|

| By Jim Nelson |

Your Weiss Ratings experts cover A LOT of types of investments. Just this week, they gave you several profitable ideas that are as diverse as you could ever want.

Sean Brodrick, your resource guru, recommended you buy silver just a few hours before it jumped 2%, while gold fell 3.5%. These two don’t often diverge to that degree.

The day before, Chris Graebe — your startup specialist — shared one of the most overlooked aspects of finding the best private equity investments … the “Money Person.”

But the stock market is still ripe with opportunities.

Take Research Director Gavin Magor’s advice to follow to billions of data points in our Weiss Ratings.

He found an unusual pair of fresh “buys” that have done the opposite of what the rest of the market’s been up to over the past month.

Michael A. Robinson — one of the best tech traders I’ve ever seen in action — declares that data is king. He recommends a company that is a data dynamo.

That leaves the final expert for this week — safe money specialist Nilus Mattive.

He shared how his 25-year career in the investment game has changed how he looks at markets.

And the most important lesson he’s learned is to make sure his readers are diversified in their portfolios.

It didn’t take long to see that advice pay off. There are two charts that explain why.

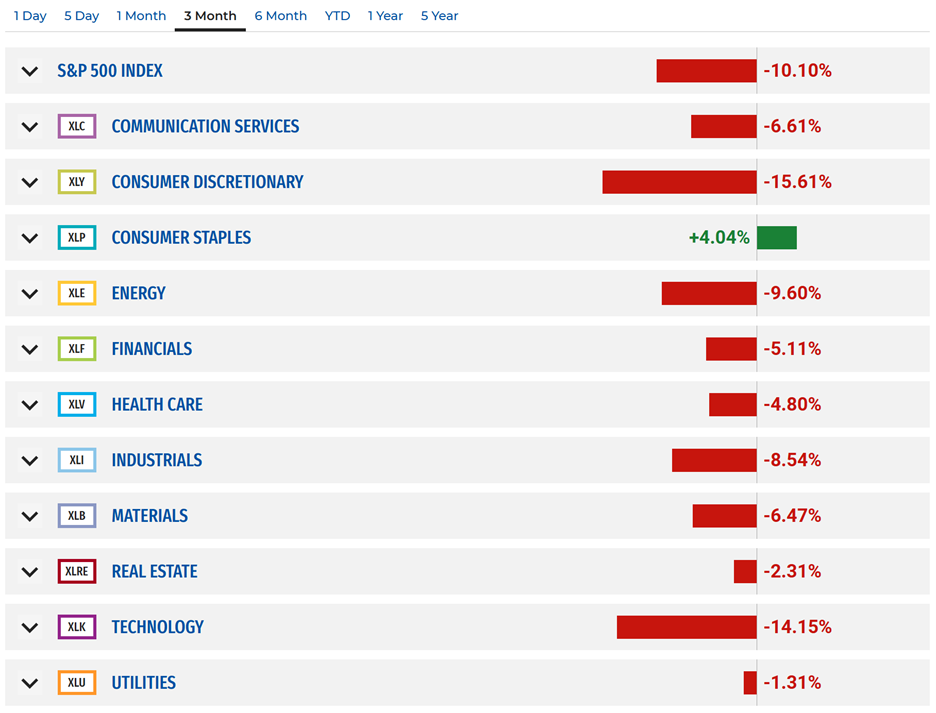

First, here’s what each sector of the S&P 500 has done over the past three months:

That’s a lot of red. But look at that one green bar — consumer staples.

That makes sense. We can’t do without food, cleaning products, etc.

That itself is a great endorsement for Nilus’ point. We all need to diversify our portfolios. But this next one seals it.

Here’s what those same sectors have done in just the past five days — when Nilus wrote about the subject:

Obviously, this has been a pretty good week for most stock investors. But this time, there’s just a sole red bar. Again, consumer staples stand alone.

This doesn’t mean you should try to time when to get into or out of staple stocks. In fact, it shows the opposite.

Those stocks are safe. So, they can add ballast to portfolios in free falls. But they aren’t exactly known to be fast growers. So, they lag in giant upswings.

The diversification Nilus discussed is about owning all kinds of investments — both inside and outside of asset classes — to weather this market.

There’s another great tool for that. And it goes back to what Gavin pointed out earlier … use the data. After all, Michael called it king.

And with a new system introduced just this week, you can use the six terabytes of data that Weiss has gathered — going back 100 years — to gain an enormous leg up on the rest of the market.

This system doesn’t discriminate between sectors. It simply chooses the absolute best to own over a short amount of time.

I urge you to watch Dr. Martin Weiss explain exactly how it works here.

That’s it for this week. Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily