MetaMask, Ondo Team Up to Bring RWA Trading to Your Wallet

|

| By Mark Gough |

Tokenization has been one of crypto’s most durable narratives over the past few years.

In fact, it was one of the first topics I wrote about for Weiss Crypto Daily.

And no wonder: It promises to marry the stability of the TradFi market and improve on it with the blockchains accessibility, autonomy and speed.

It even dominated conversations at this year’s World Economic Forum in Davos, Switzerland!

But progress has often felt slower than expected. And for a market that thrives on hype, a slow but steady path can really take the wind out of a narrative’s sails.

Fragmented access, regulatory uncertainty and limited distribution beyond crypto-native users have all done their part to hinder progress.

Which is why I am thrilled to tell you that this week held the opposite: a meaningful step forward for real-world tokenized assets (RWAs).

RWA Assets in Your Wallet

MetaMask announced a direct integration with Ondo Finance (ONDO, “C+”), a leader in the RWA narrative.

You can read up more on Ondo here.

This move isn’t just MetaMask acknowledging tokenized assets as important. It enables MetaMask users to access tokenized U.S. stocks, ETFs and commodities directly inside the MetaMask mobile wallet.

The integration gives users exposure to traditional financial assets without opening a brokerage account and without leaving crypto rails.

Importantly, this isn’t a test product or a limited pilot. The integration is live and usable today, embedded directly in the MetaMask mobile experience.

What’s Actually Available to Users

Through Ondo Global Markets, MetaMask users can now gain exposure to more than 200 U.S.-listed equities and ETFs.

These include large-cap stocks — such as Tesla (TSLA), Apple (AAPL), NVIDIA (NVDA), Microsoft (MSFT) and Amazon (AMZN).

And it includes broad-market and commodity-linked ETFs like Invesco QQQ Trust (QQQ), iShares Gold Trust (IAU) and iShares Silver Trust (SLV), as well.

Instead of holding shares through a traditional broker, users hold blockchain-based tokens designed to track the market value of the underlying securities.

Unfortunately, due to regulatory hurdles, this integration is not available for U.S. residents yet.

But for users outside the U.S., this removes several long-standing frictions:

- No brokerage onboarding

- No separate custodial account

- No need to move funds back onto legacy financial rails

Everything remains on-chain and under user control to create a unified portfolio view that blends traditional and digital markets.

And that matters.

Traditional brokerage platforms require users to relinquish control of assets to centralized intermediaries. Even modern trading apps rely on custodians, clearinghouses and restricted settlement windows.

In contrast, the MetaMask RWA model keeps users fully self-custodied.

Assets sit in the same wallet as crypto holdings. And transfers are not limited by banking hours or geographic constraints.

For many users outside the U.S., this represents a materially different way to access U.S. markets.

Joe Lubin, founder of ConsenSys, framed the issue clearly: Access to U.S. markets is still dominated by legacy systems that haven’t meaningfully evolved.

Tokenization offers a path toward simpler, more direct market access without sacrificing control.

How the Integration Works

The mechanics of the system are intentionally simple from a user perspective.

- Users swap USDC on the Ethereum (ETH, “B+”) mainnet for Ondo Global Markets (GM) tokens.

- GM tokens are designed to track the value of specific U.S. stocks or ETFs.

- Trading is available 24 hours a day, five days a week, aligned with U.S. market hours.

- Tokens can be transferred 24/7, even outside market hours.

All transactions take place on the Ethereum network to keep assets composable and compatible with the wider DeFi ecosystem.

That opens some big doors.

It means — in theory at least — that these tokenized equities can be integrated into the broader DeFi ecosystem that supports the Ethereum chain, like lending platforms and portfolio tools.

Impact Beyond the Feature List

At first glance, this may look like a simple product update. But the reality is that it reflects a broader shift in how market access is being rebuilt.

MetaMask has long been the default gateway to decentralized finance.

By integrating tokenized equities directly into the wallet, MetaMask is quietly expanding from a crypto-only interface into something closer to a general-purpose financial access layer.

It’s a big step. And coming from a titan in the crypto world, it’s a statement that RWA plays are in their early days.

For Ondo, the importance lies in distribution.

MetaMask already serves millions of users globally. Embedding tokenized securities into that environment dramatically lowers the barrier to entry. And it introduces real-world assets to users who are already comfortable operating on-chain.

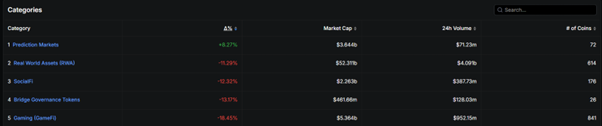

Zooming out, this development fits neatly into the broader trend of real-world assets (RWAs).

Tokenized RWAs now exceed $22 billion in total value locked and a market cap of over $52 billion.

Assets span across stablecoins, tokenized Treasuries, credit products and, increasingly, equities. And each new integration strengthens the infrastructure layer needed for that market to scale.

Regulatory Context and Limitations

It’s important to be clear about what this integration does and does not do.

Ondo’s tokenized securities are generally intended for non-U.S. investors and are subject to jurisdictional restrictions.

This isn’t a regulatory workaround for U.S. users. Nor is it an attempt to bypass securities laws.

Instead, it reflects how tokenization is progressing first in regions with more accommodating regulatory frameworks.

This is exactly what my colleagues have meant when they said that regulatory uncertainty wouldn’t stop crypto’s progress. It would simply change who can access the latest advancements.

That said, developments like this are relevant for U.S. markets as well.

It is more important than ever to have a working example of compliant, on-chain infrastructure. It strengthens the case for adoption and highlights the need for clearer regulation.

And, as I’ve pointed out previously, lawmakers are at work trying to figure out how to bring RWA opportunities to U.S. residents as we speak.

What This Means for Ondo

From an investment perspective, this integration reinforces Ondo’s position as one of the most serious players in the RWA space.

Ondo has consistently focused on institutional-grade tokenization, beginning with tokenized Treasuries and now expanding further into equities and ETFs.

The MetaMask integration doesn’t just add users, though that benefit is definitely there. But more important is how it validates Ondo’s approach to compliance, infrastructure and scalability.

As tokenization adoption grows, platforms that control both issuance and distribution are likely to benefit disproportionately.

Ondo’s ability to plug directly into major wallets gives it an advantage over projects that rely solely on niche platforms or institutional channels.

The Bigger Picture

This launch doesn’t mean brokerages are about to disappear, nor does it signal the immediate replacement of traditional financial systems.

But it does mean that crypto-native infrastructure is slowly expanding to absorb more of the global financial stack.

Each integration like this reduces friction, normalizes on-chain financial activity and makes tokenization feel less experimental and more practical.

Over time, these incremental improvements are what turn narratives into a durable market structure.

Adoption will take time, and regulation will continue to shape the pace.

But the direction is becoming clearer.

I’ll be watching how quickly users adopt this functionality and how other wallets, platforms, and issuers respond.

Regardless of whether ONDO is right for your portfolio, I suggest you do the same. Because the RWA narrative is here to stay. And you’ll want to find your way to play it soon.

After all, we’re watching tokenization move from promise to practice in real time.

Best,

Mark Gough