|

| By Chris Coney |

One of the biggest questions on many crypto and DeFi investors’ minds is which stablecoins are safest to use.

In fact, I did a deep dive into this topic in the July edition of Weiss Crypto Investor. If you are interested in checking out that service, you can do so here.

Now, I concluded my analysis of the current best stablecoins by mentioning two new stablecoins that have recently hit the market. Namely, Aave’s (AAVE, “B”) GHO and Curve Finance’s (CRV, “B-”) crvUSD.

Today, I’d like to give you a quick tour of crvUSD, why it exists and how it plans to be better than those that came before it.

Curve Finance

Curve started out as a decentralized swap exchange similar to Uniswap (UNI, “B”).

But the difference between these two platforms is that Curve was originally built to specialize in stablecoin swaps.

You see, there are many instances in DeFi where you might want to exchange one kind of stablecoin for another to take advantage of an investment opportunity.

So, you would use Curve for this, like exchanging your Tether (USDT, Stablecoin) for USD Coin (USDC, Stablecoin).

But if you’ve been following our Weiss Crypto Daily articles, you would know Curve has run into a bit of trouble recently. To be specific, the platform experienced a hack, causing it to lose millions.

If you would like to know more, my colleague Marija Matić did an excellent job breaking down the details of this incident here.

Currently, Curve only accounts for about 12% of stablecoin trading volume. In comparison, Uniswap has about 60%.

As such, Curve needed to find ways to attract users back to its platform. And it’s possible that creating crvUSD might have something to do with that.

Tradition with a Twist

Now, Curve has chosen to make crvUSD a debt-based stablecoin similar to assets like MakerDAO’s Dai (DAI, Stablecoin) and Aave’s new GHO.

So, crvUSD technically doesn’t exist until someone first deposits some combination of the following assets as collateral:

Basically, this boils down to using Bitcoin (BTC, “A-”) or ETH as collateral.

After all, wstETH and sfrxETH are both receipt tokens for staked ETH, so they can be used as an equivalent to ETH. And WBTC is an Ethereum-based token that’s backed 1-to-1 with Bitcoin.

Once collateral has been deposited, a secured loan can be taken out against it. Then, the loan amount is paid into your DeFi wallet in the form of crvUSD.

Until then, those stablecoins don’t exist.

They are digitally “printed” by a smart contract and placed in your wallet. Then, when you repay the loan, those stablecoins are burned (i.e., destroyed).

As an interesting sidebar, this is similar to what happens when the U.S. government issues new Treasury bonds, which are bought by the Federal Reserve.

The central bank will often create the dollars by printing them in order to buy those bonds, which are themselves debt.

Turning back to crvUSD, so far, it seems like a plain vanilla collateralized debt position stablecoin.

So, what makes it special?

Well, the twist comes in the form of a new way Curve plans to treat loans that are getting low on equity.

Traditionally, on money markets like Aave, the minimum equity you are allowed on a loan is 15%. Conversely, the maximum loan-to-value ratio is 85%.

If the value of your collateral drops below this point, the system will typically confiscate your collateral and sell it on the open market in order to keep the system solvent.

Since we are talking about stablecoins here, the system will often swap the collateral asset for the system's stablecoin.

To see what I mean, let’s use an example. Imagine I have $85 worth of stablecoins borrowed against $100 worth of BTC.

Once my Bitcoin collateral drops to $99, I am now below the minimum collateral ratio. So, my collateral will likely be liquidated.

The system remains solvent through this method since there should always be equity left over when the loan has been forcibly repaid by a liquidation.

And this is why the system will liquidate the collateral when the equity drops below 15%, rather than waiting for collateral to be worth the same amount as the loan.

But that puts the system at risk. If the price of the collateral is falling hard and fast, it’s possible that the system only gets $95 for selling the collateral that was backing a $100 loan.

In that situation, the system itself would be insolvent.

Soft Liquidation

The traditional way to resolve bad debts for secured loans is what I have described above. Let’s call that hard liquidation.

Essentially, there is a defined line in the sand. If your equity drops below that threshold, it immediately triggers liquidation and the loss of your collateral.

But what happens if — and it happens more often than you might think — the value of your BTC collateral only drops below the equity threshold for 30 seconds before recovering into the green?

In a hard liquidation system, that would not matter since the liquidation event would have already been triggered and resolved.

Now, Curve’s idea is to introduce a mechanism where crvUSD would mitigate this scenario through soft liquidations.

Instead of throwing the baby out with the bathwater as soon as the collateral crosses a certain equity threshold, a gradual process would be used.

Let’s use another example here to illustrate what I mean ...

Pretend the minimum equity threshold is 15%, and it gets to a point where your equity ratio is at 20%.

At this point, your crvUSD loan would enter soft liquidation mode.

That means with each step down in the value of your collateral, a small amount of it would be sold off to reduce the debt and maintain the equity buffer.

In this model, if the market only dipped for 30 seconds and then recovered as I described above, you would only lose maybe $10 worth of your $100 collateral to soft liquidation.

Remember, in a hard liquidation model, all your collateral would have been sold off to settle the loan.

If you’re like me and have traded with leverage, it’s probable that you view this as an incredibly welcome feature. It may even be enough to convince you to use it.

Is crvUSD for Regular Investors?

So far, we’ve covered the main differentiating feature of crvUSD: soft liquidation.

But that’s mainly a benefit to stablecoin borrowers who are trading with leverage. What’s in it for the average investor?

In theory, this approach makes it less likely for crvUSD to depeg from the target value of $1.

This is because soft liquidation is only forcing borrowers to sell as much of the underlying asset as needed to bring it back into the green.

In bad market conditions where the price of the underlying asset is falling fast, hard liquidations can create a snowball effect. This is because it’s causing even more of the asset to be sold into the market.

As a result, this can quickly turn into a situation where stablecoin borrowers who had large equity buffers suddenly find themselves being liquidated.

Remember that someone needs to be willing to buy the underlying collateral asset when it is liquidated and sold off.

So, if tons of liquidations are happening at once, then it’s no surprise that the number of buyers willing to pay the current market price will dry up. This will cause the price to fall to the next willing bidder.

In a soft liquidation model, the stablecoin system is only adding the minimum amount of sell pressure to the market in order to keep itself solvent.

And even with crvUSD, if the market keeps falling and the equity ratio of a loan gets too low, the system just reverts to traditional hard liquidation.

Conclusion

Although this soft liquidation model is a great innovation for stablecoins, it has yet to prove itself in the wild.

At the time of writing, crvUSD is in beta testing mode.

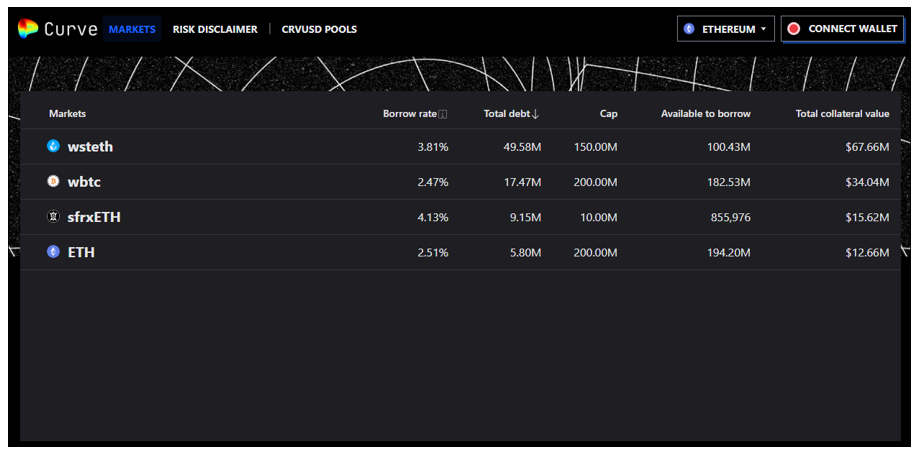

Despite that, investors have already borrowed $79 million worth of crvUSD:

In my view, one big problem for the wider market is that soft liquidation would work better if every debt-based stablecoin adopted it.

Going forward, during the next big dip in crypto prices — which will come sooner or later — I think it’s great that crvUSD will be gently selling off collateral thanks to its soft liquidation model.

Meanwhile, other stablecoin systems will be hard liquidating their borrowers … causing unnecessary amounts of the same collateral to be dumped into the market.

Even if that happens, the fact that crvUSD has a soft liquidation feature means it should make the system much more resilient in the long run.

But that’s all I’ve got for you today. Let me know what you think about Curve’s new stablecoin, crvUSD, by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me, Chris Coney, saying bye for now.