Find the Missing Link of Modern Financial Intelligence

|

| By Jurica Dujmovic |

Most of the digital asset industry is missing out on key information buried on the blockchain.

It won’t be found in price charts, ETF inflows or in the winner of the next Layer-2 arms race.

Instead, it’ll be found in the predictive market.

Its evolution means it’s poised to become something far more interesting than a glorified gambling outlet. If my outlook proves correct, the crypto prediction market could turn into a real-time, incentive-driven forecasting layer for finance, politics and macro risk.

In a market increasingly starved for signal, this corner of crypto may be one of the most underappreciated sources of it.

Source Real Value from Speculation

The mechanics are elegantly simple.

Prediction markets allow participants to trade contracts tied to future outcomes. A contract priced at 70 cents implies a 70% market-implied probability that a specific event will occur.

This is notably different from polls and expert forecasts — which capture what lay people and credentialed experts believe, respectively.

Instead, prediction markets capture what people believe strongly enough to risk money on. These probabilities update continuously as participants absorb new information and put capital behind their convictions.

Why is this useful for us?

Because academic research has long shown that properly designed prediction markets often outperform traditional forecasting methods. That’s particularly true in politically or economically charged environments.

Crypto simply removes the gatekeepers and dramatically expands who can participate.

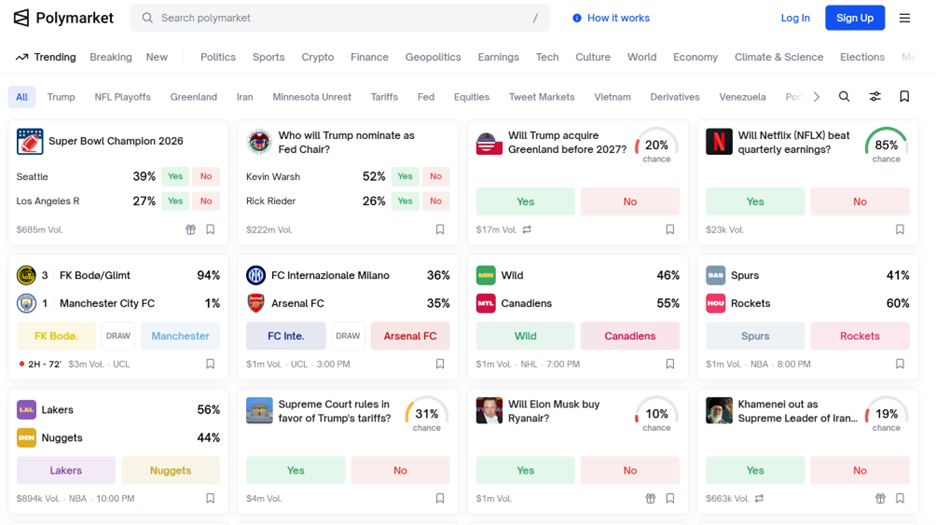

The recent resurgence of interest in prediction markets is not theoretical. Platforms like Polymarket — built on blockchain infrastructure and settled in stablecoins — have demonstrated that global, permissionless markets can attract meaningful liquidity around real-world events.

These markets now cover everything from election outcomes and central bank decisions to corporate milestones and cultural events.

But as I said, this is more than just glorified gambling. As investors, we’re not interested in the novelty of "betting" on the blockchain.

Rather, the value for us is in the emergence of a continuously updating probability feed generated by financially incentivized participants.

When someone has skin in the game, their signal tends to sharpen.

Institutional Interest and the Inevitable Regulation

The timing of this is critical, as well, as institutional interest is no longer subtle.

Intercontinental Exchange, the parent company of the New York Stock Exchange, has publicly committed up to $2 billion in investment tied to prediction market infrastructure. And Dow Jones has signed agreements to integrate prediction market data into its editorial and analytical products.

These are titans in this space. And they understand the value of forward-looking signals in a fragmented information environment.

Put simply, when the owner of the NYSE starts writing checks, it's worth looking into what they're seeing for yourself.

What are they seeing?

This is speculation. But based on my research, they likely see a solution to a market structure problem hidden in prediction markets.

See, traditional financial markets price assets based on expected future cash flows. But they struggle to price binary political or policy outcomes directly.

Prediction markets fill that gap.

They create liquid, tradable instruments around events that shape asset prices … but can't themselves be bought or sold.

For institutions managing macro risk or constructing hedges around policy uncertainty, that information can be quite valuable.

Which is why we’re seeing a shift in the marketplace.

Up to now, decentralized platforms like Polymarket have dominated this space. But recently, a parallel regulated track has begun to emerge.

Kalshi is a U.S.-based prediction market regulated by the Commodity Futures Trading Commission. It offers event contracts that resemble simplified derivatives tied to macro and political outcomes.

What sets it apart from its decentralized peers is its focus on compliance. Kalshi restricts certain participant behaviors and integrates with traditional brokerage infrastructure. And its CEO is advocating for stronger regulatory rails for his industry.

This positioning is informative. It effectively reframes prediction markets as a new category of financial instrument.

For institutional investors constrained by regulatory mandates, this distinction matters.

Quite a bit, actually.

Because regulators are no longer ignoring the sector. Proposed legislation in the U.S. seeks to clarify how prediction markets should be governed and to prohibit insider trading by government officials on these platforms.

Kalshi is positioning itself now to be on the right side of future legislation. And, surprisingly, this may be a good sign for the rest of the market, too.

While regulation is often framed as a threat to crypto innovation, in this case it may serve as a catalyst: Clear rules would likely accelerate institutional participation and legitimize prediction markets as a data source rather than a curiosity.

Sometimes the bureaucrats get it right.

Fit Predictive Markets in Your Strategy

For investors, the value in predictive markets isn't necessarily direct exposure to individual platforms or tokens. Though, if you’re interested, you should check them out.

But I see greater opportunity and value for you in the informational edge prediction markets provide.

Why?

Because these markets often move faster than polls, analyst notes or media narratives. Especially in periods of uncertainty.

Here’s how that can meaningfully impact your approach …

Let’s say you’ve structured your portfolio around regulatory risk. A fair concern considering the ongoing debates over the CLARITY Act.

With predictive platforms, you can now reference a live, liquid market that continuously prices the probability of that regulation passing.

If you’re more of a volatility trader, you can compare implied probabilities across prediction markets and options markets to identify mispricings.

And as a macro strategist, you can monitor shifts in election probabilities and adjust equity sector exposure accordingly.

In short, predictive markets allow for information arbitrage. And the info is available in real time.

There are, of course, risks.

Liquidity remains uneven across platforms. Regulatory treatment varies by jurisdiction. And ethical questions persist around markets tied to sensitive geopolitical or humanitarian outcomes.

In addition, low participation or coordinated efforts can distort outlooks.

So, like with everything else, your own due diligence is key to applying this strategy.

Still, these limitations are increasingly understood. And, in many cases, actively addressed by platform design and oversight.

In my time analyzing blockchain technology and the impact of crypto, I’ve noticed something fundamental: Crypto's most durable contributions have historically come not from speculative excess, but from infrastructure that solves real coordination problems.

Prediction markets do exactly that by aggregating dispersed information into a single, continuously updated signal.

As capital, media and regulators converge on this space, prediction markets are beginning to look less like a fringe experiment …

And more like a missing layer in modern financial intelligence.

For investors willing to look beyond price action and narratives of the week, prediction markets offer something rare in crypto …

A tool that generates insight rather than noise.

I encourage you to take some time to see how it fits in your crypto toolkit.

And if you’re looking for another handy tool, I hope you’ll consider my colleague Juan Villaverde’s Crypto Timing Model.

It uses cycle theory that, when combined with Juan’s analysis and other key indicators, find you the best times to enter and exit a crypto position.

In his Weiss Crypto Investor newsletter, the model is specifically designed to help long-term investors HODL with confidence.

In fact, its latest “Buy” recommendation just went out today!

To learn more, click here.

Best,

Jurica Dujmovic