Why Whales Swallowing Yet More BTC Is a Double-Edged Sword

Last week, crypto Twitter was abuzz with fear, uncertainty and doubt (FUD) surrounding the Ronin hack, which I touched on in my last issue. The hack highlighted the lacking security of the nascent play-to-earn industry, causing many to succumb to the FUD.

This week, however, the crypto media's tune is quite different — despite crypto prices pulling back slightly from the most recent surge higher. In fact, it's because of this pullback that the tone has shifted to optimistic.

You see, whales are rising to the surface and buying hundreds of thousands of dollars' worth of Bitcoin (BTC, Tech/Adoption Grade "A-"). When Bitcoin price slipped for 5% over the past week, it created a "buy-the-dip" opportunity whales couldn't let pass them by.

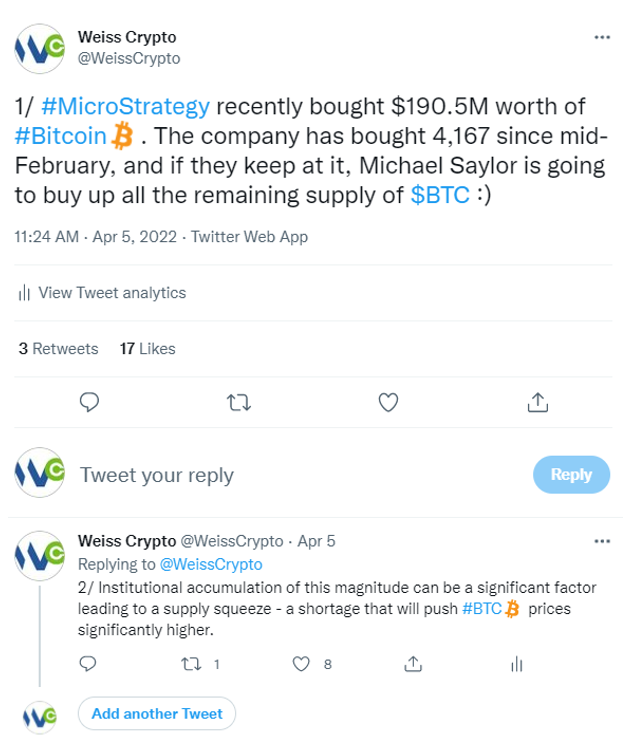

First on that list was none other than Michael Saylor and his company MicroStrategy (MSTR):

The following day, Do Kwon, founder of Terra (LUNA, Tech/Adoption Grade "D") started his $10 billion shopping spree to stabilize Terra's native stablecoin:

And just today, a group of the largest Bitcoin wallets amassed upward of 6,000 BTC, capitalizing on the current pullback.

All this buying must be a sign of incredible investor confidence in the bright future of Bitcoin. But is there really a cause for celebration?

If we hold decentralization as the holy tenet of crypto, then accumulating the wealth in the hands of the few is centralization. It's a state counter to everything that crypto stands for.

One could argue that we don't know for sure the real concentration of crypto wealth, since some of these large wallets belong to exchanges.

However, the opposite can also be true. It's not hard to imagine individual whales owning multiple wallets. And the greater the concentration of BTC, the greater the possibility of a 51% attack.

For the uninitiated, a 51% attack occurs when a miner or a group of miners controls more than half of the computational power of Bitcoin's network. The main consequence of a 51% attack is that it allows the attacker to double-spend their coins. In essence, they'd be able to spend their digital currency more than once.

This can lead to a loss of trust in the currency, as well as to inflation.

Additionally ...

- BTC transactions are transparent and easily traceable.

- Most BTC transactions are through centralized exchanges now.

- Know-your-customer (KYC) protocols are being implemented around the world.

Put these facts together, and you'll realize that BTC is on the path to becoming just like fiat — centralized and without anonymity. If left on this path, Bitcoin could become like any other asset within a traditional finance (TradFi) portfolio, albeit quite volatile.

It stops being people's money and becomes an asset available and valuable only to the few. In one way, it stops being crypto.

In the end, it seems that Bitcoin could became a victim of its own success. In my opinion, it's likely it will be absorbed by TradFi and become what I call a C.O.I.N. — crypto only in name.

But even if that happens, it won't be a disaster for the broad market. Far from it, in fact. It'll simply make room for a different, true cryptocurrency to take its place. And then, the cycle will begin anew.

My brilliant colleague and editor of Crypto Yield Hunter, Marko Grujić, said it best:

"The problem with Bitcoin is that you don't have Bitcoin anymore. As people learn and are better educated in the field, they'll figure out that Bitcoin is not what they thought it was: It is easily traceable, easily taxable, it's still a volatile asset. It's relative to things in TradFi now.

"What people think Bitcoin is, is actually Monero (XMR, Tech/Adoption Grade "C+") or a variety of other privacy coins. And that is why Monero isn't available [on centralized exchanges] in the United States."

Do you agree? Has Bitcoin diverged from the true values of crypto, or is it still its best representative?

Let me know by tweeting @WeissCrypto with hashtag #IsBTCdead. And look to your inbox tomorrow for our weekly index roundup to see how the trading week closes out.

Best,

Jurica Dujmovic