1 Million+ Reasons Not to Become Complacent About Banks

|

| By Gavin Magor |

There’s so much to talk about after last week, I just don’t know where to start.

The Fed raised interest rates, inflation slowed, more than three-quarters of U.S. companies reporting Q2 earnings beat estimates, stocks surged and … the movies, “Oppenheimer”and “Barbie,” are nearing box-office records.

I could go on and on, but I won’t because …

Banks came back sharply into focus, so my eyes were peeled on headlines like:

And also …

Umpteen articles explained how the FDIC called out banks for being less than truthful (“manipulative” might be more accurate) about the amount of uninsured deposits on their balance sheets.

That’s key because as you probably recall, a large percentage — 88% to be exact — of uninsured deposits held by Silicon Valley Bank contributed to a bank run that brought down the regional bank … and two other banks followed suit.

Customers with more than the FDIC-insured $250,000 frantically tried to withdraw money all at once, and SVB could not cover its losses.

Well, according to an S&P Global Market Intelligence report from July 6, which was cited in those articles this week, more banks than ever (55) downwardly “revised” a record amount of Q4 2022 uninsured deposits ($198 billion) after SVB failed.

The report and its findings weren’t new to me. I had already provided the nitty-gritty details a couple weeks back.

In fact, that’s not the only time my team went above and beyond and beat others to the punch. We knew SVB wasn’t alone in its mismanagement of funds. So, we spent countless hours researching approximately 4,700 banks and their exposure to unhealthy balance sheets. Unsurprisingly, we found that …

The Results Were Alarming

Many of the banks had low adjusted Tier-1 capital ratio distributions, large amounts of uninsured deposits to total assets and total loans and held-maturity securities to total deposits at a staggeringly high percentage.

A few weeks after SVB’s demise, another catalyst for collapse came to light when Beverly Hills-based PacWest Bancorp (PACW) made fresh headlines. Only this time, the culprit was a loan book with 80% of its obligations tied to commercial real estate-backed loans and residential mortgages.

At that time, PacWest decided to cut its losses while it could. The bank sold 74 construction loans worth $2.6 billion to real estate investment firm Kennedy-Wilson Holdings, at a discounted $2.4 billion. And looked to dump even more.

Again, knowing that PacWest couldn’t be the lone holder of losing CRE loans, considering the bulk of the $1.2 trillion in office space debt is owed to smaller regional banks, my team did some digging.

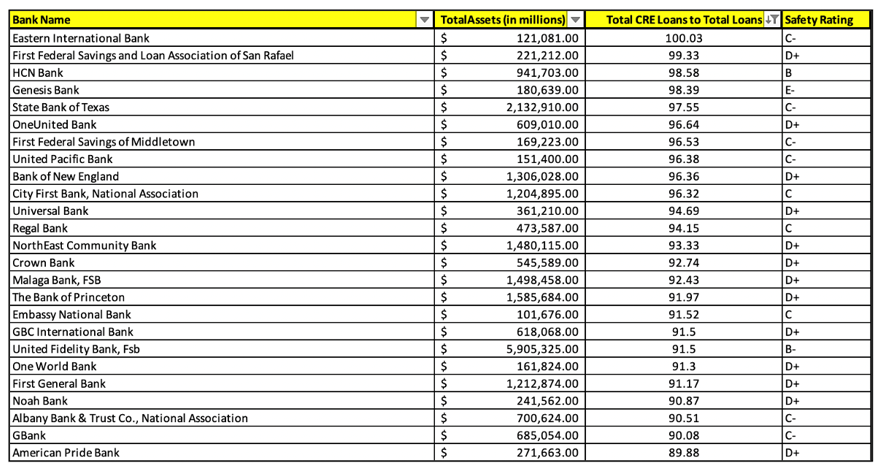

We identified 20 banks potentially at high risk due to high exposure to CRE loans (as calculated by total CRE loans divided by total loans) and with lower liquidity. Here’s the list we published on May 30:

Click here to see full-sized image.

Keep in mind, this banking industry news came on the heels of “fantastic” news that 23 U.S. banks with assets of more than $250 billion passed an annual test that attempts to identify high-risk banks each year with flying colors.

All that did was raise my team’s eyebrows and trigger me to warn you to take that A+ report card with a grain of salt.

Fast-forward to last week, and a couple more non-surprises made headlines. On Tuesday, the Banc of California (BANC) announced it would pursue a $1.1 billion bailout — I mean, “merger” — with PacWest.

The next day, JPMorgan Chase (JPM) reported it would take up to $1.8 billion of discounted single-family residential loans off the crippled bank’s hands to help facilitate its recent purchase by Banc of California.

Finally, what may have come as a surprise to banks, although I can’t fathom why, is that after a nine-month review, U.S. regulators want to increase the amount of capital held by banks — some as small as $100 billion — by 19%.

According to Yahoo! Finance, the goal is to make lenders “stronger, more resilient and better prepared for shocks like the crisis of this spring.”

Big banks see it from a more selfish perspective: It will cut into profits. So, you can expect pushback from them in a big way.

Since we’re caught up with the banking saga, for now, here’s my point for rehashing the old and informing you about the new …

Keeping You and Your Money out of Harm’s Way

It’s really important to keep tabs on your bank and where it falls on the risk scale. You need to know if it’s holding too many CRE loans, U.S. Treasurys or uninsured deposits, and mismanaging risk.

As the overseer of Weiss’ bank ratings, my job here is to identify companies at higher risks of failure, so we can warn consumers like you about where your hard-earned cash is kept.

That’s why we take the time to feed you the knowledge and provide the tools you can use to be proactive. Making informed decisions before anything bad happens is the only way to go. Reacting after the fact only triggers emotions and reduces your ability to think rationally.

This wasn’t the first time I’ve raised a yellow or red flag about the banking industry; and unfortunately, it certainly won’t be the last.

Banks are all about profits, and it’s nearly impossible for them to not make money. They’ll do anything to prevent losing cash, including underreporting uninsured deposits, which gives customers a false sense of security and allows them to stay under the regulators’ radar.

Our Bank Ratings here at Weiss are very conservative, historically accurate and far more “cautionary and skeptical” than the mainstream media or other rating companies will ever be. To that end, you’ll hear the truth and nothing but the truth from us.

We also keep as watchful an eye on insurance companies as we do banks via our Safety Ratings. And with so many homeowners in disaster-prone states like Florida, Texas and now California unable to secure affordable insurance, you’ll soon be hearing plenty more from me about that, as well.

Be sure to check all of our ratings for updates, new research or warnings, so you’ll have the knowledge and time to do what’s in your best interest.

Stay safe out there,

Gavin Magor

P.S. Dividend-paying energy stocks are just one of the things we profit from in my monthly newsletter, Wealth Megatrends. We’re also riding the reindustrialization of America, which is powering up select stocks left and right. There are plenty of opportunities available if you know where to look. Check it out here.