Regulators Get Onboard as Stablecoins Hit Record Highs

|

| By Mark Gough |

Back in June, Marija Matić let you know that stablecoins were no longer just tools for crypto traders.

Rather, they were on their way to becoming critical infrastructure for real-world finance.

Indeed, as 2025 progressed, stablecoins have become the quiet powerhouse of the digital asset economy.

And now, stablecoins have reached a significant new milestone.

The total stablecoin market cap has reached an all-time high of $294.75 billion.

And that’s not the only record broken recently. Active monthly senders hit 25.2 million.

These numbers highlight how stablecoins function as the essential rails for crypto payments, trading and settlement.

But this is far from the end of the road.

Tether (USDT) — the issuer of the world’s largest stablecoin — is considering a major fundraising round with plans to raise as much as $20 billion.

If successful, this raise could bring Tether’s valuation up to $500 billion … and make it one of the world's most valuable financial infrastructure companies.

Now that would be a flashing neon sign. One that confirms dollar-pegged tokens have become integral to global liquidity. Even the most anti-crypto talking heads would have to take note.

If Tether can pull this off, it would be a massive feat for a company that once operated with a lean staff of just seven employees. As of mid-2025, it is reported to employ around 200 people.

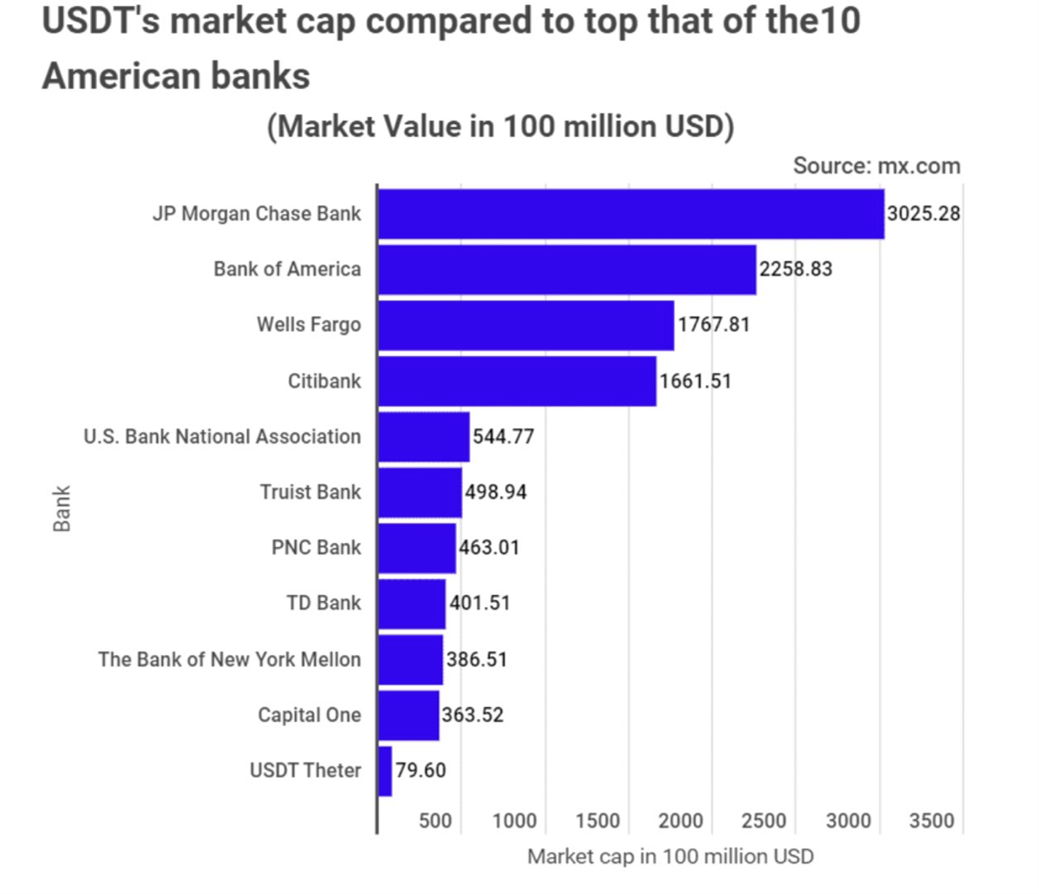

For further perspective, if Tether achieves this valuation, it would be worth more than many of America’s largest banks.

- Bank of America (BAC) is valued at about $225 billion,

- Wells Fargo (WFC) stands at $177 billion

- And Citibank (C) is at $166 billion.

At $500 billion, Tether would not only surpass each of them individually ... it would almost be larger than all three combined.

Think about that: A company without branches, deposit bases or traditional lending operations could soon be valued at a level that directly competes with some of the largest banks.

These are financial institutions that have defined the global banking system for more than a century!

All this is a testament to how disruptive and useful stablecoins have become.

Marija was right. These assets are no longer simply trading tools for crypto markets.

They are rapidly evolving into the infrastructure of global liquidity.

New Products and Use Cases

The disruption of stablecoins is just the tip of the iceberg when it comes to crypto’s expanding utility.

World Liberty Financial (WLFI, Not Yet Rated) confirmed that it is working to launch a debit card. It aims to link decentralized finance activity more directly with everyday spending.

In another sign of mainstream crossover, Ripple’s RLUSD stablecoin has become an official off-ramp for BlackRock and VanEck tokenized funds through Securitize.

This integration directly links traditional asset managers and crypto-native payment rails.

Across the world in Kazakhstan, we can see utility expanded even more.

The country just unveiled its own stablecoin, KZTE, pegged to the tenge and issued on the Solana (SOL, “B”) network.

The rollout includes partnerships with Mastercard (MA), Intebix and Eurasian Bank in a clear showing of how governments and financial institutions can experiment with public blockchain infrastructure for national currencies.

If you’ve been in the crypto space for a while, you’ll know that nothing puts the breaks on progress quite like restrictive regulations.

Fortunately, regulatory headlines suggest a growing openness to innovation.

Securities and Exchange Commission Chair Paul Atkins announced plans to roll out an “innovation exemption” by December. This will be designed to help crypto firms bring products to market faster … without lengthy approval bottlenecks.

The SEC also cleared the listing of Grayscale Ethereum Trust ETF under generic rules — a significant step in normalizing digital asset products within existing frameworks.

At the same time, the Commodity Futures Trading Commission has launched an initiative to evaluate tokenized collateral in derivatives markets, including the use of stablecoins.

This could set the stage for possible integration of digital assets into mainstream risk management tools in the U.S.

If you’re interested in weighing in, public feedback is open until Oct. 20.

Just click here to submit your two satoshis.

Final Thoughts

The day’s headlines highlight the diverging crosscurrents in crypto.

Stablecoins are stronger than ever, with adoption expanding across institutions, governments and retail users.

Regulators signal faster, more flexible frameworks. Even as ETF flows suggest near-term caution.

Against that backdrop, long-term voices like Coinbase CEO Brian Armstrong continue to frame Bitcoin and digital assets as core to the financial future — with projections of million-dollar BTC keeping the big picture firmly in focus.

The road in the near-term may be bumpy. And right now, the broad crypto market is in no hurry to go anywhere.

But we’re playing the long game.

Headlines like these and the updates your crypto experts break down in your Weiss Crypto Daily reports can help you keep perspective.

So be sure to check in tomorrow for even more.

Best,

Mark Gough