|

| By Marija Matic |

As of writing, Bitcoin (BTC, “A-”) has rallied roughly $10,000 off November’s bottom.

But that reality hasn’t been reflected in market sentiment yet.

It’s not hard to understand why. Despite last week’s relief bounce, the key $93,200 resistance level for Bitcoin remains untouched.

Open interest on BTC and Ethereum (ETH, “B+”) perpetual futures is down 40–50% since early October. Now, we have a market that’s thin, sensitive and easily moved by headlines.

All eyes now turn to Wednesday’s Federal Reserve meeting.

Traders have priced in an 89.9% chance of a rate cut. But experienced players know that’s not the real signal.

Fed Chair Jerome Powell’s guidance on the balance sheet and the Fed’s 2026 rate outlook is what will determine whether this recovery gains momentum or fades into a year-end drift.

But something much bigger happened last week. A change that could enshrine Ethereum’s position as the smart-contract ecosystem of choice.

On Dec. 3, Ethereum rolled out its latest upgrade.

My colleague Mark Gough gave you the heads up last week. And he explained all the technical reasons why this upgrade is a big deal.

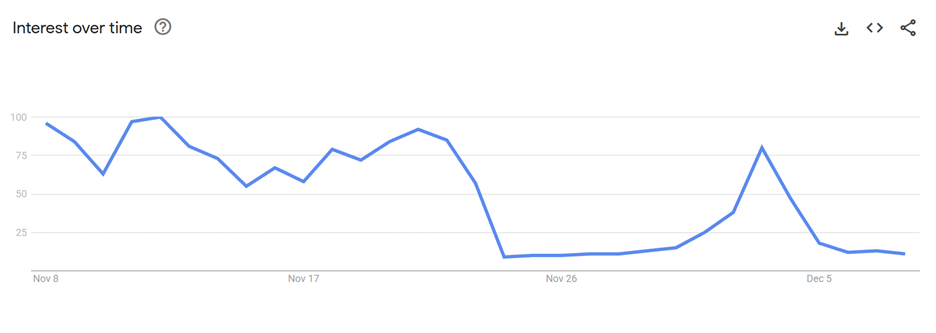

But a quick glance at Google says not many others are talking about it.

Don’t be fooled by the quiet.

The smart money has already silently begun to position itself to reap the benefits of this significant shift.

The Ethereum Fix Nobody's Talking About

While everyone debates Bitcoin’s next move, Ethereum just implemented one of its most important economic changes in years.

Here’s the simple version:

For months, Ethereum’s Layer-2 networks were using Ethereum’s security and infrastructure while paying nearly nothing for it.

It’s like if you or I rented a penthouse for vacation and left only a tip.

The Fusaka upgrade changed that dynamic. It introduced a minimum fee L2s must pay for Ethereum blockspace, aligning the cost with the actual service they consume.

The outcome is surprisingly elegant:

- Users get cheaper transactions (L2 fees dropped below $0.005),

- Ethereum finally earns predictable revenue from the L2 activity that now drives most of its traffic, and

- Those fees feed directly into ETH’s burn mechanism, which can reduce supply.

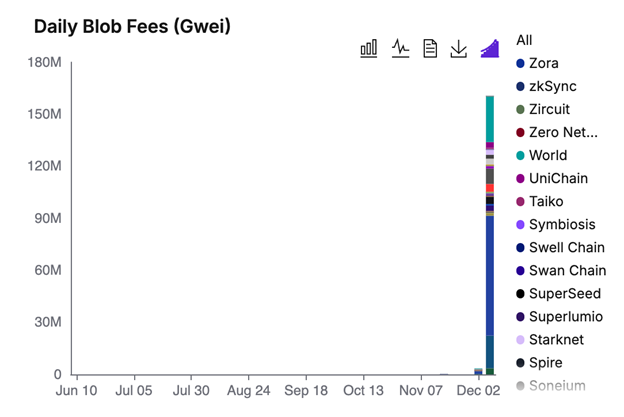

Now, the raw economic data from the past few days makes much more sense.

Blobscan shows fees collected from Layer-2s jumped 42x in the days after the upgrade.

Dollar amounts are still small relative to L1 revenue. But the model is now fixed. As L2 usage grows, so does Ethereum’s burn and revenue base.

In short, value that was going to the Layer-2 network … will now be shared more fairly with Ethereum.

Headlines may be quiet about this change. But sophisticated players who knew what this meant acted fast.

Three smart whale wallets have already positioned themselves, placing $426 million in longs on ETH.

It didn’t take long for institutional desks to notice, either.

Bitmine purchased $434.74 million worth of ETH last week alone, bringing their total holdings to $12.13 billion.

Even smaller institutional players like Amber Group and Metalpha are withdrawing ETH from exchanges - 6,000 and 3,000 ETH respectively today.

That alone isn’t confirmation of their long-term strategy. But when institutions move coins to cold storage, they're typically planning to hold, not trade.

Further cementing this point? Earlier today, we saw the publication of the headline nobody expected this early:

BlackRock already manages an ETH ETF. But the inclusion of staking - something expressly forbidden when the first round of ETFs were approved last year - opens up the world of yield farming for any holders.

When the world’s largest asset manager begins treating crypto assets as yield-bearing infrastructure, that’s a shift in worldview worth your attention.

Long-Term Conviction Not Exclusive to Ethereum

While this catalyst specifically benefits Ethereum, it has revealed another important development: Institutions are doubling down on their crypto exposure across the board.

Harvard University nearly quadrupled its Bitcoin holdings to $443 million while doubling its gold allocation to $235 million.

This tells us that Harvard is betting on currency debasement … and favoring Bitcoin over gold at a 2-to-1 ratio!

When the smartest brains in the room make that kind of allocation shift, I pay attention.

And despite headlines positing that Strategy may finally renege on its “never sell” mantra, on-chain data suggests otherwise.

The company bought another batch of Bitcoin last week, bringing total holdings to $60.58 billion worth.

Meanwhile, we're witnessing a boom in decentralized trading that's flying under most radars.

Perpetual decentralized exchanges crossed $1 trillion in trading volume for the second consecutive month in November according to DeFiLlama.

That’s a 15x increase in two years!

Web3 platforms like Hyperliquid are handling institutional-scale volumes, proving these decentralized platforms are becoming genuine powerhouses, not just experiments.

Follow the Stablecoins

These savvy whales and select institutions jumping on the bandwagon isn’t the only signal something bigger is afoot.

When you want to check out the pulse in crypto, sometimes, you only need to look at stablecoins.

- Circle printed $10 billion USDC in a single month.

- Tether added another $1 billion USDT on Tron (TRX, “C+”) today.

That’s billions in fresh capital sitting on the sidelines. It’s the crypto equivalent of seeing armies amass at the border.

Nothing has happened yet … but you know something will.

Big players don't create billions in stablecoins to sit on the sidelines. These two sector dominators have plans to deploy them.

When they mint stablecoins en masse like this, the typical pattern is the market consolidates for a few weeks. Then, significant moves follow, catching retail traders off guard.

We’ll see if it follows through this time round.

Wednesday Could Be Crypto’s Moment of Truth

With billions in minted stablecoins ready to deploy and institutions doubling down on their long-term positions, we're approaching Wednesday's Fed meeting at a first inflection point.

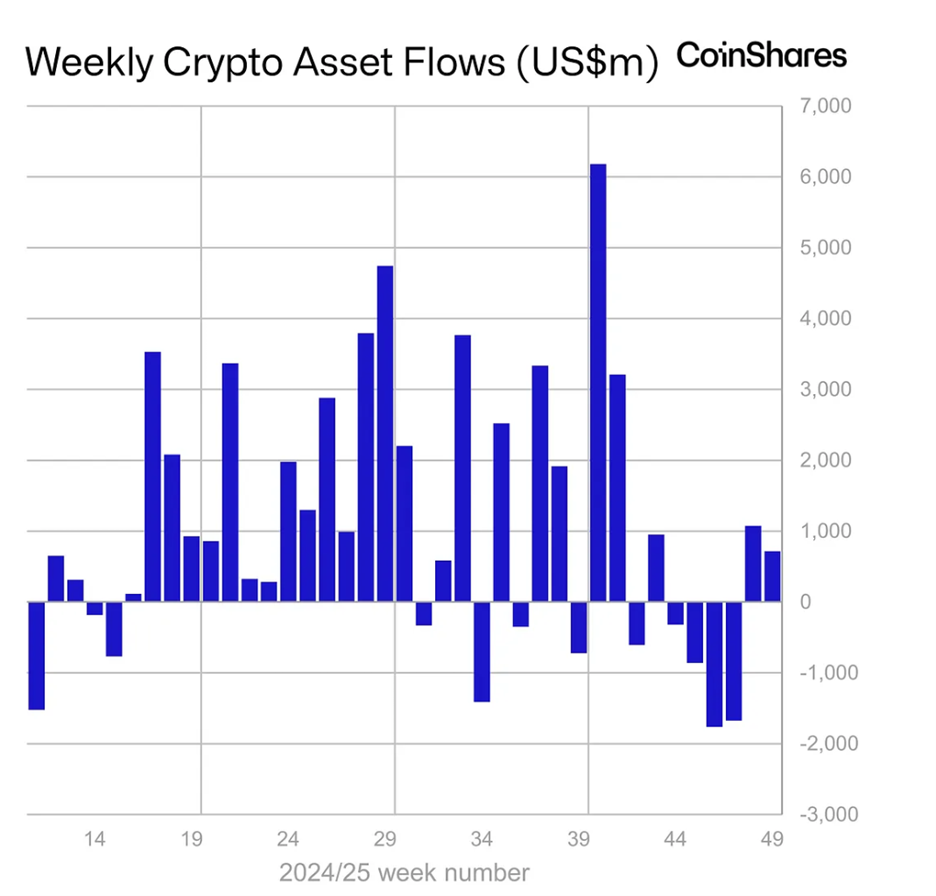

Last week, crypto ETFs saw $716 million in inflows after four weeks of outflows. This suggests that U.S. investors are cautiously returning.

But many will likely spook at any downside pressure.

Which means BTC’s $93,200 resistance level remains the key.

A break above after Powell speaks, and all that sidelined capital could rush in. Fail, and we may drift sideways into the holidays. (Which falls in-line with what my colleague Juan Villaverde expects.)

But while the market watches the Fed for near-term direction, the real story is still being written quietly in the background:

- Endowments treating Bitcoin as a superior store of value to gold,

- Ethereum fixing its economic engine and attracting institutional flows,

- Stablecoins expanding rapidly,

- Decentralized exchanges moving trillions,

- And global regulators opening the gates rather than closing them.

Something is shifting. And for once, it’s happening before retail notices.

Does that mean it’s time to make your next move?

Only you can say for sure.

But the big players at the table are already getting into position. No matter what else, that alone should be enough to make you sit up and take notice.

Best,

Marija Matić