|

| By Chris Coney |

It’s time for another look into the world of zero exposure yields in DeFi.

If you are unfamiliar with this topic, you can check out my previous article to get up to speed.

Today, we are going to explore a specific opportunity that will allow you to earn close to 17% on your USD Coin (USDC, Stablecoin) with very little risk.

This is all thanks to a new lending market model from TimeSwap.

A Safe 17% Yield?

TimeSwap is an innovative lending protocol that is offering substantial yields on USDC deposits right now.

As the lender, all you need to do is deposit some USDC, accept the terms of the loan and sit back and wait for the contract to mature.

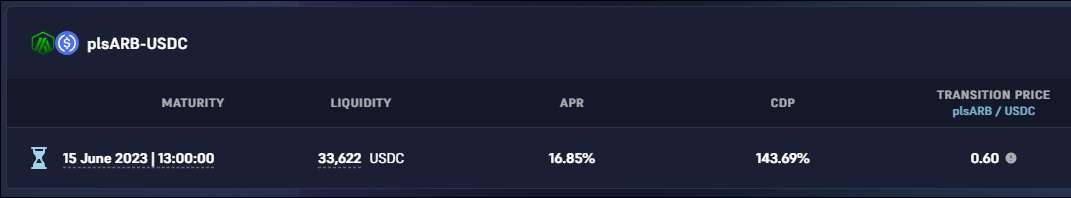

At time of writing, the plsARB-USDC liquidity pool on TimeSwap is paying an annual percentage yield of 16.85%.

Additionally, the collateralized debt position is 143.69%.

Here is what this pool looks like on TimeSwap right now:

Now, the CDP is the first indicator to use to assess the risk of this investment.

Although the risks of using the regulated USDC stablecoin are minimal, when lending, we still want to consider the possibility of the borrower defaulting.

So, how much risk do we have to shoulder in order to earn that 16.85% yield?

Well, there is currently $1.43 of collateral backing every $1 of USDC that has been borrowed.

However, the CDP — which is another way of saying the loan to value ratio — can change as the markets fluctuate.

Are We Exposed or Not?

The idea of ZEYs is that we use DeFi to earn high yields without being exposed to crypto asset price fluctuations.

That is true here in the sense that we deposit USDC stablecoins and earn 16.85%.

So, what happens if the value of the collateral drops sharply? Obviously, the higher the CDP, the bigger this cushion is.

But how else can we assess this risk?

Transition Price

Referring back to the TimeSwap screenshot above, the last metric displayed in the far-right column is the Transition Price.

This is the price at which the contract “transitions” from paying the loan back in USDC to paying it back in the collateral asset.

The first asset listed in the pool name — i.e., plsARB — tells us what the collateral asset is.

In this case, the transition price is 0.60, or 60 cents.

This means when the date and time shown in the Maturity column arrives, if the price of the collateral token is greater than 60 cents, then the loan will be solvent. So, the lender will likely pay back their loan in full with USDC.

However, if the maturity date arrives and the price of the collateral token is lower than the transition price of 60 cents, then the loan is technically insolvent.

At that point, the plsARB locked on the platform to secure the loan will likely be used to pay out the lender instead.

To put this into perspective, here is the price chart for the Arbitrum (ARB, Not Yet Rated) token and how far it would have to fall to reach the transition price of 60 cents:

In the Event of Default

If the borrower chooses to pay the loan back with their locked collateral, then the lender must dispose of the collateral asset if they wish to end up with the USDC they originally loaned.

This would mean going to a decentralized exchange that lists the collateral asset for trading, and then swapping it for USDC at market price.

In the case of this 16.85% yield opportunity, the collateral asset is plsARB. This is the ARB token locked in Plutus DAO, which is an Arbitrum-native governance aggregator that aims to maximize user liquidity and rewards.

Although plsARB should have the same market price as native ARB, it is more like a receipt for a deposit rather than the real asset itself.

But as long as it is trading on a DEX with decent liquidity, you should have no problems swapping it for USDC and getting your money back.

Could You Lose Money?

Technically, you could lose money with TimeSwap if the value of plsARB took a huge plunge before the maturity date.

In such a scenario, the lender would find themselves on the maturity date with an amount of collateral that is worth less than the USDC they originally loaned.

This is neither good nor bad — it is just something to be aware of when weighing the pros and cons of this opportunity.

Considering there are opportunities to lend out USDC in DeFi for 11% APY on a completely unsecured basis, I would say the TimeSwap model — at least in this case — is far superior.

With TimeSwap, at least there is some asset securing the loans.

Additionally, you are able to assess whether you think that asset will fall below the transition price before the loan matures. If you think it will, then you would have the foresight to not invest in the first place.

Conclusion

Overall, TimeSwap is an incredibly new and cutting-edge approach to DeFi-based lending.

Unlike Aave (AAVE, “C+”) — which is another decentralized liquidity market protocol — TimeSwap is a pure market. This means it doesn’t have any price feeds for the collateral assets.

Even though each loan displays a transition price, there is no obligation on the part of the borrower to pay their loan back in one asset or the other.

So, if a borrower’s collateral is worth more than the transition price at maturity, you would expect them to pay back their loan using USDC, because that is the more profitable thing for them to do.

However, they still have the freedom to decide to pay their loan back by sacrificing their collateral.

In that case, the lender would receive far more back than they lent out.

Using the example from above, if the CDP is 143% — meaning each dollar of the loan is backed by $1.43 worth of collateral — the lender would receive the interest plus an additional 43% gain on their deposit if the borrower chose to pay back the loan by sacrificing their collateral.

This is one of the reasons why TimeSwap doesn’t need price feeds to operate an efficient market.

Purely by leveraging profit incentives for the lender and borrower, the efficiency of the market happens organically.

Central planners take note.

But that’s all I’ve got for you today. Let me know what you think about this ZEY method by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me, Chris Coney, saying bye for now.