Franklin Templeton, Binance Bring MMFs to the Blockchain

|

| By Mark Gough |

Like an avalanche, mainstream adoption starts small.

Then, all of a sudden, you see the rush.

Last week, I told you about the epic team-up between MetaMask and Ondo Finance (ONDO, “C+”). That partnership opened the door to over 200 tokenized U.S.-listed equities and ETFs to non-U.S. residents.

It was a big move.

Now, it’s looking like it was just the beginning. Because the tokenization of real-world assets just entered a new phase of institutional integration.

Another Big Pair Breaks Headlines

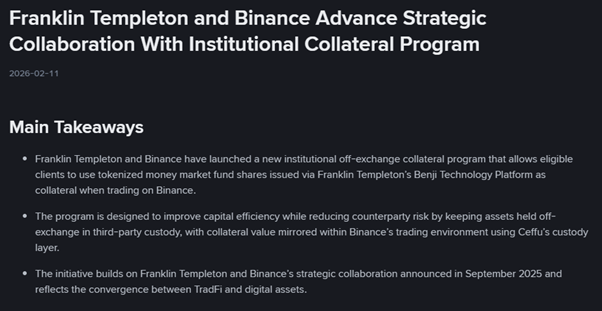

Global asset management leader Franklin Templeton and Binance, the largest centralized exchange, have teamed up in a major development for institutional markets.

Together, they’ve launched a live off-exchange collateral program.

Now, institutions can use tokenized money market funds (MMFs) as collateral while trading on Binance. The entire process can be done without moving those assets onto the exchange itself.

This is not a pilot. It’s live infrastructure.

And for those of us tracking the tokenization of real-world assets (RWAs), this is exactly the direction the market has been building toward.

What Actually Changed?

At the center of this collaboration is Franklin Templeton’s Benji platform, which issues tokenized shares of regulated U.S. money market funds.

Now, eligible institutional clients can:

- Hold Benji-issued tokenized money market fund shares

- Keep those assets in regulated off-exchange custody

- Mirror their value inside Binance’s trading environment

- Use them as collateral to trade crypto markets

Custody and settlement are supported by Ceffu, Binance’s institutional custody partner.

This is a game-changer.

Why This Matters for Institutions

For years, one of the biggest friction points in institutional crypto trading has been counterparty risk.

If you wanted to trade size, you had to:

- Park large amounts of capital on the exchange

- Accept exchange custody risk

- Forgo yield on idle collateral

- Hedge exposure through additional layers

This model changes that.

Now, institutions can benefit from blockchain technology to keep yield-bearing money market exposure in custody and still deploy capital efficiently in digital markets.

That solves a very real institutional pain point. And it’s a solution that significantly improves capital efficiency, risk management, balance sheet optimization and regulatory comfort.

For institutions, this is how crypto starts to look operationally mature.

The Bigger Narrative: RWA Infrastructure Is Scaling

Zoom out.

This isn’t just about Binance. This is about the tokenization of traditional financial assets moving into active use.

Put simply, RWAs are finally showing their utility.

Franklin Templeton has been building tokenized fund infrastructure for years. Benji isn’t theoretical. It already manages billions in tokenized money market fund assets.

Now those tokenized assets can act as collateral, be integrated into a global exchange and bring TradFi yield products into the “always on” crypto markets.

That’s the real story.

We’ve talked before about tokenization unlocking crypto’s speed, 24/7 nature and streamlined approach . But that was theoretical.

This partnership turns that thesis into execution.

Why Binance Is All In

The benefit for Franklin Templeton is clear. But Binance walks away with a win here, too.

Because this partnership significantly strengthens its institutional offering.

Institutions don’t just want access to markets. They want infrastructure that resembles prime brokerage models in traditional finance.

By integrating tokenized real-world assets into its collateral framework, Binance gains the ability to reduce capital friction, enhance institutional trust, expand its non-crypto asset participation and strengthen its regulatory position.

Simply put, this is a huge step toward moving from a retail-dominated venue into an institutional platform.

And it’s one that other exchanges may follow.

In fact, I expect to see the competitive edge inspire — or pressure — other leaders. After all, if Binance can offer …

- Tokenized RWA collateral

- Off-exchange custody

- Yield-bearing asset support

Then institutions will expect similar structures elsewhere. Or they’ll all flock to Binance.

I don’t see too many exchanges willing to get left behind. So, I believe we’ll see asset managers continually turn to tokenized funds and exchanges integrate off-exchange collateral models.

At the same time, the range of assets that can be offered will expand as the RWA narrative continues to move from theory to reality.

Right now, we’re likely just in Phase One.

Risk Considerations & Market Impact

It’s important to stay balanced.

While this partnership is a huge step in normalizing what “Crypto x TradFi” products actually look like, there are risks to consider.

For one, institutions are still relying on a third party (Ceffu) to custody their assets. And because regulations vary across regions, eligibility will vary based on jurisdiction.

This is progress — not perfection.

And it’s also not something I expect will move markets tomorrow.

But structurally? This is long-term bullish for …

- RWA tokenization platforms

- Institutional-focused exchanges

- Infrastructure providers

- Stable yield-backed crypto strategies

The more traditional assets can plug into crypto markets seamlessly, the stronger the institutional adoption narrative becomes.

And that narrative is building steadily in 2026.

Final Take

Franklin Templeton and Binance just delivered a real institutional bridge.

Not a white paper. Not a pilot. But live infrastructure that creates a true, usable bridge between crypto and institutions.

If tokenization is the next major structural shift in markets, this is exactly how it unfolds: quietly, through infrastructure upgrades that most retail investors won’t notice until it’s everywhere.

Because this isn’t just another partnership announcement.

It’s another brick in the institutional foundation of digital markets.

Best,

Mark Gough

P.S. While Franklin Templeton and Binance lay the foundation for RWA utility, you should lay the foundations of a portfolio that works as hard as you do.

That’s why Weiss Ratings founder Dr. Martin Weiss hosted his Infinite Income Summit yesterday. In it, he reveals the strategy that’s looking at a 16-to-1 outperformance!