|

| By Sam Blumenfeld |

Geopolitical tensions and Federal Reserve policies continue to move the cryptocurrency and traditional equity markets.

The crisis in Ukraine has worsened sentiment for risk assets, but markets saw brief relief after Fed Chair Jerome Powell backed a smaller impending rate hike of 25 basis points.

Here's what that means for the two biggest cryptos by market cap:

- Bitcoin (BTC, Tech/Adoption Grade "A-") is trading 7.5% lower today, sitting just below the critical $40,000 price level.

- Ethereum (ETH, Tech/Adoption Grade "A") is down 7.65% in the last 24 hours as it looks for support above $2,600.

- Bitcoin's crypto market dominance increased another 60 basis points to 43.7%. The market leader generally increases its share during periods of turbulence.

It's been a volatile ride for crypto over the last several months … and as you can see, this week has been no different.

For those of you who follow its chart, Bitcoin logged a massive daily green candle on Monday when it increased from about $37,500 to $44,250. It has formed a triple-top pattern since the beginning of February, with the asset struggling eclipse $45,000 on three separate occasions.

Here's Bitcoin's price in U.S. dollars via Coinbase Global (COIN):

BTC has faced consistent selling pressure during each attempt, and the asset just crossed below its 21-day moving average (MA). However, it's fared better than much of the broader market.

Bitcoin is a relative safe haven in crypto compared with the more speculative projects. It would be a better sign for the broader market if it managed to regain its short-term momentum.

Meanwhile, Ethereum has struggled to generate significant momentum. Its chart has looked worse than Bitcoin's since the beginning of February's relief rally.

Specifically, ETH labored through each of the three recent drops. Instead of continuing to test resistance like Bitcoin, Ethereum set lower highs.

Here's Ethereum's price in U.S. dollars via Coinbase:

ETH fell below its 21-day MA yesterday, and it has continued sliding with the broader market today. It will be important to see if the second-largest crypto manages to find support at either $2,600 or $2,500.

If Ethereum continues faltering among the added uncertainty, it's likely that we'll see most other altcoins follow its path.

Index Roundup

Although the crypto market is slipping today, it finished the seven-day trading week ending Thursday in the green. Most of the market moved in tandem, minus the midsized cryptocurrencies, which outperformed.

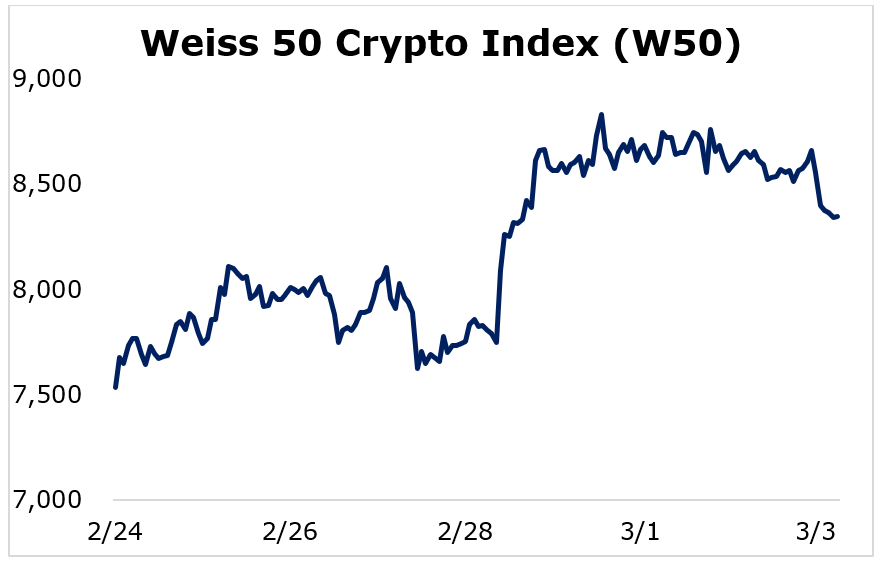

The Weiss 50 Crypto Index (W50) gained 10.79%, with most of the crypto market recording solid gains during the week.

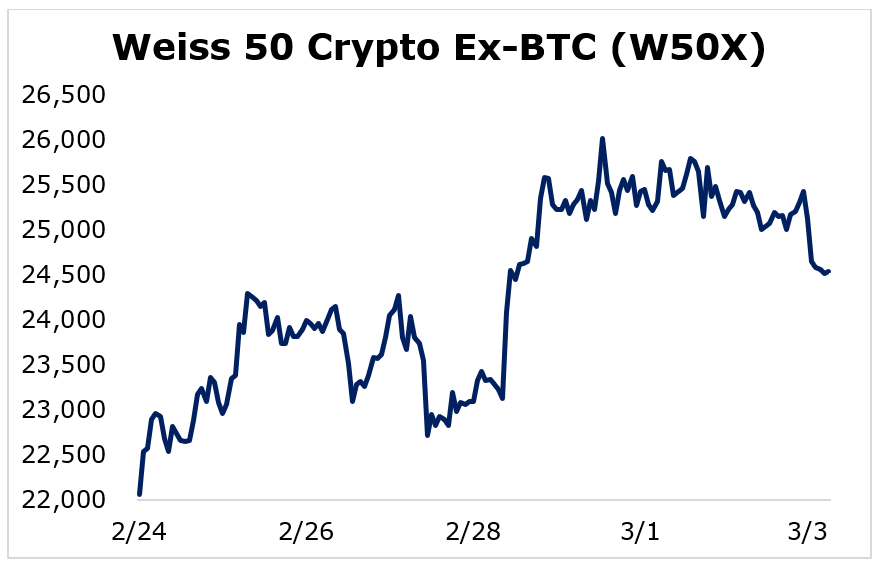

The Weiss 50 Ex-BTC Index (W50X) increased 11.28%, highlighting how Bitcoin's trading was consistent with the broader market.

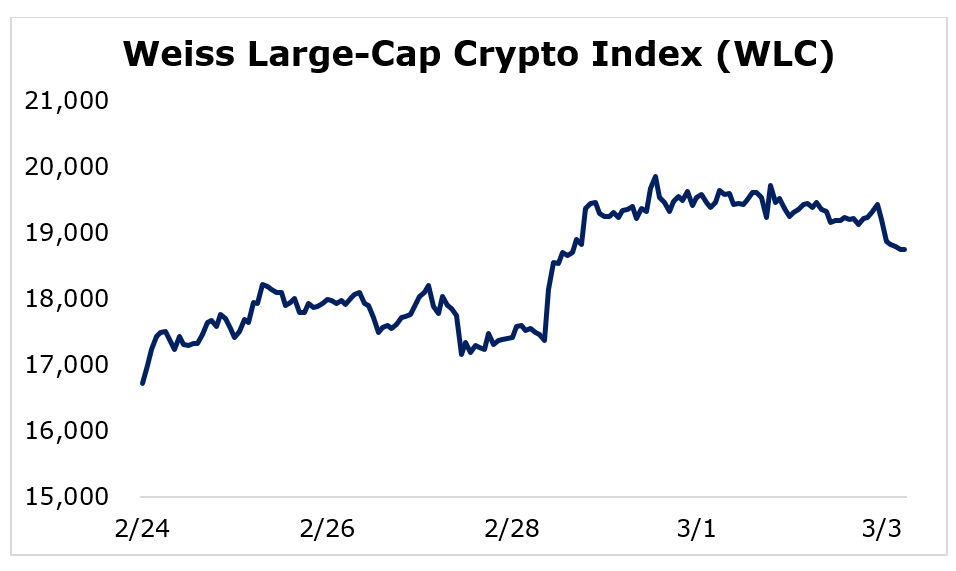

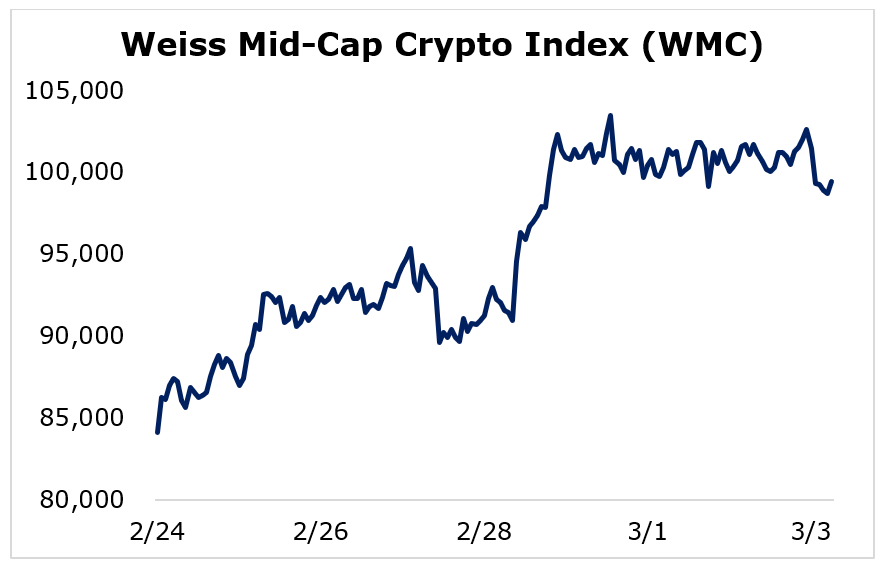

Breaking down performance this week by market capitalization, we see that the mid-caps outperformed their larger and smaller counterparts. Aside from the midsized cryptocurrencies, most of the market traded together.

The large-caps logged the smallest gain by a tiny margin, as the Weiss Large-Cap Crypto Index (WLC) rose 12.17%.

The mid-caps were the biggest winners, with the Weiss Mid-Cap Crypto Index (WMC) soaring 18.20%.

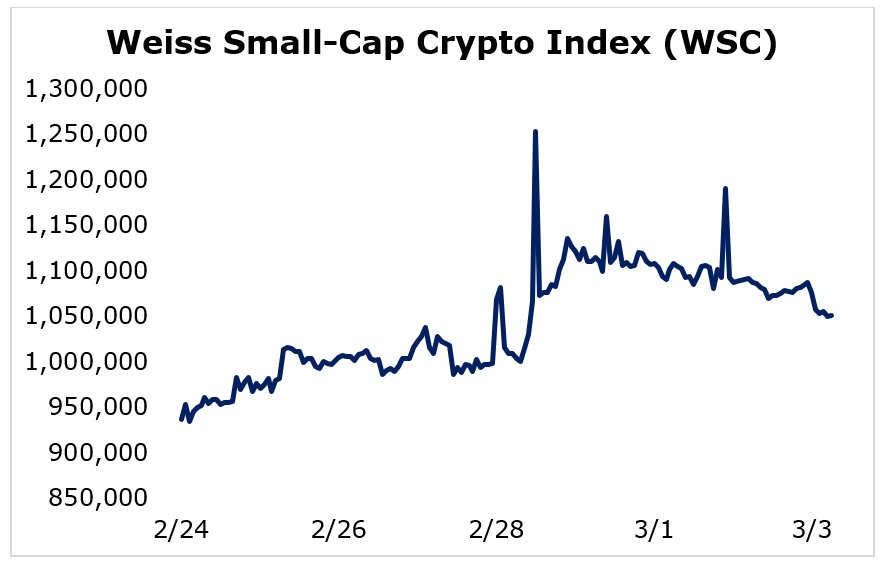

The small-caps performed almost identically to the largest cryptocurrencies, as the Weiss Small-Cap Crypto Index (WSC) grew 12.22%.

Despite the slide toward the end of the week, the broader crypto market logged solid gains.

The market has fallen further since we made these charts, so it will be important to see how it reacts in the shorter term.

If the crypto market can regain momentum, it's possible that it could extend February's relief rally.

Notable News, Notes &Tweets

- Banking giant Charles Schwab (SCHW) has filed to launch a "crypto economy ETF."

- Shake Shack will be partnering with Cash App to offer Bitcoin rewards for purchases made at their restaurants.

- The city of Lugano, Switzerland, will recognize Bitcoin as legal tender and allow citizens to pay taxes using it.

What's Next

Volatile trading is common within the crypto market. And as news continues to break around the crisis in Ukraine and the threat of nuclear war, we will continue to see big swings … and more of them.

Add in the regulatory uncertainty and impending rate hikes, and it's easy to see why Bitcoin and other cryptocurrencies struggle to regain price momentum.

However, there's something more important than price action to focus on. While prices swing back and forth, adoption is consistently ramping up.

More corporations and governments recognize the opportunities available with crypto. For example, Ukraine raised a fast $13 million from crowdfunding appeals when it started accepting crypto donations on Feb. 26. And that's just one example of why crypto is here to stay. Look for other countries and individuals to join them in the not-too-distant future.

Don't let short-term price movements spook you. With adoption on the rise, higher prices are also on the horizon.

Bottom line: Recent world events appear to be accelerating crypto's rise, which makes this market's long-term direction look more promising than ever.

Best,

Sam Blumenfeld