|

| By Mark Gough |

The crypto neobank narrative is entering breakout mode.

My colleague Marija Matić briefly touched on neobanks last week.

Basically, these are digital banks. No branches. Just checking accounts, debit cards, money transfers and more, all managed from your phone.

But blockchain technology takes neobanks to the next level. And they are beginning to revolutionize your banking experience.

For investors watching the next wave of mainstream crypto adoption, neobanks like UR by Mantle could become the missing bridge between traditional finance (TradFi) and decentralized finance (DeFi).

Neobanks: The Next Major Crypto Frontier

Traditional banks remain slow, fragmented and expensive. Especially across borders.

Crypto exchanges improved access, but they stopped short of full banking utility.

Neobanks bridge that gap. They combine the convenience of digital banking with the openness of crypto. This convergence is reshaping the landscape of digital finance.

For investors watching the next wave of mainstream crypto adoption, neobanks could become the missing link between traditional finance (TradFi) and decentralized finance (DeFi).

And that has generated a lot of attention.

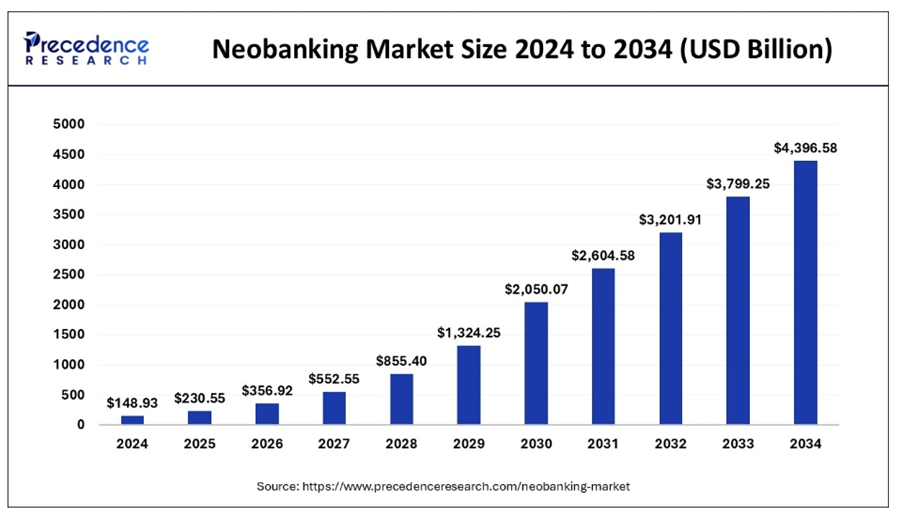

The global neobanking industry reached ~$149 billion in 2024 and is projected to soar to over $4 trillion by 2034. In other words, it’s expected to grow at more than 40% annually.

Within that explosive expansion, crypto integration is now the key differentiator.

By 2026, roughly 40% of neobanks are expected to offer crypto services. That would allow them to service a global base with 93 million U.S. crypto holders and tens of millions more entering the market each year.

Meanwhile, stablecoins — the backbone of the neobank thesis — have quietly become core payment infrastructure.

With a combined market cap above $250 billion, stablecoins now process more daily transaction volume than Visa or Mastercard.

This milestone marks a turning point: For the first time, blockchain payment rails are outpacing legacy systems in both efficiency and global reach.

Regulatory clarity is also catching up. Europe’s MiCA framework and pending U.S. stablecoin legislation provide the compliance foundations allowing banks, fintechs and DeFi platforms to interconnect securely.

When the convenience of online banking meets DeFi utility, you have a strong catalyst for broader adoption.

Ur By Mantle

With the crypto neobank narrative entering breakout mode, I want to take a look at one of the early standouts.

Because it, and the network it’s on, are a sign of what’s to come.

Launched in mid-2025, UR (pronounced “You Are”) is Mantle’s (MNT, “B-”) flagship neobank — a blockchain-based digital bank built for global use.

UR operates under Swiss financial regulation to offer users verified accounts with Swiss IBANs across EUR, CHF, USD, and RMB.

Deposits are 1:1 backed by underlying assets, combining traditional banking protections with blockchain transparency.

And it plans to integrate with Mantle’sDeFi suite, including Mantle Index Four (MI4) and the mETH liquid staking protocol. Benefits include …

- Up to 5% APY on USDe through its integration with Ethena Labs. (Unlike promotional bank offers, this yield is supported by Mantle’s ecosystem economics and treasury reserves.)

- No off-ramp or transfer fees

- Funds can be moved via SWIFT, SEPA and crypto networks, including Ethereum (ETH, “A-”) and Arbitrum (ARB, “C+”). Never before have individuals had so much control over their cross-border payments.

- A debit card — issued by Mastercard — that connects fiat and stablecoin balances for spending anywhere. This card can instantly convert between the two.

Mantle’s DeFi suite also creates a feedback loop where user deposits deepen liquidity to enhance yields and attract more users.

In short, it’s the kind of circular economy that could give Mantle lasting network effects while boosting UR’s utility.

As Mantle’s Global Head of Strategy, Timothy Chen put it:

“UR is a foundational step toward closing the gap between on-chain capital and everyday financial utility. We’re not just building a crypto neobank — we’re prototyping what the next generation of financial institutions should look like.”

Rising Competition Across the Sector

UR isn’t alone in chasing this vision. A wave of competitors has emerged:

- Plasma One, backed by Peter Thiel investors, focuses on emerging markets and stablecoin access. Its zero-fee transfers and high yields appeal to the unbanked population across 150+ countries.

- Tria, built on Arbitrum, emphasizes self-custody and multi-chain yield strategies for crypto-native users.

- EtherFi Cash extends the reach of its $11 billion restaking protocol into DeFi-native banking, merging yield and payments.

- Galaxy One, launched by Galaxy Digital, provides a U.S.-regulated platform bridging equities, ETFs and crypto for accredited investors.

- MetaMask Card, meanwhile, leverages one of crypto’s largest user bases to enable instant wallet-to-merchant payments.

Each player is taking a different approach by targeting different audiences. But their goals are the same: to make your crypto as easy to use and as trustworthy as a traditional bank account.

The Institutional Tailwind

Behind the scenes, major financial institutions are preparing to make these crypto banks possible.

Citi has begun issuing tokenized deposits for 24/7 cross-border payments.

HSBC has launched tokenized gold on its internal blockchain.

The Basel Committee’s new global standards, which will take effect in January 2026, will allow regulated banks to hold crypto assets with defined risk weightings — a critical regulatory milestone.

Together, these moves signal that crypto no longer operates on the financial fringe.

The infrastructure for large-scale integration is being built now, paving the way for neobanks to plug directly into global payment and settlement systems.

The Bigger Picture

The rise of crypto neobanks marks the next logical phase in digital finance.

DeFi proved what was possible. Stablecoins made it liquid.

Now, neobanks are making it usable. They wrap the apps you use every day with blockchain infrastructure so you can do more with your fiat and crypto.

Mantle’s ecosystem, powered by UR, illustrates how a Layer-2 network can evolve beyond scaling into full financial functionality.

If the neobank model succeeds, it could turn today’s wallets and yield protocols into tomorrow’s checking accounts and savings plans — all of which will run on transparent, programmable money.

The convergence of TradFi and DeFi is no longer theoretical.

It’s unfolding in real time — in code, in regulation and, soon, in how you can manage your money.

Mantle itself saw daily trading volume jump 120% to $1.2 billion in October. And transactions climbed to nearly 80,000 per day, with weekly active users more than doubling in that same time.

In short, it has seen the fastest growth rate among all major Layer-2 networks.

If you want to stay on the frontier of what DeFi can do, I suggest keeping a close eye on this project.

And on the neobank opportunities still ahead.

Best,

Mark Gough

P.S. The reinvigorated institutional interest in crypto means it will be harder to casually stumble upon the impressive returns crypto traders have targeted for years.

That’s why I hope you watch Juan Villaverde’s urgent crypto briefing before it goes offline tomorrow.

As a cycles expert, Juan has tracked the crypto market for years. He’s taken that expertise and boosted it with AI to create his improved Crypto Timing Model 2.0. Through testing, it has proven it can generate AVERAGE gains of 6,630% for each crypto asset.

And in his briefing, Juan shows you how it can work for you, too. You can see for yourself here.