The long-anticipated Ethereum (ETH, “A-”) spot ETFs were finally listed yesterday. And they’re already off to the races!

This is a huge development. A spot ETH ETF allows traditional investors to purchase ETH at its current trading price. Previously, opportunities like the Grayscale Ethereum Trust (ETHE) only allowed traditional investors to trade ETH at a discount.

This shift makes the new spot ETFs particularly attractive to institutional investors such as hedge funds, pension funds, banks, endowments and retail investors who are unable or uncomfortable diving straight into the crypto market.

Now, investors can choose between eight spot Ethereum ETFs:

- iShares Ethereum Trust (ETHA)

- 21Shares Core Ethereum ETF (CETH)

- VanEck Ethereum ETF (ETHV)

- Grayscale Ethereum Mini Trust (ETH)

- Fidelity Ethereum Fund (FETH)

- Bitwise Ethereum ETF (ETHW)

- Franklin Ethereum ETF (EZET)

- Invesco Galaxy Ethereum ETF (QETH)

Reports suggest that it was an extremely good day, beating most expectations. The ETH ETF is the second-best ETF launch in the past 12 months, beaten only by the launch of the Bitcoin (BTC, “A-”) spot ETFs.

That’s to be expected since Bitcoin breached the containment of the crypto sphere to gain mainstream recognition. Ethereum, on the other hand, is still a bit of a secret to traditional investors. Neither its role as the No. 1 smart contract blockchain nor its developing position in the web3 revolution have not been priced in by the TradFi market.

That’s why my colleague Maria Matić said if the spot ETH ETF inflows reached 20% of what the BTC ETFs saw on their first day, she’d consider them a success.

And she was very close to the mark!

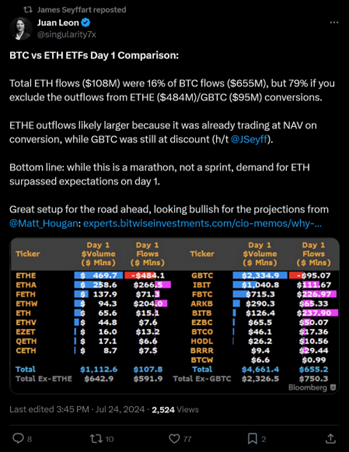

Total ETH flows of $108 million were 16% of BTC flows of $655 million. But I’m not disappointed by that performance considering yesterday also saw outflows from the Grayscale Ethereum Trust as investors either took profits or rotated into the new, lower-fee Grayscale Ethereum Mini-Trust (ETH).

We saw a similar sell-off with the Grayscale Bitcoin Trust (GBTC) when the BTC ETFs were listed. And, just like then, we expect this selling to taper off in time.

As Juan Leon, Senior Investment Strategist at Bitwiseinvest, states, “while this is a marathon, not a sprint, demand for ETH surpassed expectations on day 1.”

What Comes Next

Investors are holding their breath to see what the outcome of such a successful launch will be.

We may see FOMO — that is, fear of missing out — ignite a buying surge that will send the price of ETH higher.

But we could also face a “sell the news” scenario. Remember, back when the BTC ETFs were listed, BTC’s price initially saw a 17% drop as investors took profits. Only after was it followed by an astounding 89% surge.

If ETH cannot close above the current resistance at $3,564, a retracement to $3,167 is possible.

Let me be clear, though: this uncertainty is mainly a near-term concern. ETH’s outlook for the long-term is considerably more bullish, with a 100% to120% increase expected over the next 6-12 months.

Why? Well, there are a few factors.

First and foremost, the increased institutional adoption, which is now possible thanks to the ETFs. Previously, many of these investors were locked out due to regulation or unease in jumping into the crypto market directly. The ETFs open the doors for mainstream institutions to put ETH on their books.

Additionally, the ETFs boost confidence in Ethereum as an asset class. Meaning more investors will become more comfortable holding ETH.

So, does this mean now is the time to buy or add to your Ethereum position?

Well, that depends. With the anticipated volatility in the near term, it may not be a bad idea to wait until things settle.

And even once they do, savvy investors may want to consider diversifying their approach.

In addition to ETH, coins within the Ethereum ecosystem could offer promising opportunities. These include DeFI coins, rollups and Layer-2 opportunities or infrastructure projects such as Uniswap (UNI, “B”), Pendle (PENDLE, “B+”) or Omni (OMNI, Not Yet Rated), for example.

Pivoting to competing Layer-1 projects may also be an approach to consider. Now that Ethereum ETFs have officially launched, many in the market are looking ahead to predict the next crypto to be brought into the TradFi mainstream.

Companies are already eyeing Solana (SOL, “B”) as the next possible crypto to get its own spot ETF. And no wonder — SOL has been a leading asset so far this bull cycle.

But beyond the next ETF, projects like SOL and Sui (SUI, Not Yet Rated) are noteworthy because they are poised to capitalize on the post-ETF market dynamics.

Avalanche (AVAX, “B+”) is another project that should be considered, as its vesting period for locked coins is almost over, and most of them have been circulated to the market.

But while ETH is naturally dominating headlines, I want to inform you of …

2 Additional Forces Acting on the Market

These will likely also cause near-term volatility for crypto assets. So let’s start with the more immediate one: Former President and current presidential candidate Donald Trump will speak at the Bitcoin Conference on its final day, July 27, 2024.

This event will attract key figures from the crypto industry and traditional finance sectors, generating significant media coverage and public interest. Trump is already considered the more crypto-friendly of the candidates.

Many believe that a positive crypto stance from him could lead to favorable policies in the future. I expect the crypto community will likely hang on to his every word.

But this narrative may change.

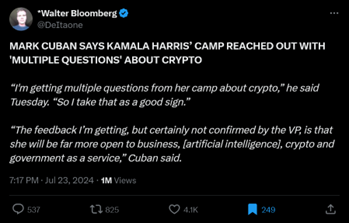

While President Joe Biden was seen as sluggish on crypto, Vice President Harris — who is now running for president — is more of an unknown variable. Interestingly, Mark Cuban revealed that her campaign reached out with “multiple questions” about crypto, which he takes as a positive step.

This is why we say that the election season will impact the markets. And, as a developing story, it’s one you’ll want to keep on top of.

Once the Bitcoin Conference is over, the next potential near-term force will be the upcoming Federal Open Market Committee meeting on July 30-31. The key piece of which will be the Fed’sinterest rate decision.

In short, the Fed will have to determine whether it will cut or hike interest rates … or maintain the status quo. Either one will impact market sentiment and liquidity.

A cut or indication of a more accommodative policy in the future could boost investor confidence, leading to higher inflows into risk assets like crypto.

On the other hand, a rate hike will have a negative impact. Though I should note, in my opinion, this outcome is unlikely.

Fed Chair Jerome Powell has indicated a potential shift from pandemic-era inflation control to easing monetary policy. The Fed is expected to maintain its benchmark interest rate at 5.25%-5.50% during the upcoming meeting, then potentially cut rates in September.

So, while all three forces currently acting on the market have the makings for near-term volatility, they also have the potential to strengthen the market in the long run.

As we gear up for the upcoming altcoin rally, any pullbacks in August should be seen as a buying opportunity.

In fact, my colleague Juan Villaverde recently recommended his Weiss Crypto Investor Members load up on key positions.

Weiss Crypto Investor is his way to help members make the most of the crypto market … without being crypto experts. His model portfolio rides the most promising assets in the leading narratives — such as AI, Layer-1s, memecoins and more — and uses Juan’s Crypto Timing Model to guide them through the 4-year crypto cycle to find the best entry and exit opportunities.

And to great success. Right now, his model portfolio boasts two triple-digit open gains, and that’s just the start.

To learn more about Weiss Crypto Investor, I suggest you click here.

Or, if you’re happy navigating this bull market on your own, you may want to consider dollar-cost averaging to invest in top-quality projects over the coming weeks, while prices are still low.

Because the rally is coming. You’ll want to be prepared before then.

Best,

Mark Gough