Microsoft’s “Blockchain-as-a-Service” Could Be an Early Warning Sign

|

| By Jurica Dujmovic |

It seems like bad times just keep on coming.

On one hand, the war in Ukraine rages on with no indication of stopping. On the other hand, a different type of war is taking place: a war against the very soul of crypto, and it's being fought with regulation and corporate assimilation.

Last week's, I pointed out that JPMorgan Chase (JPM) owns a huge chunk of critical Ethereum infrastructure, and why that was a knock against the nature of decentralized finance (DeFi). Now, that's been compounded by yet another piece of discouraging information:

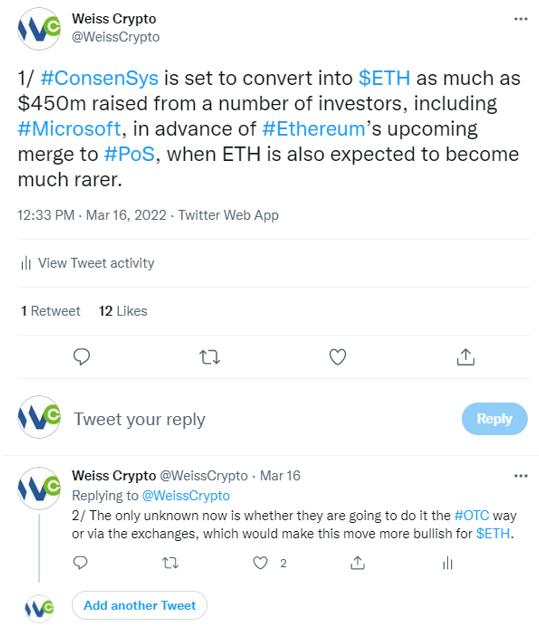

ConsenSys — a blockchain software technology company — is now partially owned by none other than one of the kings of centralization and dubious business practices, Microsoft (MSFT).

While the company is allegedly using the web3 tech to get back at Meta (FB), Google, Twitter (TWTR) and others, it's more than obvious that it'll also use its influence to further subjugate ConsenSys, turning its entry points — nodes and MetaMask — into yet another integral part of its service.

To understand what Microsoft could possibly do with ConsenSys, let's consider what Bill Gates' company is currently doing with the rest of its lineup:

With Windows 11, Microsoft is turning toward a desktop-as-a-service model, where users won't even own the operating system they purchased. Instead, it will fully depend on a subscription from the Redmond giant.

This type of subscription-based service is a direct continuation of what Microsoft has been doing with its Office 365 service (rebranded as Microsoft 365), which replaced the traditional Office suite of apps.

The plan for this team is for Microsoft to create a "blockchain-as-a-service" model, granting Ethereum developers access to a private network where they can develop updates and dApps for Ethereum. This is intriguing because, at the moment, developers on the Ethereum network have to pay small amounts of ETH for computational steps to develop on Ethereum's public, open-source blockchain.

Microsoft's private network, supported by its Azure division, would allow developers to work for free.

According to ConsenSys founder Joseph Lubin, the idea would be to develop on the private network and "at some point ... spin up a public node and, in the integrated development environment, click one button and deploy the debugged program to the public Ethereum blockchain."

And maybe that's where it ends. Maybe average or casual investors in the crypto space may not mind development happening behind closed doors, where once the entire community was able to see what was in the works. Or, maybe, Microsoft will see the profit potential and move from "blockchain-as-a-service" for just developers to every user.

Imagine ConsenSys entry points under a similar service model: To access MetaMask — and by extension, your crypto assets — you'd first have to log in via your Microsoft account on their private network, giving the tech giant access to your data.

That's how insane and laughable this will likely be. In Microsoft's hands, web3 will likely be nothing more than yet another add-on, provided to users via a centralized Microsoft account.

While the Ethereum blockchain itself won't be affected by this, it's possible this is just the start of web2 companies assimilating the most popular nodes and wallets, turning them into something far removed from the foundational principles of crypto.

And I'm not the only one noticing the warning signs. The lure of mainstream adoption at the cost of true decentralization pushed yet another fan favorite crypto project toward a DINO-like move:

Check out our Twitter page to read the full thread.

Honestly, though, Bored Ape's application of know-your-customer (KYC) protocol isn't even the most offensive part. KYC is just an inconvenience. Rather, it's what its implementation represents.

A comment thread by Twitter user MachG sums it up the best:

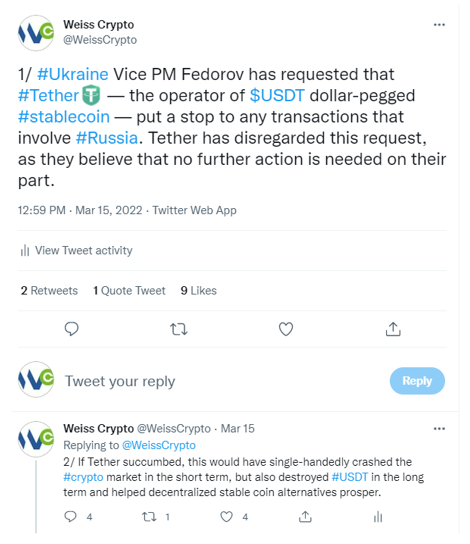

Pressure on crypto projects to adapt to become more palatable to the traditional finance crowd ramps up daily. Next up in that line seems to be Tether (USDT), which is already a centralized — i.e., operated by a central authority — stablecoin:

Luckily, it seems Tether is holding on to crypto's foundational ideology.

But Undiscovered Crypto editor Marija Matić — who wrote this tweet — confirms in the second post my earlier assumption: If Tether decided to step in and control access, that alone wouldn't be enough to destabilize crypto in the long term. Instead, all it would do is kill Tether and create a void that would be filled with another stablecoin — likely a decentralized one.

If things like this continue and giants of the traditional financial system convince crypto projects to turn away from the ideals such as decentralization and trustlessness, we'll likely be left with a rift in the space: Decentralized In Name Only (DINO) projects on one side and true DeFi projects on the other.

This would yield both positive and negative outcomes.

The positive: Crypto will survive, no matter what the web2 giants or regulatory bodies try to do.

The negative: This will effectively derail if not thwart the mainstream DeFi adoption we've dreamed about for so long as the masses of casual investors stick with DINO projects for their familiarity and ease of use.

But if mainstream adoption requires crypto to abandon its raison d'être and become yet another extension of a centralized, overregulated system that protects corporate greed, then "crypto" becomes nothing but a trendy buzzword for the masses to consume.

On the other side, HODLers, developers and crypto maximalists will return to crypto's origins — to Discord, Reddit, GitHub and other online forums — and get back to work creating what will become the backbone of an even stronger, more resilient crypto movement.

For now, the battle is ongoing. But soon, crypto will face its biggest choice: To pay the price of mainstream adoption — even if it means losing itself in the process — or remain defiant and possibly risk that adoption ... and profit opportunities.

Which of these two would you pledge your assets to? Let us know by commenting on Twitter using the hashtag #CryptoFuture and tagging us @WeissCrypto.

Until then, stay safe and trade well.

Jurica Dujmovic