2 Ways to Find Vigor in a Volatile Market

|

| By Gavin Magor |

Perhaps I could feel the rumblings coming.

In last week’s timely column, I told you to be ready for volatility. But what we saw was a rare market tsunami.

Last Monday was the worst performance in a trading day in nearly a year and a half.

It’s days like those when our stock screeners show a sea of red from all the selling.

Emotions run high. Market crash feelings arise, and we have flash backs to days like Black Monday in 1987.

Whilst I don’t expect a lot of days like last Monday going forward, I do expect volatility to remain during this “silly season.”

I mean, just think about the fact that the market is already back up nearly 3% from its Monday lows. Yet the VIX remained above 20 all week.

The storm is here. It’s time to hurricane-proof your portfolio.

One strategic way to do that is with inverse ETFs, which increase in value as the market goes down. That is a great hedge method.

Others include gold, bonds and high dividend paying names.

Above all else, you want to find defensive investments.

How to Use Weiss Ratings for Defense

The perfect way to explore strong defensive stocks is with the Weiss Ratings.

On a daily basis, the Weiss Ratings empower investors with ratings, research and newsletters that provide the highest accuracy, the best safety and the most profitable investment guidance.

Every single day, we issue 53,000 newly updated ratings on nearly all U.S.-listed stocks, mutual funds and ETFs.

We also publish safety ratings on nearly all U.S. banks, credit unions and insurance companies.

Plus, you can also find cryptocurrency ratings on most actively traded digital assets.

These ratings are good. Of course, don’t just take my word for it …

The Wall Street Journal reported that the Weiss stock ratings ranked No. 1 in profit performance, ahead of ratings by Goldman Sachs, JPMorgan, Merrill Lynch, Morgan Stanley, Standard & Poor’s and all other firms covered.

So, say, for example, you wanted to use the Weiss Ratings to add some stable dividend paying names to your portfolio … it’s just a few clicks away.

Crème de la Crème of High Dividend Names

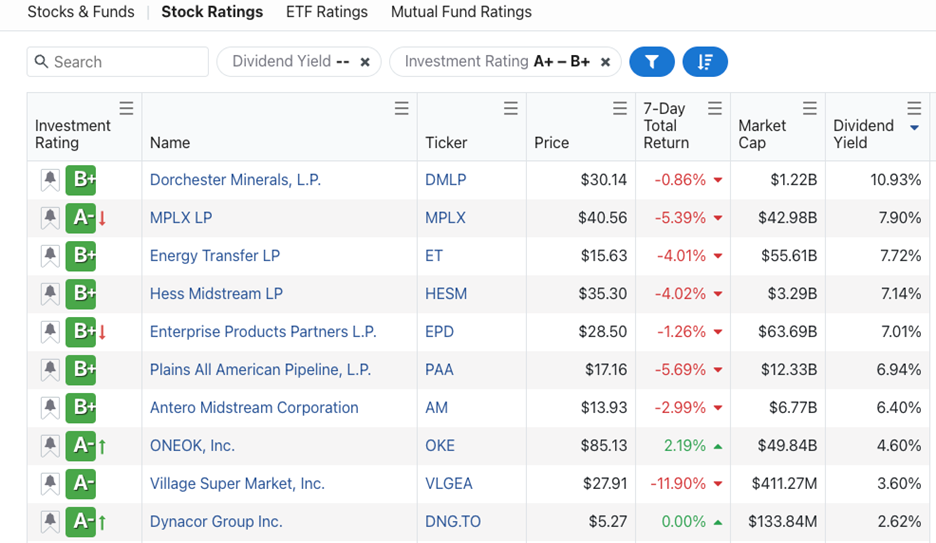

After going to the Weiss Stock Ratings page, I filtered for stocks with ratings of “A+” through “B+” and filtered them by dividend yield.

Here’s what populated:

These names, aside from being highly rated strong names worthy of your attention, also pay out nice dividends.

For example, Dorchester Minerals (DMLP) is an interesting company that pays a massive 10.93% dividend yield.

Excluding that large payout — which has been going for a while now — the stock is up around 164% over the past four years.

Let’s take a gander at the five-year chart:

This is one strong example of the supreme power of the Weiss Ratings.

So, please be sure to explore all of our highly rated names. You can curate your search to whatever you are looking for.

Another way to beat volatility? By taking advantage of recent legal changes for massively lucrative private deals …

Powerful Private Deal Disruption

My esteemed colleague and fellow analyst Chris Graebe is preparing a special Private Investment Summit for Tuesday, Aug. 13 at 2 p.m. Eastern.

In it, he will present a truly fantastic new opportunity on a company that has developed a new technology that could disrupt a $1.8 trillion market.

You can come and see for yourself, for free and from the comfort of your couch. All you have to do is sign up here.

Cheers!

Gavin Magor

with

P.J. Amirata