|

| By Jurica Dujmovic |

Every week, the crypto market seems to wake up with a new obsession.

One week, it’s AI tokens.

The next, it’s Bitcoin (BTC, “A-”) Layer-2 networks.

And then, before you know it, everyone’s talking about decentralized storage or “real-world assets.”

It’s easy to dismiss this as noise. The chatter of a hyperactive crowd chasing shiny objects.

But there’s a deeper rhythm underneath.

The way narratives rotate tells us a lot about where capital, conviction and risk appetite are moving.

The trick is learning how to read it.

The fact is, good investors watch crypto markets react. But the best ones learn to read them before they move again.

The Great Attention Economy of Crypto

Crypto is, at its core, an attention market.

Narratives are how capital discovers new opportunities before fundamentals show up in full force.

When a sector starts trending, it means developers, investors and influencers are converging on a shared storyline: "This could matter."

Sometimes they're wrong. But often those bursts of curiosity mark the intersection of innovation and capital.

This week's action — the way attention swung from abstract protocol mechanics toward tangible infrastructure — offers a perfect case study.

By tracking where capital flows and which narratives gain traction, you can start to see the market's collective mood shift in real time.

It's like learning to read the current before the wave hits.

But how do you actually train your crypto trading brain?

That's why I put together this “Attention Index” leaderboard (below).

Not as a list of "what to buy." But rather as a way to map the stories shaping sentiment right now …

To see where attention and capital are converging, and which of those narratives could have the fundamentals to stick once the noise fades.

Think of it as a sentiment compass. A snapshot of where the market's imagination is pointing this week — and where it might wander next.

This Week's Attention Index

- DePIN — the clear front-runner, fueled by Filecoin's (FIL, “E+”) rally and the broader "crypto-meets-physical-infrastructure" theme.

- Real-World Assets (RWA) — steady inflows and new records in tokenized treasuries; the quiet climber.

- Layer-2 Scaling — Ethereum's workhorses are still compounding value and users.

- Restaking / AVSs — growing fast, but riskier; the "yield innovation" corner.

- AI × Crypto — a supporting actor this week, riding DePIN's compute momentum.

Now, let's zoom in on what those rankings actually mean.

From Code to Concrete

The big mover was DePIN, a catch-all for networks that use tokens to coordinate physical resources like compute, storage or wireless coverage.

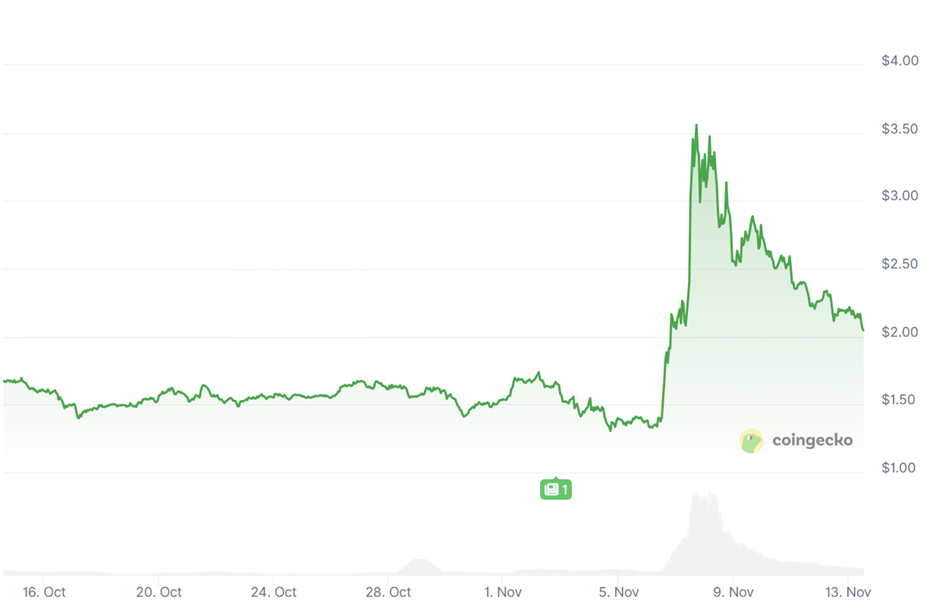

Filecoin's 70% jump earlier in November turned the spotlight back on the idea that decentralized networks can rival web2 cloud giants.

Whether it's io.net (IO, “C-”) linking GPU power for AI tasks or Helium's (HNT, “C-”) wireless nodes paying users in tokens, DePIN has become the new "infrastructure realism" narrative.

That is, crypto doing something you can actually touch.

And that matters.

It's a rare story that bridges the speculative world of on-chain finance with physical outcomes.

For a market craving proof that the blockchain isn't just trading vapor, this narrative feels refreshing.

The Rise of Real-World Assets

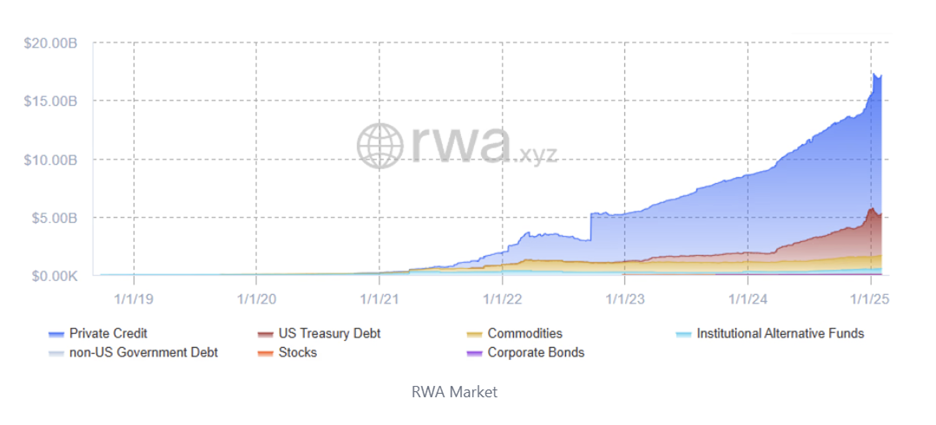

While DePIN grabs the headlines, another narrative keeps grinding higher under the surface: real-world assets (RWA).

Tokenized treasuries and yield-bearing stablecoins may not generate social-media buzz. But their numbers speak louder than their memes.

The sector hit an all-time-high of roughly $17.7 billion in total value locked this month.

In a way, RWA is the anti-narrative narrative: boring, compliant and institutionally friendly.

In short, it’s everything early crypto wasn't.

But it's also the most credible bridge to mainstream finance I've ever seen.

For investors who think in terms of durability, this is the tortoise in a field of hares.

Core Infrastructure Keeps Its Crown

Meanwhile, Layer-2 scaling networks — the blockchains that make Ethereum (ETH, “B+”) faster and cheaper — remain the quiet backbone of the entire system.

Total value secured on L2s sits around $40 billion. And that base continues to expand even when prices wobble.

These aren't the sexiest tokens. But they don’t need to be.

Instead, they represent the rails everyone else is building on.

In traditional markets, you'd call them picks and shovels plays. They don't always lead bull runs, but they rarely leave you empty-handed either.

The Restaking Race and the Search for Yield

If 2023 was the year of staking, 2025 is shaping up to be the year of restaking. That’s the process where users can pledge their staked assets to secure new networks.

EigenCloud (EIGEN, “C-”), the category's juggernaut, commands nearly $20 billion in total value.

New middleware competitors — notably Symbiotic and Karak — are emerging, while liquid restaking protocols like KernelDAO (KERNEL, “C-”) sit one layer above as aggregators/liquidity routes.

For investors, the restaking story carries echoes of DeFi Summer: high yields, technical complexity and real risk if things go wrong.

But it's also an early look at how Ethereum's security can scale horizontally into other ecosystems.

In short, I see this as a sign of maturity, not mania.

What the Attention Index Really Means

If you step back, the weekly Attention Index reads like a map of collective psychology.

Each row — DePIN, RWA, AI, restaking and L2s — represents a different emotional wavelength of the market.

- DePIN and AI express optimism about crypto building things again.

- RWA reflects a desire for stability and institutional validation.

- Restaking and L2s show ongoing faith in Ethereum's base layer as infrastructure.

Viewed together, they're less about which token pumps next and more about how the community allocates belief.

And belief, in speculative markets, is a form of capital.

Why Investors Should Care

So back to the only question that matters to you: "What good is this information to me?"

Here's the answer.

- It keeps you oriented. Knowing which narratives dominate helps you understand why your portfolio moves. If AI coins suddenly rally, maybe DePIN and compute tokens follow — not by coincidence, but by shared narrative gravity.

- It helps you recognize maturity. Narratives that pair rising attention with growing fundamentals — user counts, TVL, revenue — are where hype can turn into adoption. That's where long-term opportunity lives.

- It teaches you when not to chase. By observing how attention peaks and fades, you learn to step aside when euphoria tops out.

Ultimately, this is about pattern recognition.

Each week's data is a single frame; together they form the movie of a market learning, adapting and speculating in cycles.

A good narrative doesn't guarantee returns — but it's almost impossible for a major move to happen without one.

That's why following the rotations matters.

It's not about chasing the next hot coin. It's about staying fluent in the market's changing language.

The Bottom Line

Right now, the stories with both heat and backbone appear to be DePIN, RWA and Layer-2 scaling.

They combine attention, measurable growth, and real use cases — the trifecta that usually precedes structural trends.

Restaking remains the wildcard: promising, complex and potentially volatile.

But the point isn't to memorize who's winning. It's to understand why the crowd keeps changing the game, and what that says about where crypto is headed next.

Because in this market, narratives don't just describe reality —they create it.

Best,

Jurica Dujmovic

P.S. If reading and predicting narratives feels like a tall order, don’t worry.

There are a few key infrastructure plays that benefit from several of these market-leading narratives.

These are cryptos that have proven themselves able to maintain momentum … even after the sector’s 15 minutes of fame have faded.

To learn more about which ones my colleague Juan Villaverde is targeting — and when his Crypto Timing Model says to load up — click here.