|

| By Mark Gough |

If you’ve been around the blockchain for a few years, you may remember MakerDAO, token MKR.

Initially an OG DeFi pioneer, this protocol fell out of favor as internal governance issues had users looking elsewhere.

But in August 2024, the long-standing MakerDAO brand underwent a full-scale evolution.

With its new name — Sky Protocol (SKY, “C”) — also came a major architectural and governance overhaul designed to meet modern DeFi demands.

Now, Sky offers a next-generation platform built for mainstream adoption, institutional integration and sustainable yield.

In other words, this protocol isn’t just building the future of DeFi.

It’s already profiting from it.

A Two-Token Engine for Sustainable Yield

MakerDAO’s rebrand was driven by three key objectives:

First was to overcome unit bias by making its governance tokens more accessible.

Second was to make itself more appealing to institutions to catch the wave of TradFi firms looking for crypto exposure.

And third was to simplify the user experience through a modern, multichain interface.

Founder Rune Christensen described the transition as a necessary leap forward.

To accomplish these goals, the protocol introduced two new tokens:

SKY: Governance and Value Accrual

Replacing the old MKR token on a 1:24,000 conversion ratio, the SKY token now anchors protocol governance.

Holders can vote, activate tokens for rewards and earn yield through participation.

It has a fixed supply to fight against inflation. And staking yields — which typically range between 13% and 15% and have even hit as high as 20% — are funded directly from protocol revenues.

SKY also features a sealed activation reward, which offers higher yields but locks tokens with a 5% exit fee.

This makes SKY a genuine yield governance token. Meaning stakers don’t have to wonder if the source of their yield will fizzle out.

They can confirm for themselves that it won’t.

USDS: Sky’s Regulatory-Ready Stablecoin

USDS replaced the old DAI stablecoin on a 1:1 ratio for seamless integration.

It remains over-collateralized and algorithmically managed, similar to DAI. But now, it includes enhanced compliance features such as:

- A freezing function to address theft or transfer errors, and

- Cross-chain interoperability with Ethereum (ETH, “B+”), Base, Arbitrum (ARB, “C+”) and Optimism (OP, “C”).

These refinements make USDS one of the few DeFi-native stablecoins that could realistically coexist within regulated financial systems.

Related story: Shadow Lobby Fights Stablecoin’s $6.6 Trillion Disruption

That makes this exactly the right type of stablecoin to entice the wave of TradFi firms chomping at the bit for new stablecoin opportunities.

Product Innovations Drive Sky’s Growth

Sky isn’t just correcting the mistakes of MakerDAO’s past. It’s looking to the future.

Which is why its ecosystem isn’t limited to a single protocol.

Its Sky Stars operate as semi-autonomous units. And each one specializes in different financial verticals:

- Spark: This is the DeFi lending and borrowing hub. It manages over $11 billion in total volume locked.

- Grove: Sky’s institutional credit strategy, which manages $1 billion in allocations.

- Keel: This Star expands into Solana’s (SOL, “B-”) on-chain markets with $2.5 billion in deployments.

Each contributes to Sky’s broader revenue base, reinforcing its role as a decentralized, yield-generating financial network.

To hammer that point home, Sky offers four key benefits for users that could spark even more growth. They are …

1. Sky Savings Rate (SSR)

USDS holders can earn passive yield through a low-risk, interest-bearing savings product.

This is similar in concept to Maker’s DSR, but with a streamlined user experience.

2. Sky Token Rewards (STR)

This is an annual distribution of 600 million SKY tokens to liquidity providers and USDS savers.

This accomplishes two goals: ensure active ecosystem participation and broaden token decentralization.

3. SkyLink Multichain Bridge

SkyLink connects Ethereum (ETH) with Layer-2 networks and alternative chains. In doing so, Sky can offer reduced fees and faster throughput, allowing it to compete as a hub for cross-chain DeFi liquidity.

4. Sky.money Interface

This user interface offers a single, unified platform for trading, governance, staking and savings.

In short, it’s built to make complex DeFi actions feel as simple as a mobile banking app. A necessity for broadening adoption and appealing to a non-crypto native user base.

Aggressive Buybacks and Tokenomics Strength

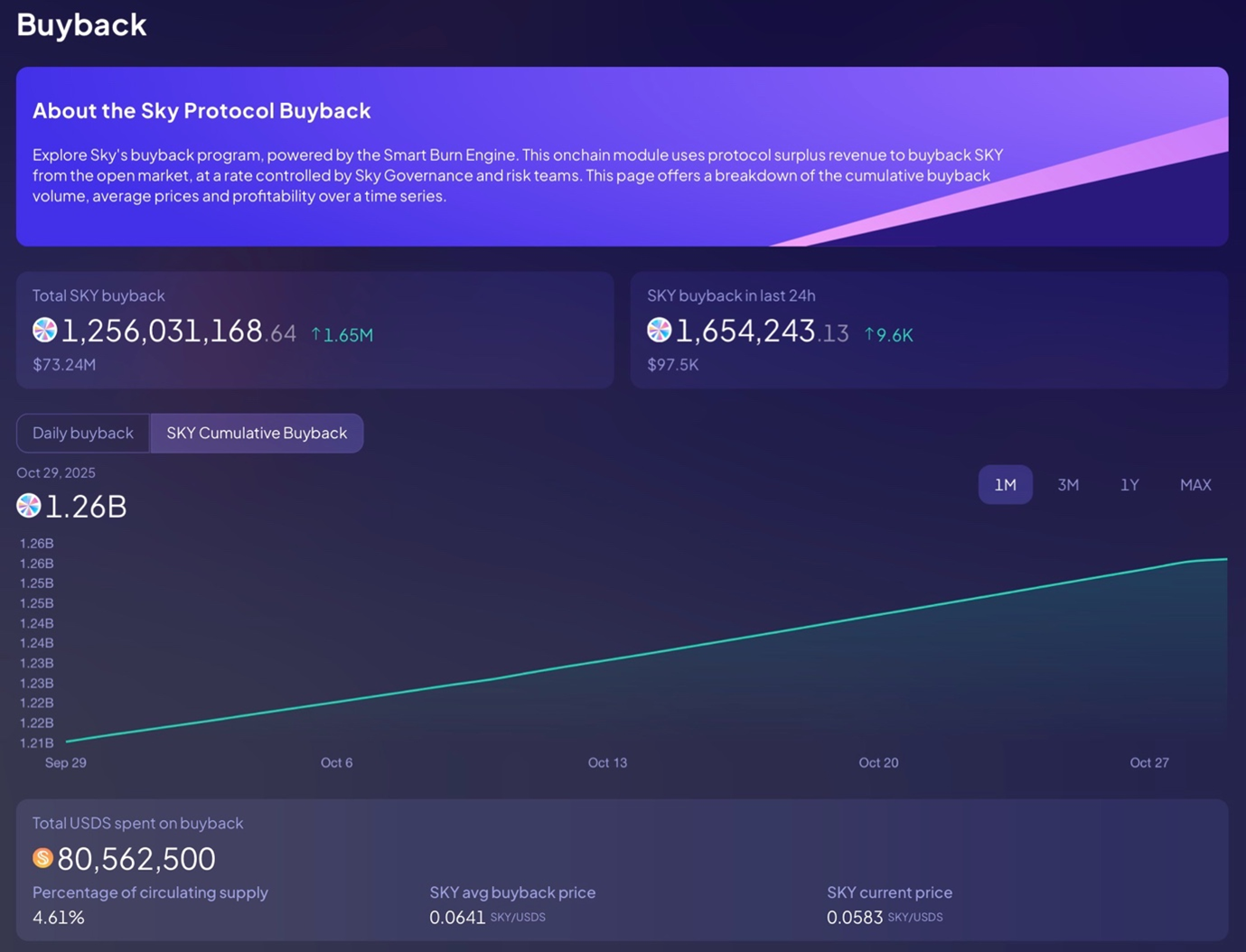

Since early 2025, Sky Protocol has executed one of DeFi’s largest buyback programs:

- $80.5 million in USDS spent repurchasing 1.25 billion SKY tokens.

- Equivalent to 4.6% of total supply removed from circulation.

- Daily buybacks averaging $100,000, with governance proposals targeting up to $300,000 daily.

At $300,000 per day, Sky would repurchase over $109 million annually — effectively returning 50% of protocol profits to token holders.

That’s a level of capital discipline rarely seen in DeFi.

In fact, it mirrors the share buyback logic of major tech companies like Apple and Meta.

And Sky trades at a price-to-earnings ratio of 6.27x. That is dramatically below both traditional equity averages and peer DeFi protocols.

This combination of real yield, strong revenue and undervaluation makes Sky one of the most compelling asymmetric plays in DeFi.

Bottom Line

Sky Protocol has evolved from the original MakerDAO vision into something far more robust: A cash-flow-generating DeFi ecosystem with sustainable staking, buybacks and institutional bridges.

It represents one of the most fundamentally sound and potentially mispriced assets in decentralized finance today.

If DeFi 2.0 is about sustainable yield, real earnings and regulatory readiness, Sky Protocol might be its blueprint.

The numbers are there. The fundamentals are there. It’s just a matter of time before price catches up.

Which is why it should be on your radar now, before it takes off.

Best,

Mark Gough

P.S. As SKY makes crystal clear, timing is everything in the crypto market. That’s where my colleague Juan Villaverde’s Crypto Timing Model comes in.

It tracks Bitcoin’s various cycles. Using that data, Juan and his Weiss Crypto Investor members can target the best times to enter and exit trades.

And now, the model can also track the individual cycles of blue-chip altcoins as well.

If you’re interested in learning more about how the model can help your crypto investing, click here.