|

| By Jurica Dujmovic |

We can all collectively take a sigh of relief now that Federal Reserve Chair Jerome Powell has said what's been on all of our minds for a while now: The Fed has raised interest rates by half a percentage point.

If you thought this would cause markets to plunge, however, you'd be wrong:

And indeed, the rate hike was priced in. Last week's stress levels were off the charts as the markets were beset by bears from the technologically inept Mr. Buffett to everyone else expecting even greater hikes.

Mr. "Rat Poison Squared," in particular, needed sorting out, as his stance and open animosity toward crypto shows a clear lack of even a basic understanding of how cryptocurrencies work — something the Oracle of Omaha himself has admitted in the past.

Luckily, our own Alex Benfield did correct him in great detail, so I recommend you take a look.

Still, Buffett's anti-crypto stance and damaging influence on the price action played second fiddle to the main reason the market had been taking a nosedive:

When the going gets tough, there's a temptation to give in to the sentiment and become a voice of negativity yourself.

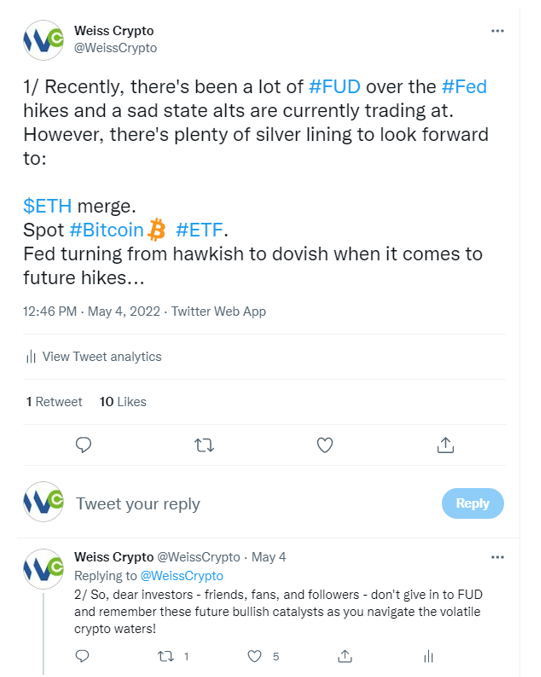

But we refuse to be guided by the crowd mentality, and market sentiment to us has been mostly a contrarian indicator. So, the rest of our tweets last week were about looking at the other, brighter side of the situation:

In fact, Juan Villaverde just revealed to his Weiss Crypto Portfolio Members that our proprietary Crypto Timing Model has begun to show some very bullish signs on Bitcoin (BTC, Tech/Adoption Grade "A-") and Ethereum's (ETH, Tech/Adoption Grade "A") charts.

We'll bring those updates to our Twitter page soon. But in the meantime, if you want to learn more about our Crypto Timing Model, you should sign up for Juan's Crypto Profit Challenge, a three-part training session that starts this coming Tuesday at 2 p.m. Eastern.

You'll have to save your seat, so I suggest you do so now.

But even if the bullishness Juan sees on the horizon is temporary, it's important to remember that we're not even in a BEARISH market — we're still strictly in a NEUTRAL trend.

And sure enough, the broad market has certainly seen worse than our current conditions. In fact, this website is dedicated to tracking the number of times Bitcoin has been pronounced dead so far.

It's over 447 times, in case you're curious.

Basically, each time the markets faced a downturn or a crisis, naysayers and defenders of the traditional financial system (TradFi) would come out of the woodwork and voice their concerns, pronouncing the inevitable demise of the cryptocurrency. But each time, Bitcoin — along with it the rest of the market — would miraculously spring from the deathbed stronger than ever.

That's because the fundamentals of the broad market — and the escape they offer from the pitfalls of TradFi — are still strong.

Let this long-term mentality be your guiding light when forming a solid investment strategy.

But for income in the short and medium term, though, you'll need more detailed information and a keen eye on the market cycles to get the most out of your investments. Just another reason to check out Juan's Crypto Profit Challenge to learn more.

That's all for this week. Stay tuned for more news, more tweets and hopefully more gains!

Best,

Jurica Dujmovic