4 New Predictions Following Bitcoins Bullish Moves

|

| By Bruce Ng |

Last week, as Bitcoin (BTC, “B+”) bounced off $25,000 due to a short squeeze, I said that the outlook for the No. 1 crypto by market cap was still bearish in the near term, particularly with September historically being a troublesome time for the market.

So, I stated that any rally we saw would be short-lived.

Reaffirming this outlook was the fact that I anticipated additional chop from the upcoming Consumer Price Index data, Federal Open Market Committee meeting and the ongoing drama surrounding the Securities and Exchange Commission’s delay tactics regarding the spot Bitcoin ETF applications as the month continued.

With all that, I predicted that any spark of recovery would have to wait until the start of Q4.

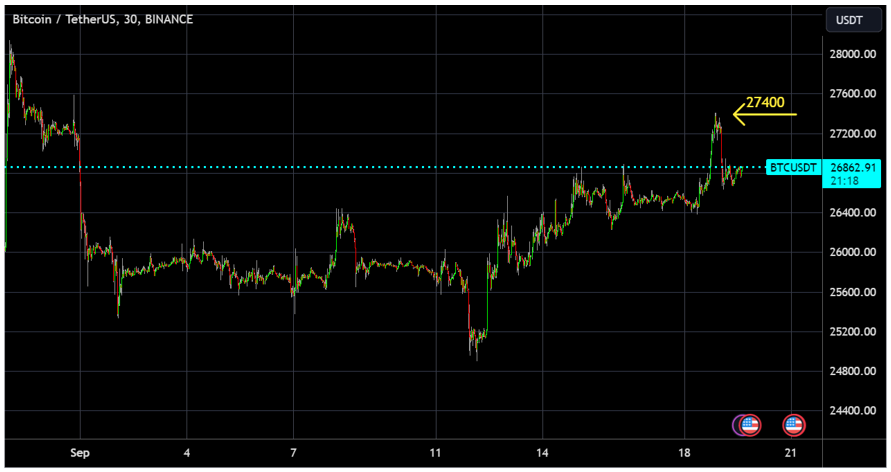

But, if you read my colleague Marija Matic’s article yesterday, you’ll know that the short squeeze pushed BTC to hit as high as $27,400 yesterday.

Click here to see full-sized image.

So, with my first prediction not quite on the money, does that mean the rest will also crumble?

Not quite.

Just because the squeeze pushed BTC higher than I initially anticipated doesn’t mean it won’t be short-lived still. And while the market is navigating September smoother than usual, those macroeconomic factors and FUD-inducing headlines are still formidable obstacles we’ll be facing over the next few weeks.

So, I still stand by my final conclusion: Any real spark for a rally will have to wait until Q4.

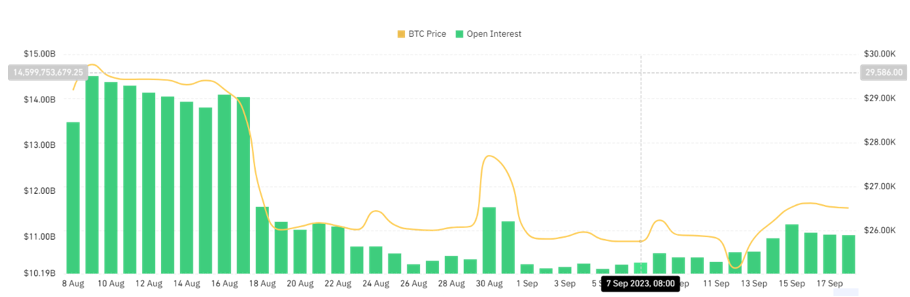

Taking a closer look at our favourite metrics —the open interest and long/short ratio —which fills in a broader picture for us.

From Sept. 13-15, the OI rose in tandem with the price increase, meaning more long positions were being opened, signifying bullishness in Bitcoin’s future.

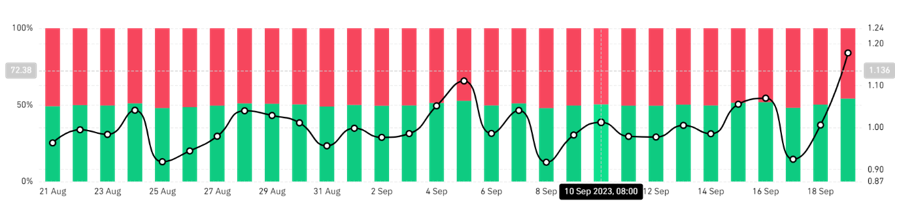

Now let’s take a look at the long/short ratio:

Now the long/short ratio is incredibly long heavy at 54%:46%. This is the highest it has been over the past month.

As I said, I don’t expect any substantial rally just yet. And due to the fact that OI rose in tandem with the price of BTC, I think the long OI is a product of overexuberance from last week’s price action.

And with the long/short ratio heavily favouring longs, we are ripe for a long squeeze and potential downside soon.

Of course, we still have to pay attention to the FOMC meeting occurring today and on the second spot Bitcoin ETF deadline, which will occur in mid-October.

With that, I can now make four more predictions for this week:

- In the very short term — i.e., within a week — BTC will dip, and we’ll see a long squeeze.

- If that does play out, the support levels of $25,000 and $23,000 are likely to be revisited.

- In the medium term — 1-3 months — I am still bullish. In anticipation of an ETF approval in mid-October, I expect Bitcoin’s price to rally just before then in early October.

- However, despite that and October historically being a bullish month, I still think the SEC will decide to delay its official decision in mid-October, which may dampen market sentiment.

In other words, we are short-term bearish but medium-term bullish.

It’s a tough market to trade. You’ll want to carefully vet the projects you’re interested in to determine how you want to trade them in the short vs. medium vs. long term.

If that sounds daunting, you can avoid trading them entirely and still earn income in the crypto market.

How? Through a strategy called yield farming.

My colleague Chris Coney’s DeFi MasterClass shows you how to go for annual percentage yields on decentralized platforms that far surpass anything you can get in the traditional market. Through his quick, easy-to-follow modules, you’ll learn everything from how to set up your wallet to how to identify the most promising opportunities.

If that interests you, I recommend checking out Chris’ course here.

Best,

Bruce