, factors like the absence of major players in the Hong Kong market and potentially high fees could dampen demand, pushing inflows closer to the lower end of the estimates.

Hence, Bitcoin, continued to correct and is now testing a support area between $59,000 and $60,000:

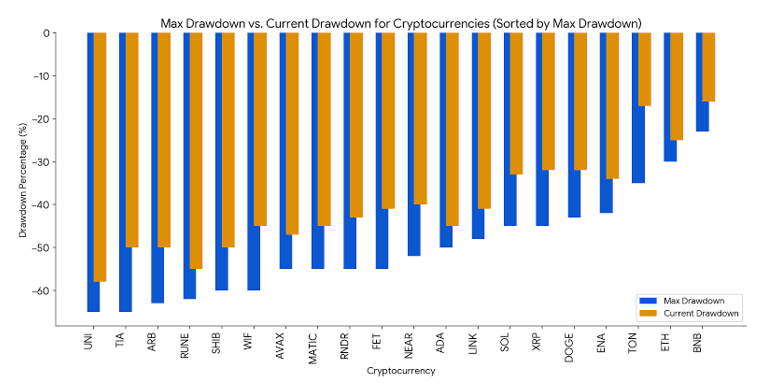

On the other hand, altcoins — which tend to be more volatile than Bitcoin — have continued their steep decline over the past week.

As expected, the severity is highly correlated with altcoin size.

Smaller altcoins have hemorrhaged over 60% of their value in recent weeks, highlighting the inherent volatility of the crypto market.

Let’s start with Ethereum, which usually leads the altcoins.

It’s down about 25% from its recent high. And while it is trading in a descending channel, it’s contending with a bit of a wild card.

Typically, this technical pattern would signal a breakout to the upside as that channel narrows. The upcoming Bitcoin halving can throw a wrench in that plan, however.

This highly anticipated event is likely to cause significant market volatility, potentially rendering any short-term chart patterns unreliable.

In short: Ethereum and the broad altcoin market are waiting for Bitcoin to make its move.

Given the possibility of a deeper Bitcoin pullback, further altcoin weakness is possible.

Below, you can see in yellow the current corrections for a few top altcoins. The blue underneath shows how much further they could drop if the correction continues:

Therefore, many investors may find it prudent to hold off on entering new positions right now.

As my colleague Dr. Bruce Ng explained yesterday, reducing your exposure to this near-term volatility should be a primary objective to mitigate risk.

So, does this mean the end of the bull market is in sight?

Not even close!

While a further price drop is possible if BTC follows past halving corrections, the long-term outlook remains bullish.

I’ve said it before, but I’ll say it again: The long-term bullish trend in is still on track even if Bitcoin dips to $50,700.

While the current volatility is making it risky to enter new positions, a much more favorable time is coming soon.

In addition to potential Bitcoin bullishness on the other side of the halving, ETH is expected to break out of a significant, seven-year trading pattern when compared to BTC this year.

This likely surge could trigger a domino effect, propelling not just ETH but altcoin prices as well.

The potential positive news regarding the long-awaited Ethereum spot ETF could fuel this bullish scenario even further, marking the beginning of the second phase of the crypto bull market.

And with so many cryptos out there set to explode at that time, we will be spoiled for choice to pick the ones most likely to outperform.

In fact, we’ll be so spoiled, picking true winners will be a bit of a challenge.

See, the rising tide of a bull market rally will lift most altcoins. But only some will generate the returns that crypto is infamous for.

If you want to learn how to narrow down your choices to invest in only the most promising opportunities I suggest you watch my colleague Juan Villaverde’s recent briefing, 205x Better Than Bitcoin.

In it, he explains how he identifies the best growth opportunities — what he calls “crypto wonders” — as well as his “backdoor” buying strategy that helps him maximize his potential profits while doing so.

With the Bitcoin halving coming up, we’ll be taking this briefing down soon. I suggest you watch it before we do.

Then, buckle up and hold on tight. Exciting times are ahead!

Best,

Beth Canova