|

| By Mark Gough |

The market is shifting beneath our feet.

After months of Bitcoin (BTC, “A-”) dominance, the tide has finally turned. Just as I predicted.

Back on June 4, I laid out my thesis with precision:

“If Ethereum (ETH, “A-”) continues to lead and Bitcoin's dominance — which is butting against resistance at 64.5% — begins to retreat, capital could shift into altcoins and ignite a broader rally across the market.”

Nearly eight weeks later, that forecast has played out with near-perfect accuracy.

-

Ethereum maintained its strength and leadership over Bitcoin. It has continued its strong relative performance since April.

Now, ETH trades near its yearly highs after doubling from its lows.

- Bitcoin Dominance (BTC.D) was rejected at the 66% resistance level and fell to 60%, confirming the start of capital rotation. It now sits near 62%.

- Select altcoins — particularly those in high-conviction sectors like RWAs, AI infrastructure and modular chains — have begun to show sustained momentum.

This isn’t noise. And it’s not hype.

It’s structured capital rotation. And it’s only just beginning.

Targeted Rotation Accelerates

While I am glad to see ETH claim the spotlight, I need to be clear: What we’re seeing is not a blanket altcoin season.

Rather, it’s a selective, narrative-driven rotation into projects with real-world adoption potential and institutional relevance.

For investors, the difference is important.

In cycles past, you could expect liquidity to spread across the altcoin sector with relative confidence. And that rising tide lifted most boats.

Now, you need to be selective about where to put your investment dollars.

Here are the sectors grabbing most of the attention … and capital:

Real-world assets: RWAs are breaking out, with leaders like Ondo Finance (ONDO, “D”) and Centrifuge (CFG, “E-”) showing continued strength as tokenized treasuries and credit markets gain traction.

Decentralized finance: DeFi is awakening, and its push is led by protocols with proven staying power.

Aave (AAVE, “C+”), for example, is one of the original DeFi blue chips. It recently began to show fresh signs of life as lending volume returns. In fact, it broke out of its long-term range to now retest key resistance levels.

Another DeFi play, BNB (BNB, “C+”), is often overlooked as a “legacy alt.” But it just hit a new all-time high — a rare feat in this cycle.

Its strength reflects the growing dominance of BNB Chain in emerging markets and the rising velocity of real-world applications within its ecosystem.

Finally, Ethena (ENA, “B+”) has rebounded sharply from its June low of 22 cents to 70 earlier this month. That’s a +218% gain!

This rally is thanks to Ethena’s place in the new stablecoin sector narrative.

As its own stablecoin, USDe, gained traction and Treasury bill-backed stablecoins become a focal point in regulatory and institutional circles, Ethena has become a proxy for speculating on that narrative.

The last sector I want to highlight is AI. Specifically, AI infrastructure projects that build compute markets, decentralized data feeds and model validation layers.

These types of projects have shown serious momentum as capital follows the AI convergence theme.

What Comes Next

I don’t have a crystal ball. So, I can’t tell you exactly how the coming weeks will shake out in the crypto market.

But here’s what I am watching to get a better picture:

- BTC.D breaking below 59%. That would open the door to a deeper and broader altcoin rally.

- ETH breaking above $4,000 and retest its previous all-time high to confirm sustained momentum.

If that breakout gets confirmed, I can see Ethereum hitting $6,000 by year end. And if the bull rally extends into next year, it could potentially hit $10,000.

ETH Institutional Adoption Now Impossible to Ignore

There are a few catalysts fueling Ethereum’s momentum.

But one of the most powerful is Ethereum’s quick rise as a treasury staple, with real inflows to match.

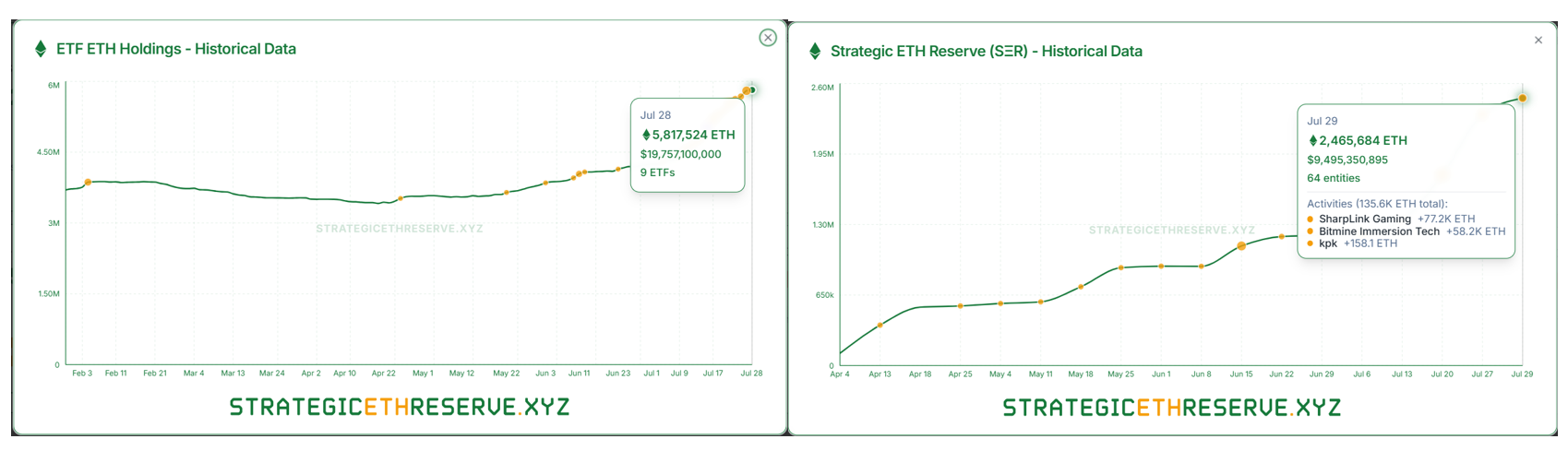

In the past month, we saw $453 million in ETF inflows in a single day, the largest ever for Ethereum. This is a metric I’ll be watching closely going forward. Sustained daily inflows above $100 million could accelerate Ethereum’s move toward new highs.

In total, 5.8 million ETH — worth nearly $20 billion — is now held across all U.S.-based ETH ETFs.

And Strategic ETH Reserve (SER) holdings now sit at 2.46 million ETH, spread across 64 entities.

This is no longer a speculative trend.

ETH is being adopted using the Bitcoin-as-treasury playbook, backed by institutional-grade infrastructure and regulatory clarity.

We’re already seeing ETF inflows mirror the early days of Bitcoin’s institutional run.

But unlike Bitcoin, Ethereum has the potential to offer staking yield, deep liquidity and developer dominance to sweeten the proposition.

Final Thoughts

Ethereum has solidified its position not just as a top-performing asset but as a foundational layer for institutional crypto infrastructure.

And it did so at an opportune moment. Right as Bitcoin dominance dropped off. Now, ETH and select altcoins are finally able to catch a sustainable bid. Not from hype, but from structural rotation and capital alignment.

I called it back in early June. Now, it’s playing out across every major metric.

And it’s creating opportunities along the way for investors savvy enough to catch them.

Best,

Mark Gough