It’s ‘Not-So-Secret Money Printing’ Season

|

| By Juan Villaverde |

Like many investors, I’ve been keeping an eye on China lately.

The country’s massive monetary stimulus has already made waves in global markets. And, if you’ve been keeping up with my Weiss Crypto Daily updates, you’ll know exactly why that’s bullish for the broad market.

If you’re not caught up, here’s the spark notes: Global liquidity is the true fuel that powers crypto markets.

When it comes to global liquidity, though, not even the People’s Bank of China can rival the U.S. Federal Reserve.

So far, the Fed hasn’t announced any money printing plan. Instead, it has started to raise rates in a trend that is unlikely to stop anytime soon.

That’s been enough for some talking heads. But not for me. I know not to pop the champagne just yet.

That’s because rate cuts alone won’t be enough to send crypto soaring. We still need the real magic ingredient to get the markets going: a liquidity injection from the Fed.

And we’re likely to get one. Soon.

That’s because dollar liquidity is drying up. And when liquidity runs low, cracks start showing in the very foundation of the banking system.

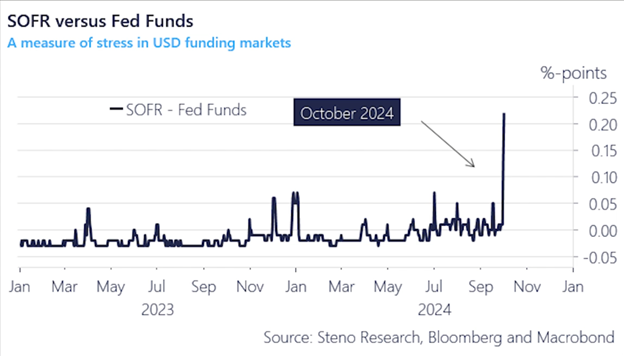

Need proof? Let’s look at a little thing called the Secure Overnight Financing Rate (SOFR) and how it compares to the Fed funds rate:

- The Fed funds rate is the interest rate set by the Fed for uncollateralized overnight loans between member banks.

- SOFR, on the other hand, is the private rate banks charge each other for the same loans.

When SOFR suddenly spikes relative to the Fed funds rate — like it did last week — it’s the financial system’s way of waving a red flag.

And the Fed watches for that red flag like a hawk. The last time it was raised was in 2019. In response, the Fed hit the panic button and printed money like crazy to stabilize things.

And it worked! But now, the solution is also a bit of a problem.

See, money printing — also called Quantitative Easing, or “QE” — isn’t a popular strategy. Especially after the latest round in 2019.

In fact, “QE” is just as dirty a word to the public now as “bailout” was after the 2008 financial crisis. So don’t expect Fed Chair Jerome Powell to get up on stage and announce a new round of QE.

Instead, to add liquidity to the market, the Fed has to dust off its slight-of-hand skills.

Remember the Silicon Valley Bank collapse?

Back in March 2023, there wasn’t a full-scale “bailout.” Oh no, the actions taken were just to “stabilize the system” … with a little help from the Fed.

The private sector played hero to the public. But guess who was really pulling the strings and flooding the system with cash?

Yep, the Fed. And it will likely use the same playbook now.

So don’t be fooled: Just because Powell won’t call it QE doesn’t mean the Fed isn’t quietly pumping liquidity into the system.

He will find ways to slip fresh cash into the banking system — whether through rule changes or by nudging banks to borrow more. Powell will keep trying to convince us that the days of printing money are behind us.

But guess what?

The markets see right through it! After the mini-banking crisis of 2023, Bitcoin (BTC, “A”) surged.

If the Fed starts sneaking in fresh liquidity — especially now that we’ve seen selling pressure just about out, as Dr. Bruce Ng revealed on Tuesday — crypto will likely skyrocket.

It always has when new liquidity gets injected.

So, while the game might look different, the rules are the same: When the Fed prints, markets rise.

If you see Bitcoin rally above $67,000, that’s your cue that the monetary engine is firing on all cylinders again.

And it won’t stop until at least the middle of next year.

Now, I use Bitcoin as a broad market indicator. That’s because it tends to lead the markets.

At least, at first. But it isn’t likely to make the largest gains.

There are other cryptos I’ve been watching — and I’ve recommended my Weiss Crypto Investor Members add to their portfolios — that I believe will outperform Bitcoin this cycle.

There’s one in particular that’s on my radar right now. To learn more about it — and what my Timing Model expects the market to look like after Nov. 5 — I urge you to watch this video now.

Best,

Juan