Our Crypto Timing Model Called for This Correction

|

| By Bruce Ng |

Hurricane Debby isn’t the only storm stirring up stress. While its winds whip up the southeastern U.S., the latest Bitcoin (BTC, “A”) price action has thrown investors into a spiral worldwide.

Indeed, it is quite worrying, to say the least. But, notably, it’s not without precedent … or opportunity.

Bitcoin fell below $54,000 today after hovering near $70,000 just one week earlier. Other leading cryptos have followed suit.

You’ll remember, though, that Bitcoin dumped in an even more catastrophic way amid the COVID flash crash. And it recovered shortly thereafter.

COVID 2020 Flash Crash

In March 2020, due to the COVID pandemic, equities and BTC tanked 50% in a massive wipeout.

It occurred in a span of three weeks. Following that, the Federal Open Market Committee decided to switch on its money-printing machine on April 16.

Not only did prices rebound to pre-crash levels within a matter of weeks, but Bitcoin went on a parabolic surge up till the end of that year.

I believe we are in a similar situation today.

In the last few days, five major macro events took place that caused BTC to dump hard:

- Threats of another major war breaking out between Israel and Iran.

- Warren Buffett selling stocks at record levels and sitting in $200 billion in cash.

- Jump Crypto — Jump Trading Group’s crypto division and a major player in crypto — has unstaked and transferred $315 million in Ethereum (ETH, “A-”) to exchanges. Rumors are swirling that Jump intends to sell, which could send the market down further.

- Macroeconomic indicators of a recession approaching.

- The Nikkei suffering its worst day since Black Monday, cascading to crypto and other global markets.

And it wasn’t just these headlines that caused this crypto turbulence. Though, they certainly added to it.

My colleague Juan Villaverde pointed out a key resistance level for BTC two weeks ago. According to his Crypto Timing Model, resistance at $70,000 was unlikely to be overtaken without a correction first.

Sure enough, Bitcoin came within touching distance of $70,000 just last week before falling more than 23% in a week’s time.

That’s the “why” behind the latest pullback. Now the question is, “when will it be over?”

Looking back to 2020, we see one potential way out.

After the COVID crash, the FOMC delivered two rate cuts at “unscheduled” meetings. In a matter of weeks, the money printer was turned back on, and prices recovered to pre-crash levels.

It looks like the Fed may try the same trick again. The futures market is pricing in the Fed scheduling an emergency meeting in August to discuss a 50-basis-point (0.5%) rate cut.

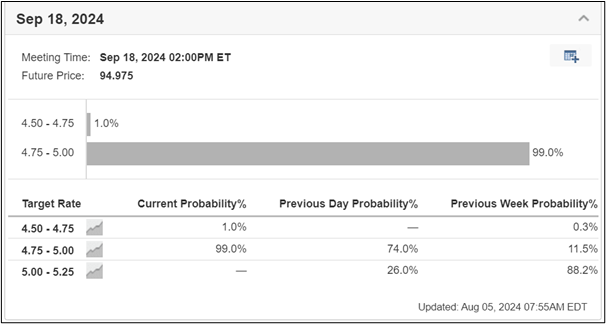

The current Fed Funds rate is 5.25% to 5.50%. A 50-bps rate cut will bring the funds rate down to 4.75%-5.00%.

The likelihood of a cut happening during this “off” month is uncertain. But there is still hope on the horizon.

That’s because it is much more likely — 99% likely, in fact —that we’ll see a 50-bps rate cut at the next scheduled FOMC meeting on Sept. 18:

So, a rate cut is likely coming. But when it happens will alter our expectations for the market.

If the cut comes at an emergency meeting, I expect BTC to rally hard.

If we have to wait, however, then the markets will likely bleed more before chopping sideways until the rate cut.

That will be a tough storm to weather. But I’m here to tell you that there are still opportunities, even in difficult markets.

This correction means there are big potential gains to be found when the green days return. And they inevitably will.

Now is a good time to look into — but not yet buy — coins that have the best potential to not only reclaim but surpass their recent highs when the rally kicks into gear.

We’ve talked about this strategy before.

Savvy investors should look for a new low to be established before jumping in. But when that time comes, they could see outsized returns on their investment.

So keep your powder dry for now. Then use this time to line up your next big move.

To learn which cryptos may be best suited for a long-term, “buy-and-hold” type strategy, I suggest you read up on Juan’s Weiss Crypto Investor newsletter.

In it, Juan follows the sectors leading the market by selecting the most promising opportunities in each for his model portfolio. And he uses his Crypto Timing Model to find the most opportune entry and exit prices to target long-term gains.

And indeed, Juan’s Timing Model helped him see this volatility in advance.

He warned his Weiss Crypto Investor members last month that by “drawing from historical patterns … it is clearly wise to anticipate further corrections and prolonged sideways trading before crypto markets stabilize.”

This foresight is why Juan recommended a few adjustments to his model portfolio before the latest drawdown.

Check out what he has to say about his strategy here.

And I’ll leave you with his parting wisdom …

“Don’t be discouraged. Remember:

- Periods like these are part of crypto’s natural market cycle.

- They are not indicative of an impending bear market. Plus, they may also offer opportunities for strategic positioning.

- Historical patterns suggest that corrections like these are often followed by substantial rallies. Indeed, that is what I expect.”

That’s all for today. Look to tomorrow’s Weiss Crypto Daily for further updates.

Best,

Dr. Bruce Ng