|

| By Sam Blumenfeld |

The broad market has pretty quickly found support and is already showing signs of bullish momentum after the overdue pullback, which started earlier this week. If it can regain that momentum, it could look to take the next leg up toward new cycle highs.

Of course, as the market leader, Bitcoin (BTC, Tech/Adoption Grade "A-") will still have to contend with several headwinds including inflation, expected interest rate hikes and conflicts in Ukraine before it can overtake $44,700 — the key level we'll need to see reclaimed before we can look higher.

Another important level to watch is $46,000. Before March's rally, Bitcoin formed a triple top pattern when it was unable to surpass the level on three occasions. We expect some resistance here, too.

Here's Bitcoin's price in U.S. dollars via Coinbase Global (COIN):

Ethereum (ETH, Tech/Adoption Grade "A") has continued its recent pattern of outperforming the market leader, boasting a monthly gain of 21% compared to Bitcoin's 4% move. It's shown greater upside drive and resilience during this rally after reversing a trend of lower highs.

If ETH can make another push, it could lead many other altcoins higher.

Ethereum dipped below its 21-day moving average during the pullback, but the asset has already retaken it. That's bullish for ETH and a good sign for other altcoins. Plus $3,400 will be a level of critical resistance, and with prices recently near $3,240, it's one we're keeping a close eye on.

Here's Ethereum's price in U.S. dollars via Coinbase:

Index Roundup

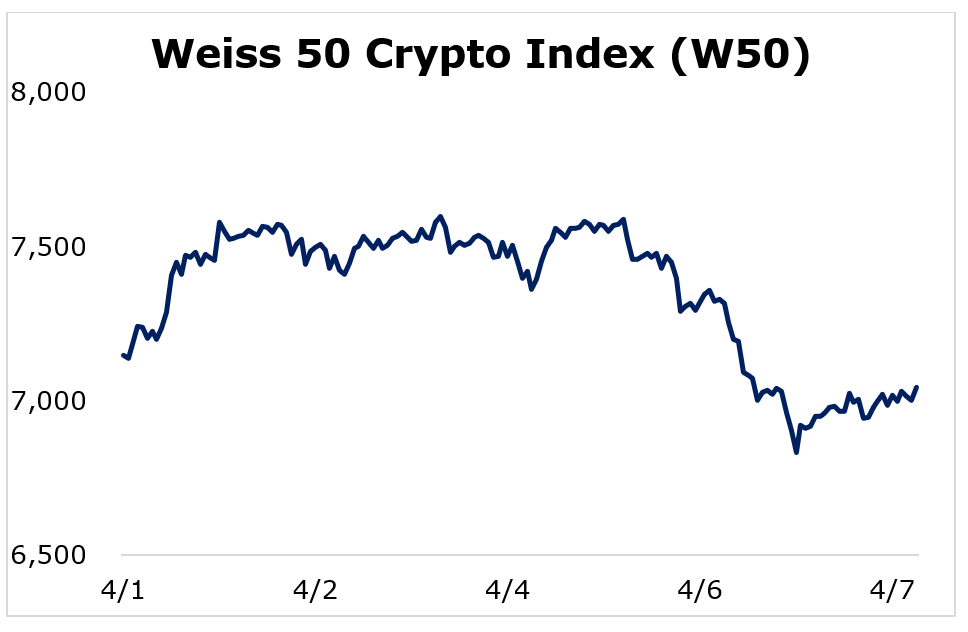

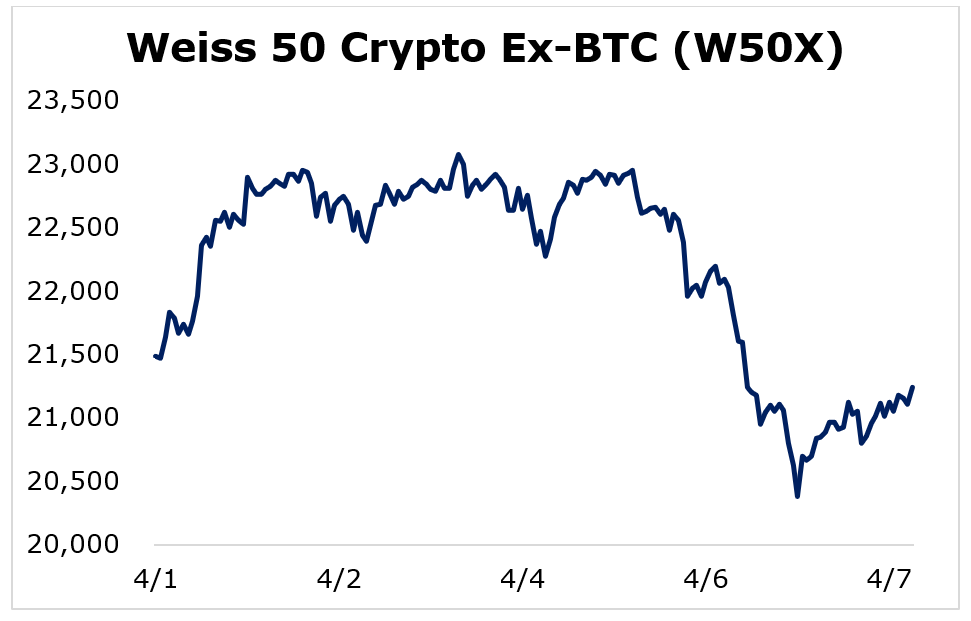

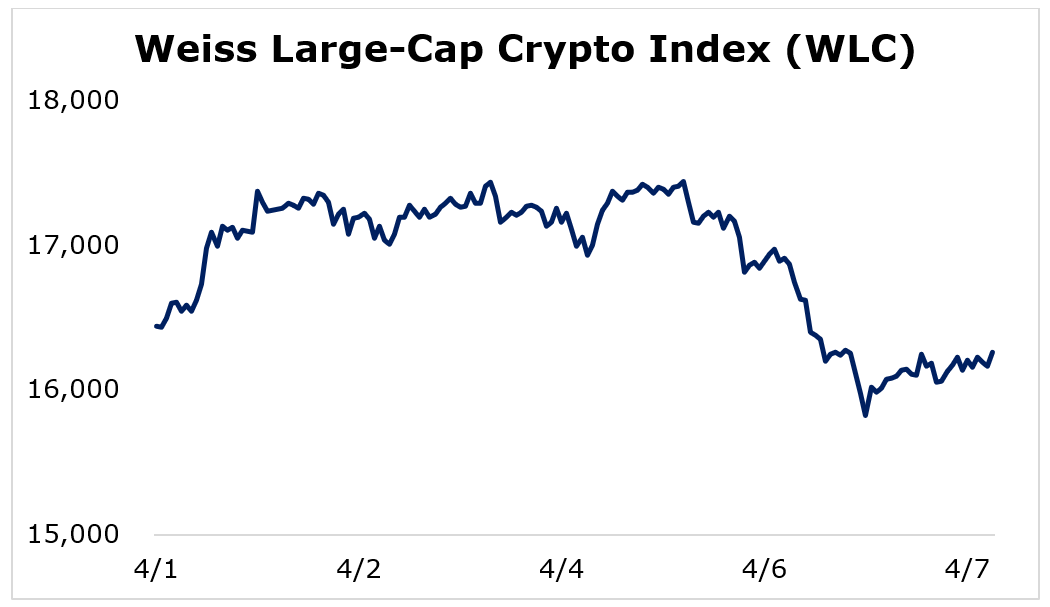

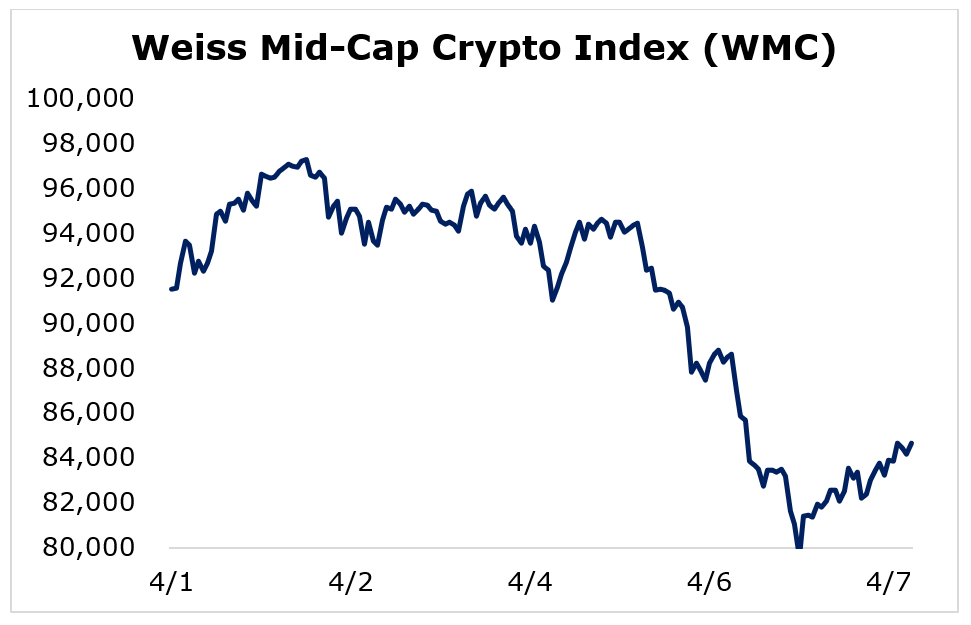

The late-week pullback caused each of the Weiss Crypto Indexes to finish in the red, but the damage was limited overall.

The Weiss 50 Crypto Index (W50) lost 1.43%, as most cryptocurrencies slid back later in the week.

The Weiss 50 Crypto Ex-BTC Index (W50X) dipped 1.16%, as Bitcoin traded mostly in-line with the broader market.

Breaking down this week's performance by market capitalization, we see that the large-caps were able to hold their value the best, with the Weiss Large-Cap Crypto Index (WLC) losing a minor 1.10%.

And the mid-caps were the biggest underperformers as shown by the Weiss Mid-Cap Crypto Index (WMC) falling 7.46%.

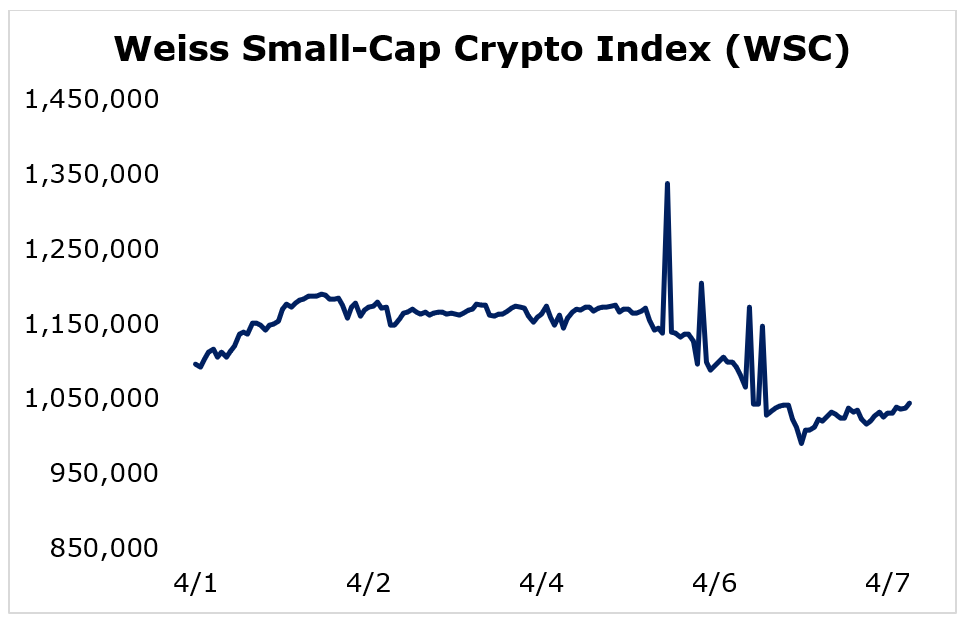

The small-caps finished in the middle of the pack, as the Weiss Small-Cap Crypto Index (WSC) dropped 4.81%.

Across the board, the crypto market has responded resiliently to the dip, as large-caps look to resume the market's recent uptrend. If the large-caps can regain momentum, it's likely that the small- and mid-caps follow.

Notable News, Notes and Tweets

- Strike CEO Jack Mallers announced that Bitcoin's lightning network will be integrating with Shopify. (SHOP).

- Block (SQ) and Blockstream are developing a Bitcoin mining venture in Texas powered by Tesla's (TSLA) solar and storage technologies.

- The Bitcoin 2022 conference in Miami is underway, with notable speakers, including Pomp, Michael Saylor, and Peter Thiel, making the case for Bitcoin's strong utility moving forward.

What's Next

Despite the headwinds cryptocurrencies — and other risk assets — are facing, it's clear that the industry is making strides on the adoption front. Industry leaders are prioritizing Bitcoin mining and payment integration, which should have positive long-term network effects.

Although, my colleague Jurica Dujmovic wrote an intriguing piece about how widespread Bitcoin adoption may not be what you expect. I recommend you read it to get a fuller picture of mainstream adoption.

The market's broad direction has been NEUTRAL, but cryptocurrencies have gained ground since the beginning of February. While the immediate return of a full-fledged bull market is unlikely at this point, the market is maturing to where it can prepare for a massive run later.

Given the flawed state of the traditional financial system, crypto should act as an important hedge against irresponsible government and central bank policies. There will always be volatile bumps in the road over the short- to medium term, but the long-term impacts of crypto and blockchain technologies are inevitable.

Best,

Sam