|

| By Nilus Mattive |

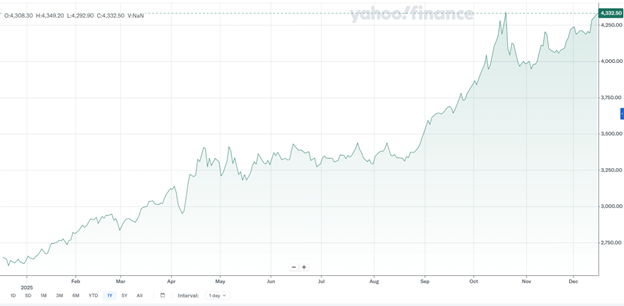

Gold has had a spectacular run in 2025. And it’s ending the year near all-time highs …

I’ve given you plenty of reasons why the positive momentum could continue in 2026.

Related stories:

But let me quickly run down two more little-known facts that might really surprise you.

No. 1: Gold’s long-term performance has been absolutely terrific.

Since the U.S. dollar went off the gold standard completely in 1971, the yellow metal has risen from a fixed price of $35 an ounce to a recent level around $4,300.

That amounts to a 9.1% average annual return … not all that far behind the broad stock market’s average annual total return of roughly 11% over the same period.

Yes, a couple of extra percentage points every single year over many decades amounts to a huge total difference in the returns between gold and stocks.

Still, gold has put up a heck of a good fight considering most people think it’s a rock that sits there and does nothing.

The yellow metal’s performance is also substantially better than the returns seen from some other major assets, including bonds!

The reason this all gets brushed under the rug?

Gold’s cycles are very long and pronounced — with 10-year periods of inactivity typically followed by a decade of very strong gains.

Which is interesting because if gold has another great year or two and stocks happen to tank, it’s entirely possible that all the performance numbers I just shared will completely reverse and gold could become the best-performing asset of the last 50 years.

Meanwhile …

No. 2: Americans do not currently own very much gold at all.

Gold’s been an investment asset for thousands of years. And it feels like most Americans have an allocation to it, right?

Well, nothing is further from the truth.

While exact numbers are hard to pin down, most surveys show somewhere between 10% and 12% of Americans own some form of gold right now.

In contrast, many recent surveys suggest far more Americans own some form of crypto (17% according to one Gallup poll) … an asset that hasn’t even existed for two decades!

Goldman Sachs recently said this simple fact could help propel gold’s next leg higher … and I agree.

As they point out:

- Gold ETFs are just 0.17% of U.S. portfolios right now.

- Which is six basis points below a peak seen back in 2012.

- While fewer than half of large U.S. institutions managing over $100 million hold any gold ETF position at all.

When you put this together with the fact that gold typically performs well over much longer cycles, it’s easy to see why the action in 2025 could really just be the beginning of a self-fulfilling rally.

If anything, I think you could see more money come out of crypto and go into precious metals from investors looking for both dollar diversification and fast upside potential.

Best wishes,

Nilus Mattive

P.S. And while gold itself is where I’d recommend you start investing, it’s the smaller gold and silver producers that will see the massive, leveraged gains that would come from this rally.

My colleague and precious metals expert Sean Brodrick recently put together the best of the best mining stocks to own. You can gain access here.