|

Editor’s Note: On Friday, we brought in a guest columnist, Mark Gough, to offer a new perspective on the broad crypto market. You can check that out here. Now, we invited Mark back. This time, he’s got the scoop on the latest on the most exciting development in the crypto AI space … and what you can do to make the most of it. I’ll let him take it from here … |

Mergers and acquisitions may be common in TradFi. But they are rare in the cryptocurrency space.

That’s why the unprecedented three-way merger that’s been announced within the AI crypto space is drawing a lot of attention.

The three major AI players set to merge are Fetch.ai (FET, “B”), SingularityNET (AGIX, Not Yet Rated) and Ocean Protocol (OCEAN, “B-”).

Each one has been a dominating force targeting a specific need in crypto AI. Now, they are joining forces under one banner, each bringing its proven track record of excelling in different areas of crypto AI.

For example …

- Fetch was the first open-source network for AI agents — AI-powered dynamos designed to operate in the real world. They gather data, solve complex problems and make decisions based on their observations.

Think of them as digital assistants with a touch of autonomy.

- Ocean specializes in data privacy and trading.

- SingularityNET lets anyone create, share and monetize AI services at scale. It is the world’s first decentralized AI network.

They are coming together to form the Superintelligence Alliance (ASI, Not Yet Rated).

This new project will be the largest open-sourced, decentralized network focused on accelerating the development of decentralized artificial general intelligence … and subsequently, artificial superintelligence.

See, the “artificial intelligence” we currently have is actually better understood as “machine learning.” It’s not true, non-human intelligence. Rather, modern AI programs are algorithms. How impressive they are is reliant on their data sets.

But artificial superintelligence would, in theory, have intellectual scope beyond human intelligence.

That’s the goal.

Since artificial superintelligence is still theoretical, science fiction represents the best examples of what superintelligent machines might be like.

Think the talking and reasoning droids in Star Wars, the hyper-intelligent and evolutionarily capable personal assistants in Her, the HAL computer from 2001: A Space Odyssey.

How is the Superintelligence Alliance planning on tackling this lofty goal?

By combining the strengths of Fetch, SingularityNET and Ocean to create a decentralized infrastructure that can operate on a large scale and to expedite investment in the field of AI.

This could position Superintelligence Alliance as a viable competitor to OpenAI and Google’s Gemini, two giants of TradFi AI.

“We can deliver on the promise of a vertically integrated stack of decentralized technologies while gaining scale to compete globally. The combination of our technologies creates a leader in R&D, applications and commercialization of AGI,” Ocean Protocol CEO and co-founder Bruce Pon said.

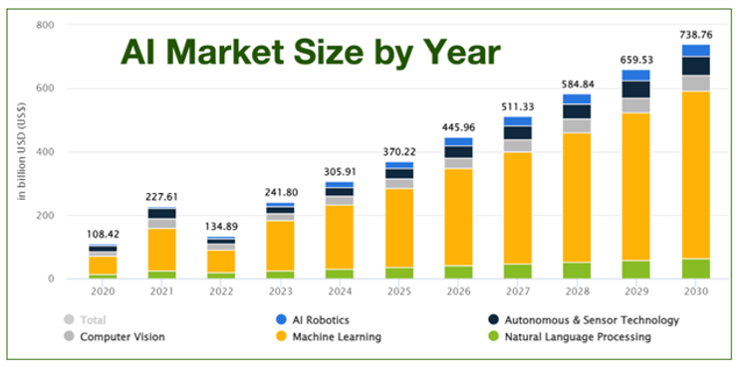

Remember, AI is a market set to explode into a $585 billion industry by 2028.

And my colleague Jurica Dujmovic has explained before why our team believes that crypto AI projects are poised to take their fair share of that pie ... if not more.

This convergence of not one, but three crypto AI leaders into a single project with a clear goal? It has the potential to be a dominating force in the crypto AI sector.

And at the core of Superintelligence Alliance lies its new native token, ASI, which will power the project.

“The unified ASI token is the glue to orchestrate all actors with common incentives,” according to Pon. They’ll be used to secure the public network and unlock computation without needing traditional banking and payment rails. “It’s the native currency for the machine economy.”

Naturally, ASI’s official listing is expected to stir the market. Calculations have its listing price set for $2.82 with a market cap of $7.6 billion.

So, when will it launch?

Well, before it does, the merge has to officially be voted on and approved. That’s the trade-off for having a decentralized structure — any changes must be supported by the community.

Luckily, voting already started and should wrap up this week. We may even see an approval as soon as tomorrow, April 16.

To stay in the know for any ASI updates, I suggest following its official page on X, formerly Twitter. Of course, we’ll keep you informed as well, but you can’t beat token updates straight from the source.

And what if you already own FET, AGIX or OCEAN?

Well then, this may be the one time you hear anyone on the Weiss crypto team suggest you may want to store your crypto on a centralized exchange!

That’s because if you put your FET, AGIX or OCEAN tokens on a centralized exchange — like Coinbase or Kraken — the platform will swap your coins for ASI based on the established exchange rates on your behalf.

Easy, right?

Those exchange rates are …

- 1:1 for FET

- 0.433:1 for OCEEAN and AGIX. That means with ASI’s listing price of $2.82, you’ll receive ASI at a rate of $1.22.

Naturally, once you have your ASI tokens, you may want to transfer them to a soft or hard wallet for additional security.

If you don’t have access to a viable CEX, don’t worry. A token bridge service will be released to help you swap for ASI manually. You’ll want to keep up with ASI’s X page for updates about that, as well.

And for everything else, keep checking in with us here at Weiss Crypto Daily.

Best,

Mark Gough