|

| By Mark Gough |

Project Crypto is the SEC’s new approach to digital assets. And it is a welcome change for crypto firms after years of regulation of crypto through litigation rather than legislation.

Most of the effort’s early work has been to clarify and expand on how crypto infrastructure could work for TradFi institutions and assets.

Why? Because the world’s financial markets are outdated. They run on 40-year-old code, take two days to settle trades and shut down on weekends.

But on-chain, those same assets can trade 24/7 and settle instantly.

That’s a prospect many in TradFi find irresistible. Indeed, Boston Consulting Group (BCG) estimates the market for tokenized assets will reach $16 trillion by 2030. At the time of writing, Defi Llama puts the total RWA market cap at $58.14 billion.

That’s growth I’m sure you don’t want to miss out on.

And one RWA project recently got a huge seal of approval from the SEC. It’s called Ondo Finance (ONDO, “C+”). And now, it has the one thing almost no other crypto project has: regulatory clarity.

I first wrote about ONDO back in February, where I said it could create Wall Street 2.0.

Its biggest obstacle at the time? Regulatory clarity.

While ONDO’s token was available to U.S. residents, none of its RWA products were. But that could soon change. According to new reporting, the SEC has formally closed its investigation into Ondo Finance.

In legal terms, this is a "No Action" outcome. That means the regulator spent months looking under the hood — examining the business model, the token structure and the compliance framework — and decided that no legal action needed to be taken.

This moves Ondo from a "risky bet" to a "regulated business" in the eyes of Wall Street.

See, for the last few years, the SEC has regulated crypto by suing projects first and asking questions later.

For a project like Ondo — which deals directly with bonds, equities and yield — this investigation was a massive risk hanging over the entire investment.

That risk is now gone.

This decision fits with the new direction we are seeing under SEC Chair Paul Atkins and his "Project Crypto" initiative.

The agency is moving away from constant lawsuits … and toward a system that allows compliant companies actually to operate.

By surviving this scrutiny, Ondo has proven that its strict know-your-customer and qualified custodian model is the correct path forward to keep regulators away.

Deep Dive: Who Is Behind Ondo?

Ondo isn’t just another crypto startup.

My research and experience tell me it’s got the fundamental power and the market position to shape the RWA sector.

But a big giveaway you can see at a glance is the team behind it.

Most crypto projects are initially the result of anonymous developers. But Ondo was built by Wall Street veterans with the express goal of bridging the gap between traditional finance and crypto.

At the helm is founder Nathan Allman, who previously worked on the Digital Assets team at Goldman Sachs.

This gives Ondo an invaluable edge.

Where many crypto projects offer ways to break or bend TradFi’s rules, Ondo’s team makes them stand out.

That’s because it’s designed to follow the rules by people who know them better than most so institutions can actually use it without fear of an SEC lawsuit.

The Backers

Ondo raised roughly $34 million in early funding from some of the best investors in the space.

This list is critical because it acts as a quality filter:

- Founders Fund: The venture firm founded by Peter Thiel, of Facebook and PayPal fame. This was the fund’s first-ever tokenization investment.

- Pantera Capital: One of the oldest and largest crypto hedge funds.

- Coinbase Ventures: The investment arm of the largest U.S. exchange, which suggests future product integrations are likely.

When you have Peter Thiel and Coinbase involved, the chance of this being a scam or an amateur operation drops significantly.

Because these players don't throw money at random yield farms. They invest in infrastructure.

The Products: More Than Just Bonds

And indeed, Ondo is building an on-chain empire.

The term "tokenized real-world assets" can sound complicated. But the concept is actually quite simple …

Ondo takes safe, traditional assets and wraps them in a digital token so they can be traded 24/7 globally.

Here are the three pillars of their ecosystem you need to know:

Pillar 1: Ondo Short-Term U.S. Gov. Treasurys (OUSG):

This token represents a share in a fund that invests primarily in BlackRock’s USD Institutional Digital Liquidity (BUIDL) fund. It’s effectively on-chain proof that you own a piece of a BlackRock asset.

Pillar 2: U.S. Dollar Yield (USDY):

This is a token secured by short-term U.S. Treasurys and bank deposits. Unlike a stablecoin, which pays you zero interest on its own, USDY pays you a yield just for holding it.

At the time of writing, it offers between 4-5% APY.

Not only is that a nice yield, comparable to the average APY offered for costly and tricky Ethereum staking. The cherry on top is that it’s structurally safer than a standard bank deposit because it is bankruptcy-remote.

That means if Ondo went bust, your assets would be safe from its creditors.

Pillar 3: Ondo Global Markets (The Game Changer)

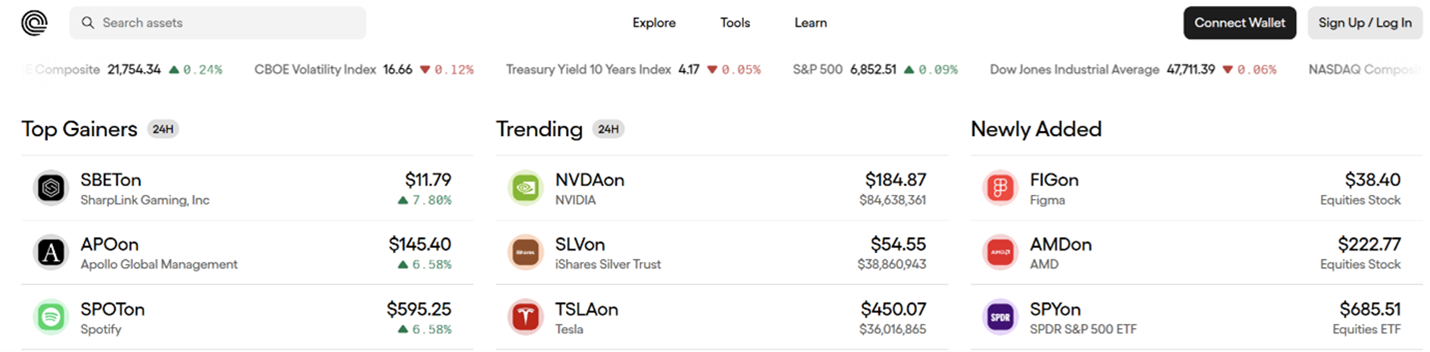

This is the newest and perhaps most exciting part of the puzzle. It’s a platform that brings publicly traded U.S. securities onto the blockchain.

This solves a massive global problem. That’s because it allows users around the world to buy U.S. assets … at any time, instantly.

The Holy Grail: Bringing It Home to the USA

This is the most speculative but potentially most profitable part of my thesis.

Right now, most of Ondo’s products — such as USDY and Global Markets — are restricted in the U.S. due to securities laws.

Which makes Ondo an "offshore" giant.

But the SEC’s clearance could change everything.

Now that the investigation is closed, the path is arguably clear for Ondo to apply for the necessary licenses to operate legally inside the United States.

- The Opportunity: If Ondo gets the green light to offer tokenized Treasurys and "Global Markets" stocks to U.S. retail investors, it will unlock the largest financial market in the world.

- The Vision: Imagine being able to trade Apple stock or U.S. Treasurys on-chain, 24/7, directly from your Coinbase or Robinhood wallet and remain fully compliant with U.S. law.

This isn't just a fantasy.

Ondo recently acquired Oasis Pro, a company with a registered Broker-Dealer license. This gives the team the legal infrastructure to launch these products in the U.S.

If that happens, the total addressable market (TAM) for Ondo doesn't just double.

It could be multiplied by 10.

I will note that ONDO is still a newer project. That means it carries more risk and has more volatile price action than crypto blue-chips, like Bitcoin (BTC, “B+”) or Ethereum (ETH, “B+”).

But if you have the tolerance for altcoin volatility, this is one to keep on your radar.

Best,

Mark Gough