Even in a Bull Market, Only Some Cryptos Can Outperform

|

| By Bruce Ng |

Over the past two days, Bitcoin (BTC, “A”) jumped up $5,000.

That’s not a fluke. The No. 1 crypto by market cap is done correcting and looking to make its next leg up.

And it’s bringing the broad market with it.

In fact, last week I talked about CryptoKoryo’s altcoin buy indicator. According to its latest readings, we are now in solid buy territory for altcoins.

Specifically, we are in the “generational buy” zone according to that indicator.

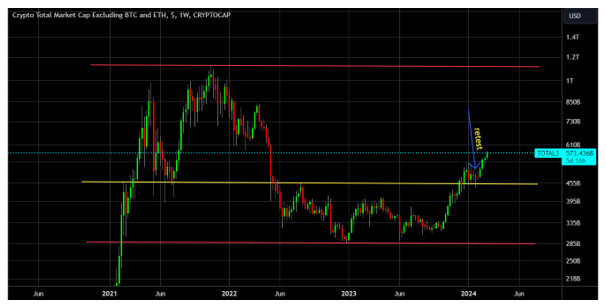

Let’s take a look at the TOTAL3 — that’s the total crypto market cap minus BTC and Ethereum (ETH, “B+”).

In other words, it represents the market cap of all altcoins combined. (Because remember, altcoins are just any crypto that isn’t Bitcoin, though many experts now exclude Ethereum as well due to its market cap.)

TOTAL3 also represents whether the entire crypto market is in risk-on or risk-off mode, since inflows into altcoins represent more risk and more bullish conditions.

So, looking at TOTAL3 support and resistance levels is great for determining when to buy or sell altcoins.

In the chart above, I’ve marked these levels as so …

- The bottom red line represents the multiyear altcoin support at $285 billion.

- The yellow line in the center is the mid-term resistance that’s held since June 2022 at $455 billion.

- The top red line shows the TOTAL3 all-time high at $1.1 trillion.

So during the bear market, TOTAL3 was hovering above the bottom red line for more than a year. Near the end of 2023, it started to climb upward, broke above the yellow mid-term resistance line, dropped back down and retested the yellow line and finally converted it into near-term support.

That’s a strong showing.

And now, TOTAL3 is bouncing back up near $573 billion and heading to new highs.

But while this rising tide will raise most boats, there is one giant caveat: While TOTAL3 goes up in the bull market, not all altcoins will pump!

Just look at the performances of these coins over the past week:

- Arbitrum (ARB, “B”): -4%

- Dymension (DYM, Not Yet Rated): -11%

- Optimism (OP, Not Yet Rated): 0%

In crypto, these coins are considered underperformers, even if they’ve posted otherwise impressive gains year to date. That’s because other altcoins are pumping 2x or more in a week.

So, how to tell which altcoins will pump?

I’ve said it before, but I’ll say it again: You’ve got to track the narratives. Especially in a bull market like this.

In crypto, these narratives function as reasons market participants tell each other as to why certain sectors of crypto will do well.

So, it’s a bit of a “follow the crowd” strategy to make sure you’re in the sector garnering the most activity and interest. From there, specific opportunities are easier to find.

Unfortunately, in the crypto market of 2024, several big narratives have emerged:

- Layer-1 smart-contract platforms looking to revolutionize base layers

- Layer-2s scaling solutions

- GambleFi, or decentralized gambling platforms

- GameFi, or mobile gaming apps that integrate cryptocurrencies as rewards

- Liquid Staking Tokens (LSTs): IOUs issued for staking on proof-of-stake networks like Ethereum

- Liquid Restaking Tokens: IOUs issued for restaking LSTs

- SocialFi: decentralized social media apps

- Memecoins

- Further development of DeFi

- Artificial Intelligence

With so many sectors pulling investor interest, the crypto landscape in 2024 can be confusing and overwhelming. Especially because narratives can also be fickle. In the past week alone:

- All AI coins were pumping after the announcement of Sam Altman’s $7 trillion bid for investment.

- But the AI excitement was short-lived as it was then superseded by DeFi when Uniswap (UNI, “B-”) — the leading decentralized exchange — pumped 50% in a single day. This sent most DeFi coins pumping shortly after.

- Just like with AI, though, this pump was also over just as it began. As I’m writing, memecoins are stealing DeFi’s thunder.

And that’s just in one week!

As we can see, liquidity rotates from one narrative to the next in a short span of time. And trying to time these rotations is a fool’s errand.

That’s why my colleague Juan Villaverde and I have a better strategy — let them ride through the bull market.

But that’s not our only trick. Our methodology involves:

- Identifying promising narratives and timing them.

- Identifying the best altcoins of each narrative.

- Identifying the best small-cap cryptos in promising narratives to target the unbelievable growth opportunities a crypto bull market can offer.

We also have a sweet early bird buying method that helps us maximize our profit potential even further.

You can read more about our strategy here.

And if you’re interested in learning even more — or trying this strategy out for yourself — I urge you to call our team at 1-855-278-9191, Monday through Friday, 8:30 a.m. – 5:30 p.m. Eastern.

Best,

Dr. Bruce Ng