|

| By Chris Coney |

So many new surprises pop up every week in DeFi that I almost pushed back this article on zero exposure yields once again.

I figured I would never get around to this topic if I did that, so as promised, here it is.

If my prediction two weeks ago that crypto will gradually slide in the second half of 2023 comes true, then we need a way of generating yield that isn’t linked to crypto asset prices rising.

This is why I refer to this method as zero exposure yield, because we are reducing our vulnerability to price fluctuations.

Now, here are five ways to start generating ZEYs.

Method No. 1: Lending

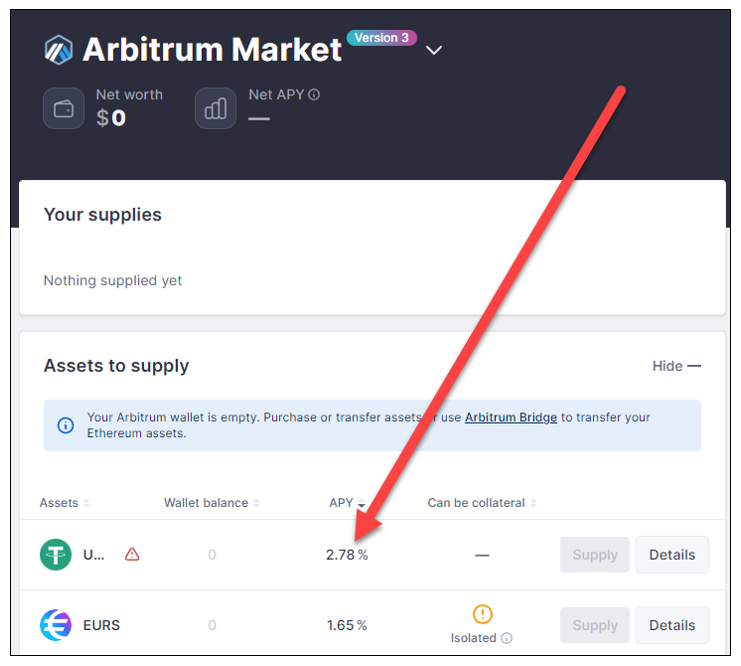

The first and most basic ZEY comes from lending on money markets like Aave (AAVE, “B-”).

Since we are talking about yields that do not expose you to crypto asset price movements, it narrows this down to only lending stablecoins.

The best stablecoin yield available on AAVE at time of writing is via the Arbitrum (ARB, Not Yet Rated) network. It offers an annual percentage yield of 2.78% on Tether (USDT, Stablecoin).

Method No. 2: Stablecoin Liquidity Pairs

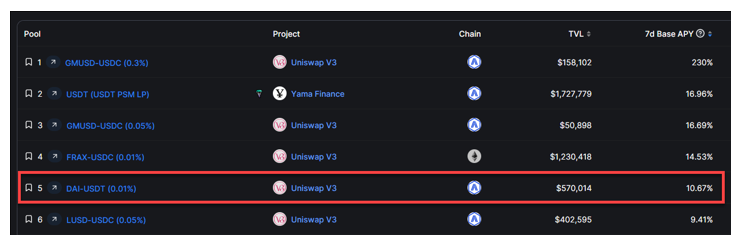

To generate yield on a decentralized exchange like Uniswap (UNI, “B”), normally we would stake one crypto asset against a stablecoin and earn fees.

However, we can’t use that exact strategy here because staking a crypto asset would create exposure to the market.

But we can still be a liquidity provider by staking two different stablecoins on the DEX instead. That way, traders can swap between the two and pay a fee.

At time of writing, the DAI-USDT stablecoin pair on Uniswap V3 via the Arbitrum network is offering a respectable APY of 10.64%. This is based on the past seven days trading volume.

Method No. 3: Bridges

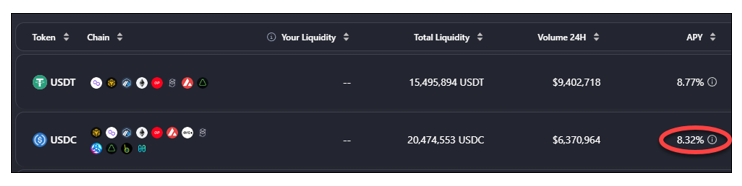

Next up, bridges are a type of DEX. Therefore, they offer a type of liquidity yield opportunity.

Although Stargate bridge boasts the largest volumes in all DeFi, it does not currently display any APYs.

However, cBridge does display APYs and currently offers 8.3% on USD Coin (USDC, Stablecoin).

Please note that these opportunities are affected by the market because they rely on trading volume. But there is no exposure to the changes in crypto asset prices.

So, as long as people are moving money from one network to another, bridges should generate yield.

Method No. 4: DEX Liquidity

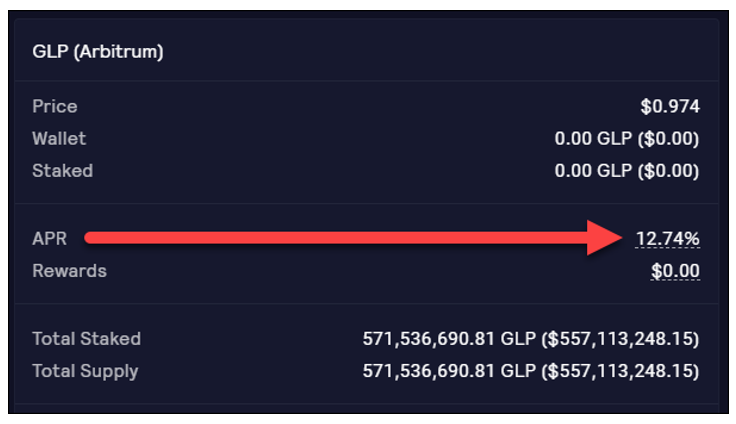

DEXes like gTrade and GMX offer investors the opportunity to provide liquidity to traders and earn a share of trading fees.

At time of writing, gTrade is offering 11% on stablecoins via the Arbitrum network.

On the other hand, GMX is offering a sizeable 12.74%:

However, when you deposit liquidity into GMX, you receive an asset called GLP to represent your stake in the liquidity pool.

It’s important to note that GLP is not a receipt token, which is essentially a receipt from a deposit on a crypto borrowing and lending platform that is equal to the underlying value of the deposited asset.

For example, on Aave, you would receive one wrapped ETH (aWETH) as a receipt token from depositing one Ethereum (ETH, “B”). And this aWETH is equal to one ETH.

So, rather than a receipt token, GLP represents the total value of the liquidity pool. And within this pool, there are various crypto assets that change in price.

Even though the GLP token you receive in exchange for your deposit might make you a 12.74% yield … there is some market risk.

This is because its capital value can go down if the collateral assets in the pool go down.

But this depends on how long an investor plans to stake in GMX.

If GLP goes down when markets are down, then the investor is faced with the prospect of waiting for the market to recover to receive the full value of their deposit back.

Method No. 5: Real World Assets

Back in April, I wrote about the up-and-coming RWA trend and highlighted invoice discounting.

Now, I would class these as ZEYs because although they use DeFi, the yields don’t come from the crypto sector. Instead, they come from the real world.

One platform you can use for RWAs is Tangible. It creates non-fungible tokens that are attached to RWAs like real estate, wines, gold bars and watches.

At time of writing, the USDR token you receive in exchange for depositing stablecoins on this platform is earning 7.29%.

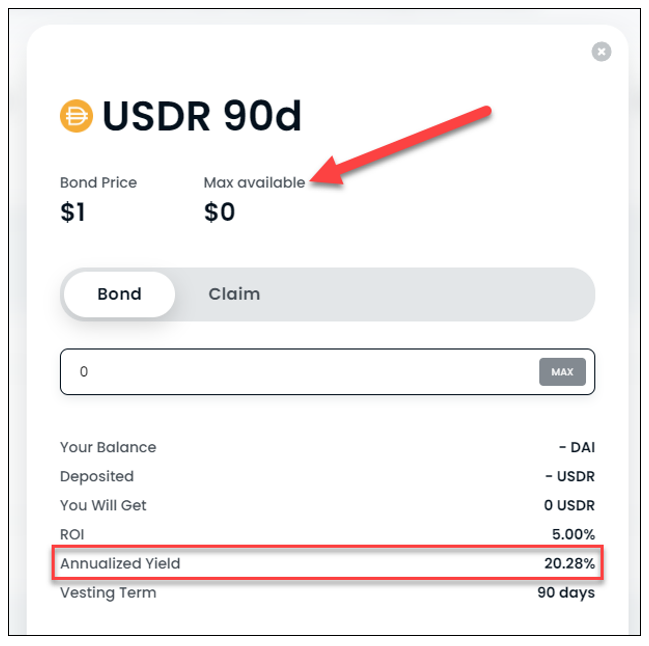

You can also “bond” your deposit for between 10 and 90 days to boost your yield as high as 20% annualized.

But here’s the catch: There’s a ceiling on the amount that can be deposited into each bond type in each period.

And as you can imagine, right now they are all sold out:

Conclusion

So, these are five examples of ZEYs that could form the basis of a conservative income strategy during periods of crypto price declines.

Although DeFi started exclusively in the tech world, sooner or later, it should be able to integrate itself into every aspect of offline activity — just like the internet.

But that’s all I’ve got for you today. Let me know your favorite ZEY method or any other thoughts you have on this topic by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me, Chris Coney, saying bye for now.