|

| By Bruce Ng |

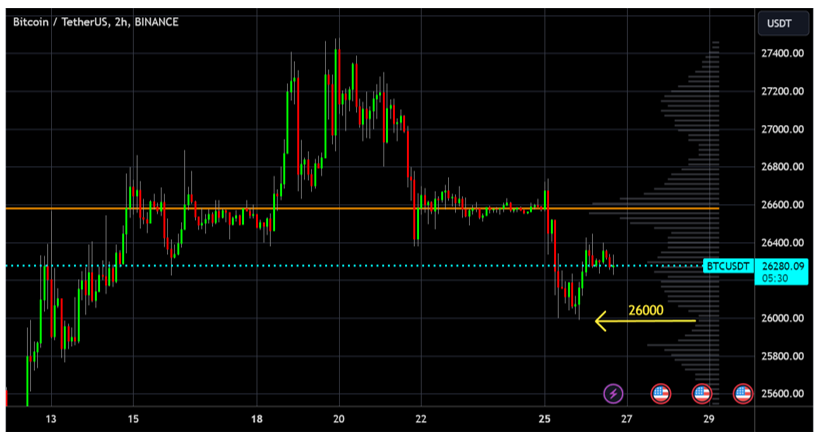

To recap, in last Tuesday’s issue, I predicted that Bitcoin (BTC, “A-”) will dip this week, and the support levels of $25,000 and $23,000 will likely be revisited. Additionally, I expected a long squeeze to occur.

How accurate were these predictions so far?

Well, the long squeeze occurred, and the dip actually happened. But BTC climbed to $27,000 first before dipping as low as $26,000 on Sept. 26.

That means we didn’t get as low as $25,000 or $23,000. Currently, BTC is trading in the $26,000 to $26,500 range … which is lukewarm price action in the world of crypto.

Click here to see full-sized image.

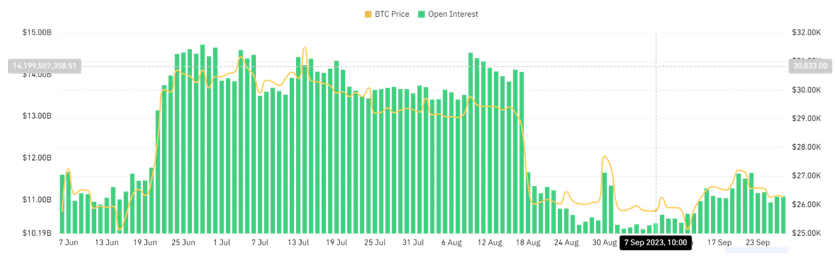

Next, let’s look at open interest to get a better idea of Bitcoin’s future.

The highest OI of the year is $14.4 billion, while the current OI is $11.1 billion. So, we are neither particularly high nor low.

At this point, we aren’t seeing any particular trend in the OI. This explains the tepid price action over the past week.

However, damage can still be done if we get a liquidation cascade.

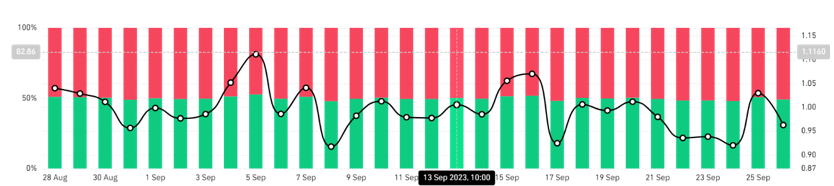

For additional information, let’s look at the long/short ratio:

Right now, the long/short ratio is 49%:51%. Again, these numbers aren’t anything to write home about.

Although it seems like the market is quite unenthusiastic at the moment, there are four upcoming macroeconomic events that could significantly impact the price of Bitcoin:

- The Consumer Price Index print on Oct. 12.

- The Federal Open Market Committee rate hike decisions on Oct. 31.

- The second deadline for the spot Bitcoin ETF decision in mid-October.

- The potential approval of an Ethereum (ETH, “B”) futures ETF on Oct. 2.

In terms of central bank actions, on Sept. 19, the Federal Reserve paused rates. This is what caused BTC to rally slightly from $26,600 to $27,400.

But soon after, this rally was retraced. The fact that there was no continuation means that there’s no new money coming into crypto now.

So, we will have to rely on the following positive news for BTC to rally:

- Anticipation for the fourth BTC halving, which is set to happen in April 2024. This is typically a self-fulfilling prophecy that pumps prices every four years.

- Allocation of capital from giant financial institutions like BlackRock (BLK) and Fidelity via the pending spot Bitcoin ETFs.

- The Fed starts cutting rates.

For now, I still think the Securities and Exchange Commission will delay the spot BTC ETF decisions in October and November. And then approve the ETFs early next year.

While the outlook for Bitcoin is still tepid in the short term, an ETH futures ETF approval is expected on Oct. 2. But so far, ETH’s price action hasn’t reflected any excitement in anticipation of that news.

As such, this bolsters my initial view that there’s not much new money currently coming into crypto.

That being said, an ETH rally that could boost prices by $500–$1,000 is still in the cards. After all, we still have a week until the ETH futures ETF approval decision.

Overall, we are left with four conclusions for this week:

- BTC is still bearish and could fall further to $25,000 or $23,000 in the short term.

- We are still bullish on the medium-term outlook of BTC, especially during October 2023 to January 2024.

- ETH might see a small rally leading up to next week’s potential ETH futures ETF approval.

- I still think 2024 will be an amazing year for crypto, especially considering all the fundamental infrastructure that has been built during this bear market. There was way more development activity in 2021–2023 compared to the bear market of 2018–2019.

In other words, we are short-term bearish but medium-term bullish.

Remember, crypto moves incredibly fast. Indeed, one year in crypto is akin to 10 years in traditional finance.

So, when I say short term, I really mean one week to one month. And when I say medium term, I mean one to three months.

With how fast-paced the crypto market is, it’s understandable that these investments can be quite stressful.

If you would much rather avoid the stress of speculating and trading in these choppy markets, there are alternative routes for you to take that can still help you collect a tidy sum.

You can achieve this through a strategy called yield farming.

My colleague Chris Coney’s 2023 DeFi MasterClass shows you how to earn annual percentage yields on decentralized platforms that can make 39x what the average money market account offers.

Through his quick, easy-to-follow modules, you’ll learn everything you need to know from how to set up your wallet to how to identify the most promising opportunities.

So, what are you waiting for? You can check out Chris’ course here.

Best,

Bruce