As Another Bank Bites the Dust, Investors Wonder Who’s Next

|

| By Gavin Magor |

A bank’s biggest responsibility is to make sure customers feel confident that under any circumstances, their money will be safe and available to withdraw on demand. Period.

And, so far, despite the failures of three midsize regional banks since March 10 — Silicon Valley, Signature and now First Republic — not one depositor has lost a single penny. Not even those with more than the FDIC-insured amount of $250,000.

A short-term inconvenience is likely all anyone experienced and will experience should another failure occur. Shareholders of each, of course, are screwed. Unfortunately, investors are always last in line to be made whole.

You’d think that the protection afforded by the FDIC, Uncle Sam and bigger banks that came to the rescue to minimize or even eliminate damage would reassure folks to think and act more rationally.

But nothing’s changed since SVB’s troubles came to light thanks to the media, online social sites and some venture capitalists who are up to no good. News spread fast and far. Customers withdrew money at a record pace and in massive amounts.

So did customers at other similar banks, moving assets to those deemed too big to fail. The narrative became and remains, “if this can happen to SVB, how do I know it can’t happen to mine?”

You may not want to hear my answer. But the truth is …

Bad Things Happen to

Both Good & Bad Banks

Even solvent institutions with assets that exceed the value of liabilities can fail if a run is so severe that it can’t convert assets into cash fast enough to satisfy customer demands.

Obviously, mismanaging risk in a rising rate environment, overloading on cheap bonds, catering to niche, high-wealth clients and lack of regulatory oversight and lower standards for banks under the $250 billion threshold all played a part in this trio of failures.

But they weren’t necessarily destined for failure. Banks go through cycles — just like stocks and the economy — without skipping a beat, and customers are unaware.

They can’t, however, survive a lack of trust. It’s no different than marriage. If your spouse thinks you’re cheating — even without signs or proof — you’re still in a heap of trouble.

That’s because people will believe what they want, and it sometimes becomes a self-fulfilling prophecy. So, the run on banks thus far hasn’t really been based on reality and logic, and certainly not financials.

The way I look at it, while SVB, Signature and now First Republic are all guilty of taking on high risks and holding too many unrealized losses, they’re also victims of circumstance.

Even as First Republic attempted to stay afloat and fix its problems, the bank lost deposit after deposit after fearful customers moved money into bigger, highly-regulated banks perceived to be more secure.

In addition to the uninsured deposits, First Republic was also carrying many principal-only mortgage loans with fixed, long-term interest rates that have begun to lose value in the face of rising interest rates.

By the time the bank reported earnings last Monday, it had already lost $100 billion in deposits shortly after the SVB and Signature failings. And a $30 billion shoring up by a group of banks to help keep it afloat wasn’t enough to save FRB.

They were also hampered by folks within the organization making a run of their own, creating even more pain for First Republic.

If people continue to react hastily, and feed off each other’s fears and insecurities, you can count on more failures. If enough people take enough money out at one time, any bank is in danger.

Keep Calm

& Trust the System

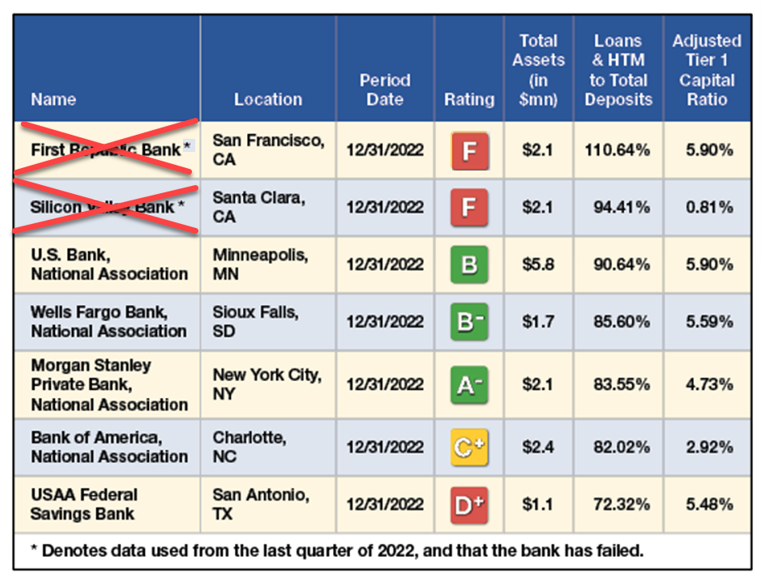

When Weiss Ratings recently released a list of banks that we were most concerned with. Of course, we called out First Republic Bank atop that list. It actually leveraged and utilized more than 100% of its deposits.

Click here to see full-sized image.

And its adjusted tier 1 capital ratio wasn’t strong enough for us not to be concerned about the higher risk they carried in terms of potential duration gap and sudden losses.

At least, anyone who heeded our warnings as a shareholder or customer of First Republic — and acted on it — saved themselves from a bit of anguish. We also called out Morgan Stanley Private Bank, National Association.

Our main concern for them was the slightly high utilization of deposits with just less than 84% of loans and HTM to total deposits, and a slightly low-adjusted tier 1 capital ratio (4.7%). For those reasons, we said we needed to keep an eye on this bank, as well.

Even Bank of America (BAC) made our list for its high-risk strategies and ratios.

So, if there are enough people running scared, what’s to say there couldn’t be a run on BAC’s assets, as well?

So, let’s recap: Three of the four largest-ever U.S. bank failures have occurred in the past two months. First Republic, with some $233 billion in assets at the end of Q1, ranks just behind the 2008 collapse of Washington Mutual Inc.

And just like back in 2008 when JPMorgan Chase (JPM) saved Washington Mutual, the bank — and all of its $2.4 trillion in assets — came to First Republic’s rescue, as well.

Investors in banks — those who really have something to lose — appeared to like the move on Monday when JPM CEO Jamie Dimon told the world he thought “the worst was over.”

Regional bank stocks showed stability then, but they were absolutely crushed the following day when PacWest (PACW) and Western Alliance (WAL) both reported double-digit declines in quarterly deposits. After several volatility halts throughout the day, shares finished down 28% and 15%, respectively.

In fact, it proved to be the worst trading day for the sector since the fall of SVB.

As often happens in troubling times, the small get weaker and the big get stronger — and with even more clout.

And JPMorgan, the largest bank in the U.S., just got larger — not just from the $229 billion in assets from the buyout — but from the $104 billion in new deposits from panicky customers looking to move their money to a too-big-to-fail bank following the previous failures.

Perhaps this intervention might convince the masses that our banking system is fundamentally sound and their money safe.

So, let’s just all take a collective deep breath and calm down because we’ve got another potential problem to deal with: JPMorgan Chase, along with Bank of America, Wells Fargo (WFC) and Citigroup (C) are the four largest holders of assets in the U.S.

It begs the question whether we’re heading toward an oligarchy in the banking industry, and if JPMorgan should’ve been allowed to buy First Republic as the “too-big-to-fail” creed rears its ugly head once more. However, if we all trust more in the system, then it might not even come to that again.

That’s all for today. I’ll have more for you soon.

All the best,

Gavin Magor

P.S. Back in December 2018, talking heads were calling “the death of crypto.” At the same time, Weiss Crypto Analyst Juan Villaverde was calling the start of the largest bull market of any asset class on the planet.

Spoiler alert: The talking heads were full of hot air. Juan was right. Investors who understood that risk and were glad to buy at bargain prices could’ve seen our list of high-rated coins surge dramatically — 20x, 54x, 102x and even as high as 234x!

How did Juan know to call the start of the next big bull? He’s a student of the cycles, and using his Crypto Timing Model, Juan monitors the cycles to determine when to act. As the next leg of the crypto bull market heats up, you can learn more and join him by clicking here.