|

| By Chris Coney |

Back in April, I published an article focused on how Uniswap’s (UNI, “B-”) V3 code was on the cusp of a deadline in which its Business Source License was going to automatically convert to a General Public License.

After this conversion, copycats of Uniswap — like SushiSwap — could be freely created.

You see, the purpose of originally issuing the Uniswap V3 code under a two-year BSL was to make the code open source while not allowing others to fork, copy or modify the code in competition with Uniswap.

Now, that deadline has passed. And as I predicted, many clones have sprung up since then.

2 for 2

The other suggestion I made in my previous article was that Uniswap Labs would likely use the initial two years that the code was protected to cook up its next big thing.

Some might have thought that was the Uniswap wallet it released in 2023, but that didn’t fool me.

I knew it would have something else up its sleeve.

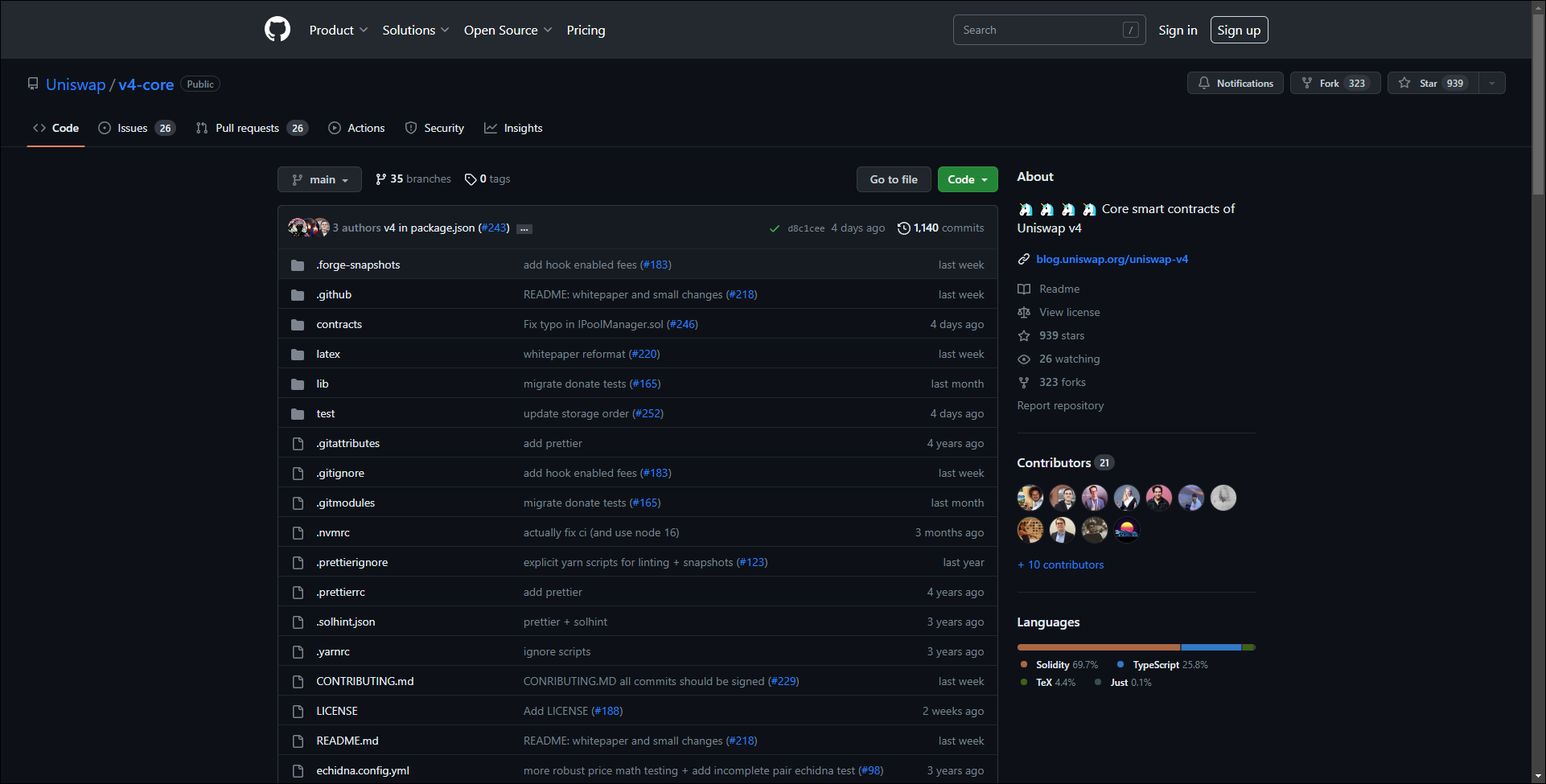

Lo and behold, the recent announcement and release of code for Uniswap V4 proves I was right.

Massive Leaps in Innovation

On my first reading of Uniswap V4’s new features, I was left thinking there was nothing particularly earth-shattering about it.

However, after some consideration, I believe this could end up being one of the biggest innovations yet.

Now, Uniswap V1 was the original version of the decentralized exchange on Ethereum (ETH, “B”).

Although there had been previous attempts to create a DEX that truly ran on the blockchain — such as EtherDelta — Uniswap was a real big breakthrough in terms of simplicity and ease of use.

It also introduced us to the automated market maker, which is essentially a type of DEX that uses algorithmic robots to make buying and selling crypto assets easy for individual traders.

While Uniswap V1 had quite a few impressive features, its biggest drawback was that every swap had to go through ETH.

Even though you could pretty much swap any ERC-20 token for ETH, if you wanted to swap one ERC-20 token for another, the process was a bit more complicated.

Namely, the first token would be swapped for ETH, and then another swap would take place to turn that ETH into the asset you wanted.

With the introduction of Uniswap V2, anyone could create a liquidity pool for any token pair, allowing them to be swapped directly for each other.

This allowed the free market to determine which pairs were in demand for trading. In turn, this attracted liquidity providers to the most popular pairs.

Next up, the big innovation in V3 was concentrated liquidity. Put simply, this allowed liquidity providers to provide liquidity at specific price ranges, which helps with increasing capital efficiency and earning higher returns.

This was also the catalyst for the creation of my proprietary Sideways Siphon strategy, which I currently use to make trade recommendations to members of my Crypto Yield Hunter service.

Uniswap V4

When I say Uniswap is the leader of the pack, I mean it.

In many ways, Uniswap is like the Apple of DeFi — creating products most people don’t even know they want until they see it.

One feature that is coming to V4 that I would have requested is the ability to dynamically adjust a pool's fee.

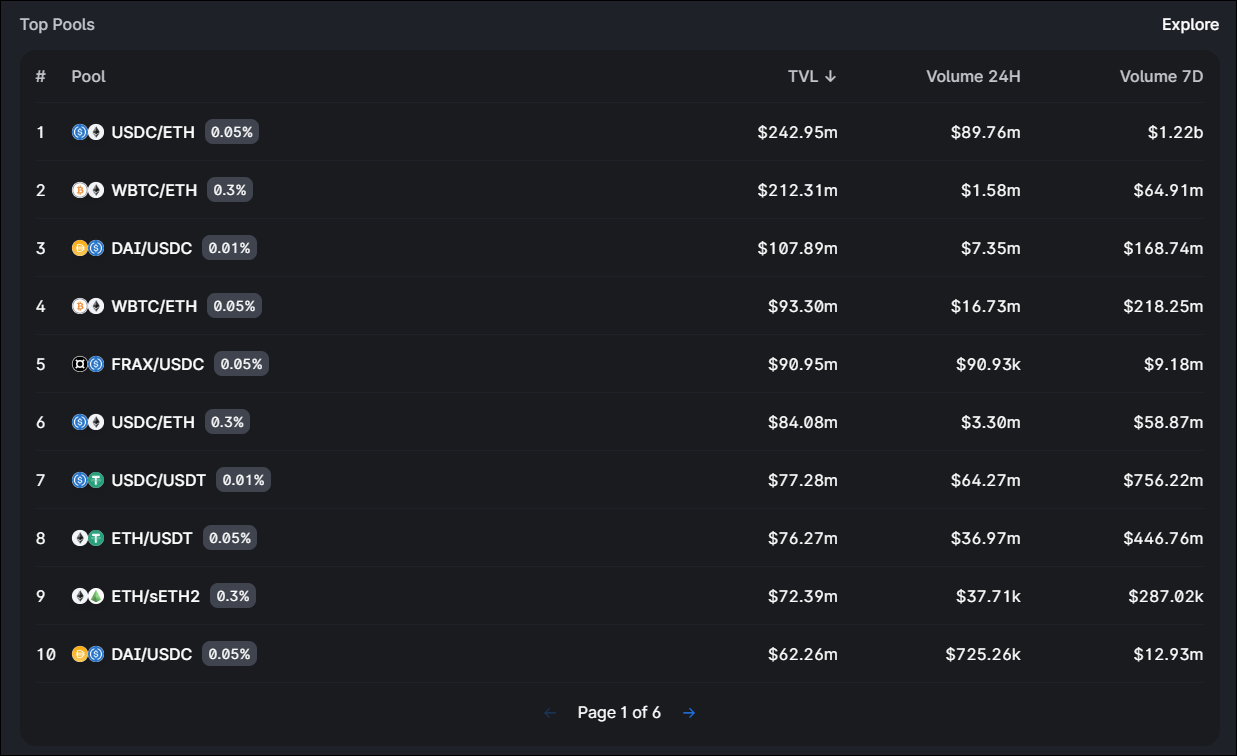

For example, once I have narrowed down the sea of trading pairs to one that I can trade profitably, I then might find that there are four copies of that liquidity pool at different fee tiers.

For the sake of an example, let’s say the ETH-USDC pool is profitable right now.

Liquidity for this trading pair on Uniswap is fragmented across four different pools:

- One is at the 1% fee tier.

- One is at the 0.3% fee tier.

- One is at the 0.05% fee tier.

- One is at the 0.01% fee tier.

Each of these pools is siloed, meaning you have to pick which one you want to deploy capital into.

It’s important to remember that you will only earn yield on trades that go through the pool you are in.

Couple that with the fact that the Uniswap exchange figures out the best pool to use on each trade … and that creates a nightmare for liquidity providers.

To account for this, Uniswap V4 plans to allow pools to be created with a dynamic fee.

That may mean, for instance, at times of high trading volume, the fee decreases. And when trading volume is low, the fee increases.

There is also the possibility of time-locked liquidity, which would be incredibly interesting from an investor’s point of view, because it’s another way to get an edge over other liquidity providers who aren’t prepared to do that.

Conclusion

Although I’ve touched on a couple of major features here, there are many more planned.

And to be clear, Uniswap V4 hasn’t been launched yet. It has just been announced, and the first set of code has been published for public review and consultation.

What is interesting about Uniswap’s approach to protecting its intellectual property this time around is that the BSL for Uniswap V4 is set to expire in 2027.

That’s four years away.

While I haven’t seen any official dates on when V4 will officially be deployed, if I had to guess, I would say it is likely to launch before the end of 2023.

That would still give Uniswap at least a three-year head start before any copycats can pop up.

But like I said in my last article, as soon as V4 launches, you can bet money it will already be hard at work on its next big innovation.

Personally, I’m a fan of Uniswap’s work, so I will take as much as it is willing to give us.

But that’s all I’ve got for you today. Let me know what you think about Uniswap V4 and what features you are most excited for by tweeting @WeissCrypto.

I’ll catch you here next week with another update.

But until then, it’s me, Chris Coney, saying bye for now.