NFTs Gain New Life and New Maturity to Appeal to Institutions

Editor’s Note: As a tech analyst, I love exploring how the latest developments can revolutionize and improve our lives.

AI is no exception. But as I’ve said in the past, AI is only as good as the data set it learns on and the programmers behind it.

Which is why I want to tell you about Weiss Rating’s AI-powered stock system.

Our founder, Dr. Martin Weiss, calls it “the crowning achievement” of his 54-year career. It doesn’t get swayed by emotions or rattled by rumors. Instead, it relies purely on objective, unbiased data.

And it works better than any other stock tool we’ve developed before, beating the stock market by 94-to-1.

And this coming Tuesday, Aug. 12, Martin will take part in a history-making demonstration to show you how it can work for you.

To attend, just click to save your seat now.

In the meantime, I have another hot tech update for you: The resurrection of a once-beloved crypto innovation …

|

| By Jurica Dujmovic |

Remember the NFT mania of 2021?

Cartoon monkeys sold for six figures …

Digital rocks commanded millions …

And every celebrity was launching their own collection.

Well, that speculative frenzy is long gone. But something more interesting has quietly taken its place.

As 2025 slowly approaches its last quarter, NFTs are making a comeback. But this time, they’re fueled by true purpose. Not as overpriced profile pictures, but as functional tools solving real problems.

The hype is dead.

Now, we’re entering the age of NFT utility.

The Market Reality Check

Let's first be clear about where we stand.

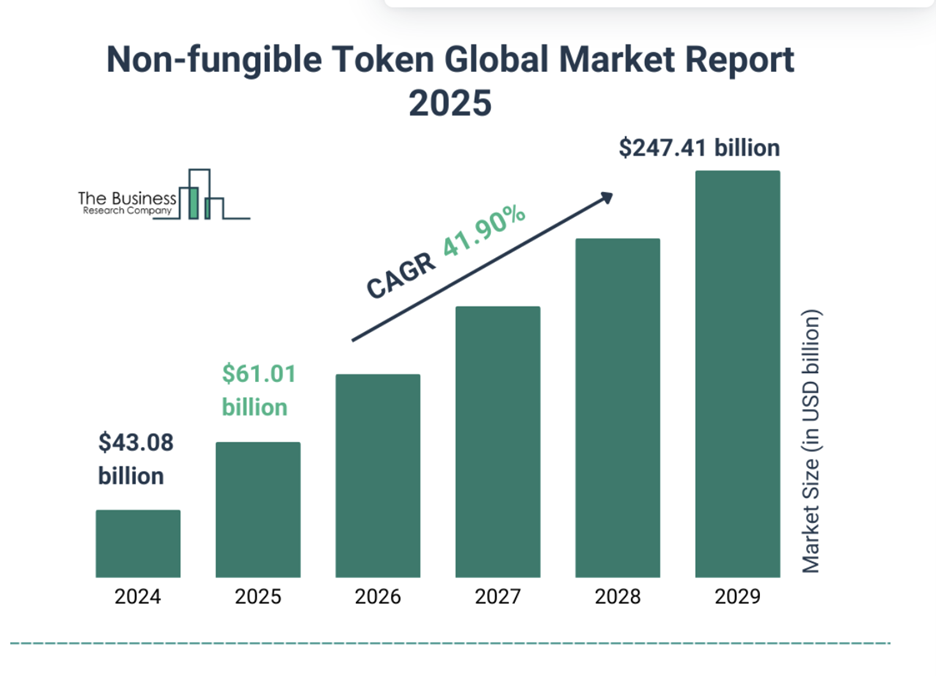

The global NFT market size in 2025 is estimated at $608.6 million according to Statista. Though other projections suggest figures ranging from $34.1 billion up to even $80 billion.

This massive spread reflects a market that is still finding its equilibrium after the speculative bubble burst.

And frankly? That's exactly what needed to happen.

More telling than the total market size is where activity is happening. In Q1 2025 alone, global NFT sales surpassed $8.2 billion.

But, as I mentioned above, this isn't driven by hype. It's driven by utility. The daily active NFT wallets averaged 410,000 in 2025, representing steady, sustained usage rather than speculative trading spikes.

This is what sustainable markets look like: Boring, consistent and actually useful.

Infrastructure Maturation Enables Real Applications

The technical barriers that plagued early NFTs have largely been resolved. Ethereum's (ETH, “A-”) Layer-2 solutions achieved significant progress in July 2025, scaling transaction capacity 17x while dramatically reducing fees.

The $52 billion in Total Value Locked across Ethereum Layer-2s indicates robust technical foundations, which were sorely lacking during the early days of NFTs.

With that firmly now in place, users have started to find value in the applications built on top.

What's Actually Working

The most compelling developments are happening in the web3 gaming industry.

Gaming NFTs now account for 38% of global NFT transactions. That’s because NFTs in this sector solve real problems.

With NFTs, players can truly own in-game assets, transfer items between games and monetize their gameplay in ways traditional gaming never allowed.

The NFT gaming market is estimated at $0.54 trillion in 2025, according to SAG ipl, a web2 design and development agency. And it expects that figure to double to $1.08 trillion by 2030, growing at a CAGR of 14.84%.

Although this figure should be viewed cautiously, the takeaway is clear: When NFTs provide genuine utility, adoption follows.

Beyond gaming, we can see improved utility benefit a few other applications as well, including …

- Identity and Credentials: NFTs are being used for digital identity verification, professional certifications, and membership tokens—applications where uniqueness and verification matter more than trading value.

- Supply Chain and Provenance: Luxury goods and collectibles are using NFTs to verify authenticity and track ownership history—solving real problems in markets plagued by counterfeiting.

- Fractional Ownership: NFT lending and fractional ownership are expanding, with a projected market of $2.3 billion in 2025. This enables access to high-value assets previously limited to wealthy collectors.

Granted, these aren't flashy use cases from the past. They're practical ones. And that's precisely why they're working.

It's taken years, but we're finally seeing what digital ownership was always meant to enable.

Multi-Chain Reality: Bitcoin Enters the Conversation

Perhaps most interesting is Bitcoin's (BTC, “A-”) re-entry into the NFT space.

Bitcoin NFT sales surged 22% from June to July 2025, with $73.3 million in trading volume over 30 days.

While this represents growth, context matters: Bitcoin NFTs — also called Ordinals — remain expensive to create and trade. Naturally, this limits their practical applications. Hence why the volume, while growing, is still small compared to Ethereum-based markets.

To me, this isn’t a sign of an Ordinals revolution. It’s simply diversification. But that's equally, if not more, valuable in establishing healthy market dynamics and signaling growing adoption.

When Bitcoin maximalists give NFTs a second chance, you know something fundamental has shifted.

And it’s a microcosm of a broader crypto shift.

The markets have moved away from memes and into projects with real promise beyond near-term popularity. And it celebrates every regulatory update.

Why? Because crypto is chasing legitimacy in order to attract institutional investors. They’re the ones really moving this market, as my colleague Mark Gough mentioned yesterday. And now, the NFT narrative is getting in on the action, as well.

The Institutional Shift

This changing participant base is fundamental to understanding where crypto sectors will go in the future.

For NFTs specifically, institutional investments now contribute approximately 15% of the market's annual revenue, with VC investment in the space reaching $4.2 billion this year.

NFT index funds and ETFs are also moving into the mainstream. There are already three major offerings approved to trade in the U.S.

Meanwhile, NFT-related job postings have grown by 48% in the past year.

This suggests the market is professionalizing.

The number of NFT users is expected to reach 11.64 million by 2025. And getting there from the current 11.58 million represents steady growth, not explosive expansion.

Over 12,000 NFT sales occur daily, indicating consistent activity rather than boom-bust cycles.

Boring is beautiful in this context. And if you ask me, sustainable beats spectacular every time.

What This Means for NFTs in the Rest of 2025

These last few months of the year aren't likely to bring a dramatic NFT "comeback" in the traditional sense.

Instead, I expect they’ll continue to show gradual maturation.

The infrastructure is solid, use cases are clarifying and professional adoption is growing.

This isn't the explosive growth of 2021. Nor is it the depression some predicted.

Rather, it's the boring, slow but sustainable march of a technology finding its proper applications.

And honestly? That's exactly what we needed to see.

The speculation phase is over. The utility phase has begun.

And for anyone who actually believed in the underlying technology rather than just the price movements, this is the best possible outcome.

NFTs are finally growing up, finding their place and solving real problems.

Growth and tech investors should consider keeping this sector on their radar.

Best,

Jurica Dujmovic