|

| By Gavin Magor |

A few months ago, we spoke about how healthcare laggards looked ready to rally. Today, we’ll check in on the health of that sector.

We’ll also follow up on another prediction from this past summer. That is, that we could soon see big things from small stocks.

I’ll drop the hint now that our expectations were met.

And I won’t leave you empty-handed.

That’s because I’ve got my eye on the NEXT investment theme that’s set to play out as we enter 2026.

First, let’s revisit our earlier trade rationale:

“If the overall market is going in one direction over time, there are always going to be laggards.

“Small-caps, for instance, usually lag larger-cap ones when interest rates and/or volatility are high.

“But small-caps aren’t the only laggards that look poised for a comeback.

“In fact, one sector looks like it’s just now breaking out: healthcare stocks.”

I sent the note about small-caps poised to break their trend on Aug. 12.

Here’s how they’ve done since then. (See the top blue line.)

Small-caps, represented here by the iShares Russell 2000 ETF (IWM), have outperformed the overall market, represented by the SPDR S&P 500 (SPY), since then.

Several times, the Russell 2000 nearly doubled the performance of the mostly mega-cap S&P 500.

We see a similar result among healthcare stocks, as represented by the Health Care SPDR (XLV):

So, today, I want to return to this theme and see if we can’t go 3-for-3.

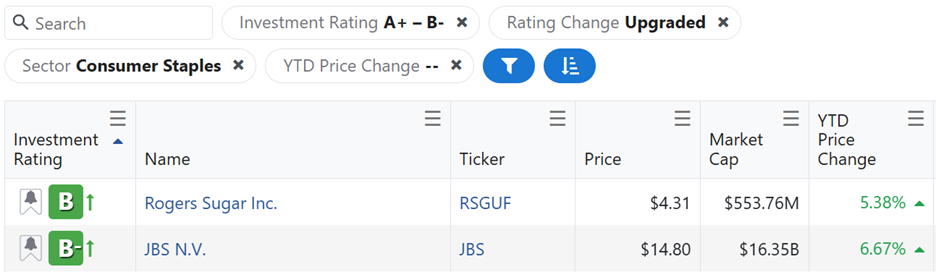

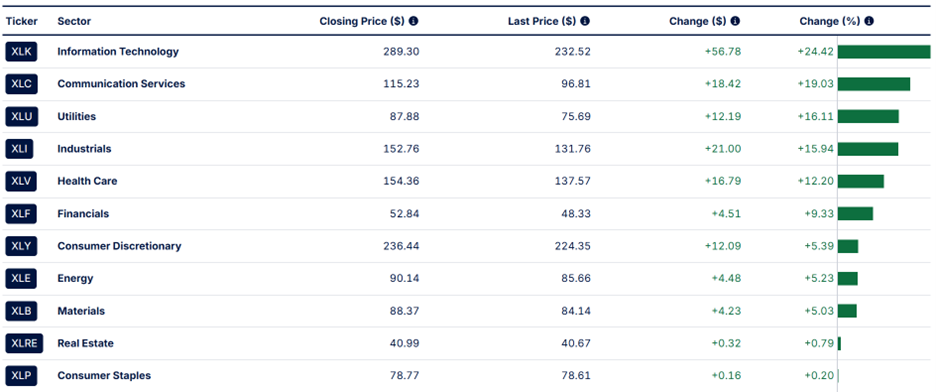

As you can see, there is no more out-of-favor group of stocks right now than consumer staples.

Staples have been basically flat in a year that the S&P 500 has gone up over 16%.

Not a surprise, really. When you get AI stocks like Palantir (PLTR) and Nvidia (NVDA) screaming higher, boring staples are easy to ignore.

But that’s why now is the perfect time to look at them.

And for that, as you likely already know, I first turn to the Weiss Ratings.

We’ll use the same tool I showed you last time.

It’s the Stock Ratings Analyst tool, available only to members of Weiss Ratings Plus. I can give you a quick peek at it here, though.

The filters I used last time were:

- Investment Rating — All stocks with a rating between “B-” and “A+.”

- Rating Change — Stocks that have been recently upgraded.

- Sector — Healthcare stocks.

All we have to do is switch out healthcare stocks with consumer staples today.

Here’s what showed up:

Only two. Both have lagged the overall market so far this year.

That fits right in with this idea. They should bounce back.

Rogers Sugar (RSGUF) is a small Canadian sugar company.

And while it plays into both the small-cap and consumer-staple themes, it trades Over The Counter here in the U.S.

You’ll have to first find out if your broker allows you to buy OTC stocks. But our ratings suggest that if it does, you might want to.

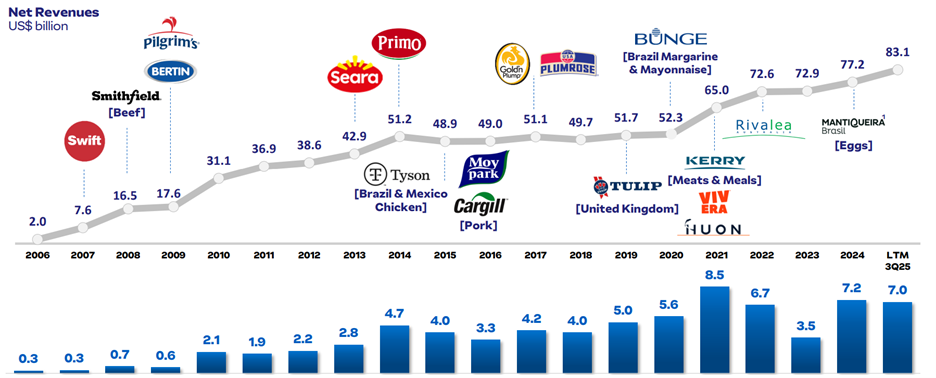

The second is JBS (JBS). It’s much larger … but also headquartered outside of the U.S.

This Netherlands-based staple sells its products around the world. And it has a wide catalog of those.

You might be familiar with some from this chart of JBS’ strategic acquisitions over the years:

You can also see that its earnings have headed in the right direction for the last two decades.

JBS, despite being a foreign-based company, trades on the NYSE.

So, if you like the idea of picking up on this third “bounce-back trade” idea, you can buy JBS pretty easily in your regular brokerage account.

Of course, you can also craft your own lists by using the Stock Ratings Analyst tool yourself.

You can find out much more about exclusive features like that and more by watching this to the end.

Cheers!

Gavin