|

Less than a month ago, we highlighted a screen I like to run using Weiss Ratings Plus’ “Stock Ratings Analyst” tool.

Here’s what I said at the time:

You never know what the newest “A”-rated stock will be.

But you can depend on stocks being upgraded all the time, in real time, in the Weiss ratings.

That said, one stock just newly earned an “A” rating.

I’ll tell you more about it momentarily.

I can also tell you that the last time this happened, we cashed in on a five-month rally.

A year ago, I ran a screen using Weiss ratings to show you that only one out of the 12,000-plus stocks that we rate was freshly elevated to the prestigious “A” rating.

That marked it as one worth watching.

You see, when we rate a stock an “A,” that means we have the utmost confidence it will perform well in the long term.

It usually means it has low volatility, growing earnings and room for its stock price to grow.

When we upgrade a stock into the “A” range, that means it has momentum, too.

That’s exactly what we found with Energy Transfer (ET) a year ago.

And we were right!

In just the following five months, shares shot up 30%.

I then shared what that same screen showed at the time — on Oct. 21:

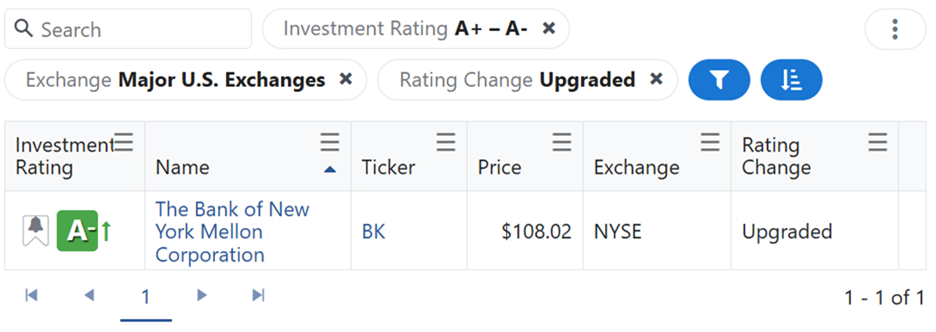

I ran the same screen yesterday morning. Here’s what I found:

Again, only one out of more than 12,000 Weiss-rated stocks was recently upgraded to the “A” range.

Well, only one is easily purchased on a major exchange.

The Bank of New York Mellon (BK) is probably not a new name to you.

After all, it carries a $74 billion market cap and — according to its website — “oversees more than $57.8 trillion in assets” for its clients.

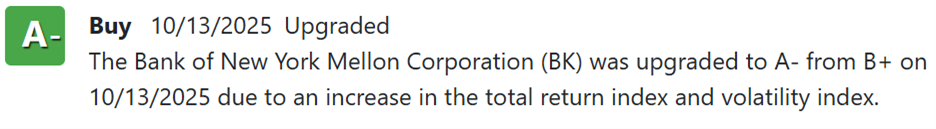

As you can see, it was upgraded because of its total return and volatility indices:

These are our proprietary ratings factors that we use to assign our ratings.

Clearly, those factors pushed BK into the same status as ET was one year ago.

We expect it to perform just as well, especially in the next few months.

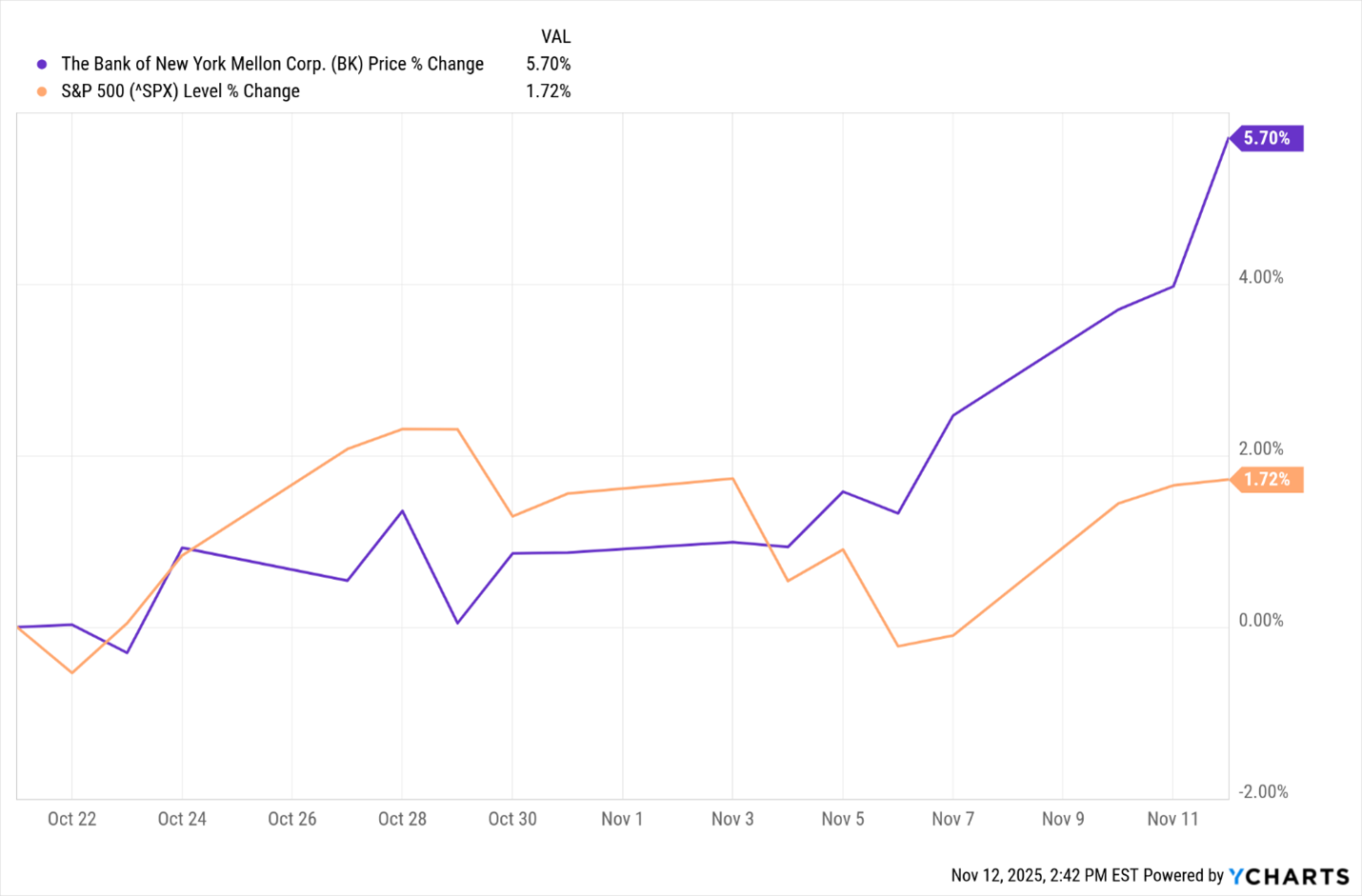

As of yesterday, BK has been outpacing the rest of the market just as we predicted:

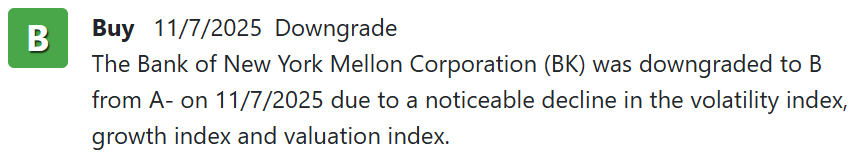

And while it remains a “Buy” — and therefore should continue to outperform the market going forward — it was since downgraded slightly to the “B” range:

But don’t worry.

I saw that since this screen has performed so well twice, I’d run it again today.

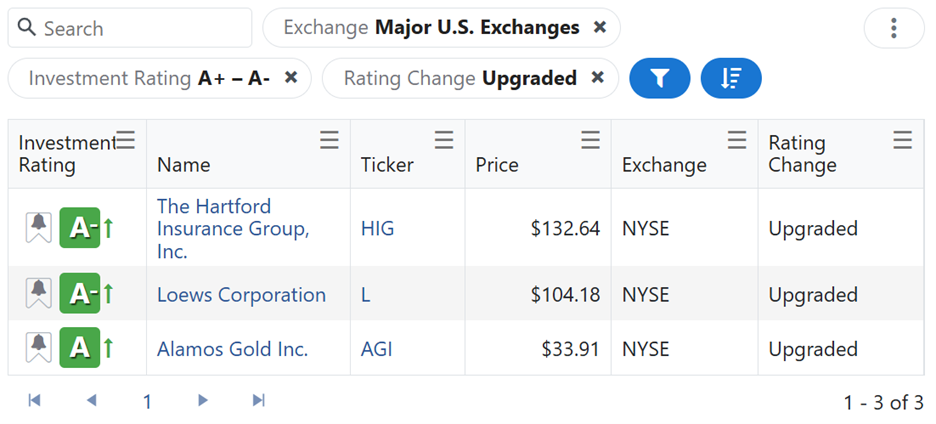

And instead of one stock, three freshly upgraded “A” companies popped up:

The beautiful thing about this simple screen is that it doesn’t necessarily target hidden, unknown companies …

It doesn’t care if it’s a fast-moving AI darling or a boring, old consumer staple.

It simply goes through all 10+ terabytes of data we have here at Weiss Ratings and finds the very best of the best that have momentum at their back.

And today’s list has triple the offerings as it did a month ago or a year before that:

None of these are particularly “new” by any means.

And they are in very different sectors — two insurers and one precious metals miner.

But they share the most important characteristic: A big, fat stamp of approval from Weiss Ratings.

And while I love to share the results of this screen frequently here in Weiss Ratings Daily when I can, you don’t have to wait to find out which companies will come up next.

You can run this screen anytime you want when you join Weiss Ratings Plus. There, you have full access to:

- The Stock Ratings Analyst tool …

- Special screeners that are updated every day, showing you stocks that were just upgraded to “Buy” or downgraded to “Sell” …

- Others like “The Ultimate Dividend Power List” and “Wall Street’s Untapped Gems” …

- Special reports like “The Best Way to Play AI’s Second Wind” and “The World’s Weakest & Strongest Banks” …

- Monthly “State of the Ratings” issues …

And so much more!

So, if you’ve gotten anything out of these little updates — last month’s, last year’s or today’s — I recommend you follow the instructions at the end of this video to turn on your full access to Ratings Plus.

Cheers!

Gavin Magor