|

| By Bob Czeschin |

Stablecoins promise the speed, transparency, censorship-resistance, and decentralization of crypto — combined with the price stability and near-universal acceptance of the U.S. dollar (or gold, in some cases).

That makes them massively useful. For example, they …

- Allow crypto investors to exit volatile positions without cashing out to fiat. This makes them the crypto-equivalent of a money-market fund attached to a conventional stock brokerage account.

- Earn interest via crypto lending platforms.

-

Move money abroad without banking delays or extortionate fees. Legacy systems like SWIFT are slow, complicated and expensive by design.

By contrast, stablecoins make transfers instant, borderless and virtually free.

-

Enable folks without bank accounts to access financial services. Up to 50% of the world’s population is underserved by banks or entirely unbanked.

In Latin America alone, tens of millions already rely on smartphones and Tether (USDT) wallets for financial transactions due to a lack of banking services.

USDT is the world’s No. 1 stablecoin pegged 1:1 to the U.S. dollar. And in Argentina, it accounts for over 40% of crypto trading volume all by itself!

-

Provide a dollar-denominated safe-haven asset to people in countries with unstable currencies or hyper-inflation.

Last year, inflation in Argentina topped 200%, causing crypto trading volume to shoot up 400% — of which, a whopping 61.8% was stablecoin-related.

-

Solidify the U.S. dollar as the world’s No. 1 reserve currency — for the balance of the 21st century.

In the words of U.S. Treasury Secretary Scott Bessent: “We are going to keep the U.S. the dominant reserve currency in the world, and we’re going to use stablecoins to do that.”

-

Encourage a hungry new horde of buyers of U.S. Treasurys — at a time when government bond markets are having trouble accommodating excess supply.

In a speech before the just-concluded Bitcoin2025 Conference in Las Vegas, Vice President J.D. Vance said stablecoins could unlock trillions of dollars in global demand for American debt.

Indeed, Tether already ranks among the top buyers of U.S. Treasurys globally — which are required to back every USDT coin it issues.

Related Story: Bitcoin-Based Stablecoins Could Unlock $1.5 Trillion

And a recent study by Citigroup further concluded …

Stablecoin Issuers Could Be the World’s Largest Buyer of Treasurys by 2030

Stablecoins are already the 18th-largest buyer of U.S. Treasury bills.

But in just five years, they could be No. 1.

Meteoric Growth

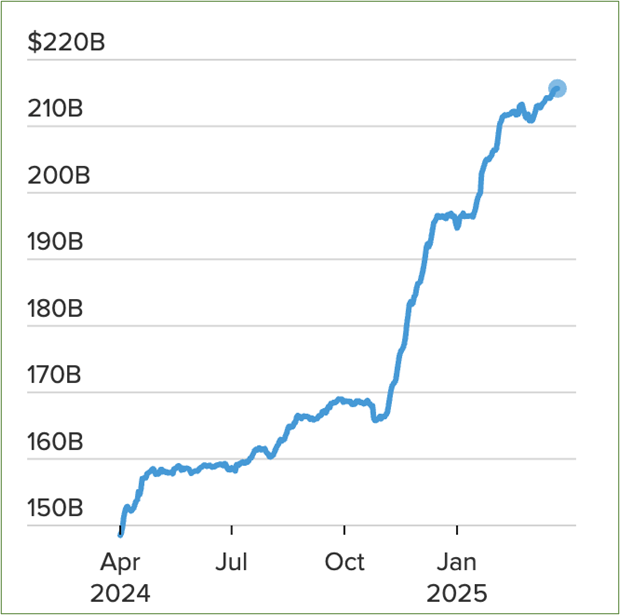

This lengthy list of compelling benefits has made dollar-denominated stablecoins — like USDT and USD Coin (USDC) — enormously popular, with a market cap exceeding $207 billion — up 54% from last year.

Stablecoin Market Cap

Meanwhile, total stablecoin trading volumes hit $27.6 trillion in 2024.

For context, that exceeds the combined volumes of Visa and Mastercard transactions worldwide by 7.7%.

So, What’s Not to Like?

Well, there is also a dark side to stablecoins.

Specifically, centralized stablecoins.

Unlike decentralized cryptos like Bitcoin (BTC, “A”), centralized stablecoins like USDT and USDC are centrally controlled and alarmingly programmable.

If you’ve been in the crypto space a while, that’s likely to give you pause.

That’s because, even if you take every precaution, centrally controlled assets mean they’re not totally in your control.

Even if you store your USDT or USDC in a battle-tested digital wallet to which you — and you alone — hold the private keys, you could wake up one morning to discover your stablecoin balance has suddenly been reduced 10%.

Or your funds are frozen altogether.

This isn’t an impossibility. In fact, it’s a precedent.

Just three months ago, Tether froze $28 million of USDT in wallets operated by Garantex, a popular Russian crypto exchange.

When Biden Administration sanctions kicked Moscow out of the dollar-based world payments system, Russians started swapping rubles for USDT to make payments abroad.

But Tether, itself, put a stop to it!

Issuers of centralized programmable stablecoins command technology that could also …

- Cause your coins to expire, if not spent by a certain date — forcing you to spend savings to “stimulate” the economy.

- Block transfers to politically incorrect parties, the wrong church or synagogue, or unpopular causes.

- Freeze stablecoins in your wallet to punish you. Just like Tether did to Garantex.

I know my colleague Jurica Dujmovic has warned you about Central Bank Digital Currencies before. He emphasized how you shouldn’t mistake them for true cryptos.

Sadly, at the end of the day, there may be little real difference between centralized, programmable stablecoins and CBDCs.

On the first day of his second term, President Trump signed an executive order prohibiting “the establishment, issuance, circulation, and use of a CBDC within the jurisdiction of the United States.”

But now, CBDCs are quietly creeping back into the promised land. Artfully concealed behind a beguiling new identity … and a compelling crypto narrative.

So, does this mean you should avoid centralized stablecoins at all costs?

Well, you could. But that would also leave you out of a growing sector with incredible opportunities. Especially for liquidity providers who want to put those stablecoins to work earning yield.

Instead, you may want to consider limiting your exposure to centralized stablecoins.

Ensuring you don’t have too much capital tied in an asset you don’t 100% control is a good first step to boost your safety.

You could also diversify your stablecoin approach to include decentralized stablecoins.

Like most true cryptos, these tokens are not overseen by a central authority. Rather, the community governs the network. So no one can take or freeze your assets.

And, if you’re interested to learn how stablecoins fit into our Weiss crypto experts’ strategies, you’ll want to watch our latest Crypto All-Access Summit.

In it, we break down how stablecoins — among other crypto opportunities — can help you take advantage of the current market. And it’s one that we believe could offer the ideal opportunity to build a true foundation of wealth that can be passed on for generations.

It won’t be online for long. So I suggest you watch it now.

Best,

Bob Czeschin