Here’s What You Need to Know About Bitcoin’s Halving

|

| By Beth Canova |

Well, it finally happened. On Friday evening, we finally saw the latest Bitcoin (BTC, “A”) halving.

So, what exactly does that mean, and how does it affect the broad crypto market?

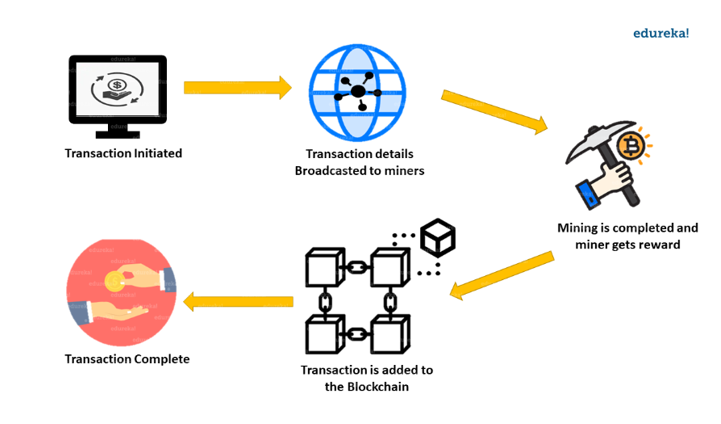

To understand that, you need to understand how transactions on the Bitcoin blockchain work.

Bitcoin is a proof-of-work blockchain. That means for transactions to be approved and recorded, their “block” on the blockchain needs to be validated by a miner. To accomplish this, a miner must solve a complex math problem.

As a reward for completing the problem and validating a block, miners receive a reward of a set amount of Bitcoin.

The halving cuts that reward for miners in, well, half. Meaning miners now need to validate double the number of Bitcoin transactions to earn the same amount of BTC they did previously.

The goal of the halving is to control the supply of Bitcoin and keep BTC’s value stable over time. By reducing the rate at which new Bitcoins are created, BTC is forced to act more like a scarce resource, such as gold.

And indeed, this behavior is exactly why Bitcoin is often called “digital gold.”

And why our Weiss Crypto experts like Mark Gough and Juan Villaverde see the current fiscal and geopolitical turmoil as bullish catalysts not just for the traditional safe haven of gold … but also for Bitcoin.

But the bullishness they really see on the horizon is when that increased demand meets the reality of a smaller BTC supply.

It may not hit right away. After all, the halving only just happened.

But after a while of miners producing fewer and fewer BTC — meaning they’re less willing to sell and add that new supply to what’s circulating — we’re likely going to see an intense upside momentum.

Even more exciting is the fact that this price action is actually part of an established pattern. As my colleague Dr. Bruce Ng pointed out on Tuesday, price action leading up to and following a halving has historically followed a set routine:

- First there is a rally before the halving.

- Then, prices dump as we close in on the halving.

- Price then recovers nearly back to pre-halving ATH on the day of the halving itself or shortly after.

- This is followed by sideways price action for a few months.

- And the final parabolic rally in the fall.

And here’s what that looked like for the last halving in 2020:

And what it looked like for the 2016 halving before that.

Now, this doesn’t necessarily mean this halving will follow precedent perfectly. But our team sees no reason to believe it’ll deviate drastically from what’s expected.

With that, our team is firm that the volatility we’ve been seeing over the past two weeks is not only expected, but it is also merely a near-term blip in what promises to be a powerful bull market.

(Dr. Bruce also pointed out three useful steps you can take now to help navigate this volatility to avoid unnecessary risk exposure. I suggest you read up on that before taking any action.)

Remember, nothing goes up in a straight line. Not even in a bull market.

And as Juan explained on Friday, this pause in no way derails our long-term outlook.

In fact, our Weiss crypto team believes that this typical price action is going to meet with the added macroeconomic tailwinds pumping up demand to send Bitcoin over $100,000 this cycle.

That’s not even mentioning the wave of new crypto investors coming in via the spot BTC ETFs or the new Hong Kong BTC ETFs.

And remember, where Bitcoin leads, the broad market follows. And many of those smaller altcoins — any crypto besides Bitcoin — have the potential to target outsized gains as the bull market frenzy pumps them ever higher.

That’s why every talking head and crypto blog is talking about the Bitcoin halving — it’s the gateway to the second phase of this crypto bull market.

If you thought the first phase was impressive — you know, when Bitcoin blasted to new heights before it’s halving for the first time ever — then you haven’t seen anything yet.

So, what do you need to know about the Bitcoin halving? I’ll narrow it down to four key points.

- Corrections and price volatility around the halving are expected, near-term events. So far, we’ve seen a rather shallow correction, meaning BTC can drop even further while still upholding our bullish long-term outlook.

- We’re likely to see some sideways trading from Bitcoin once it has finished correcting.

- Once the increased demand collides with the reduced BTC supply, Bitcoin will kick off phase two of this bull market. Then, it’ll likely soar to new highs.

- As Bitcoin loses momentum, altcoins will start leading the market — ushering in altcoin season, where some of the biggest gains in crypto can be made.

As such, this pullback should be seen by savvy investors as an opportunity to load up on Bitcoin. We may not see prices this low for a while.

Best,

Beth Canova

Crypto Managing Editor