As the recession debate tug of war continues, we received good inflation news Wednesday morning.

The U.S. Bureau of Labor and Statistics released its Consumer Price Index reading for July, which was flat from June and up 8.5% year over year — a marked improvement from last month’s reading of 9.1% YoY.

The market immediately took note, with the Dow jumping 400 points during morning trading and the Nasdaq rising 2%. This comes on the back of over a month of strength in the S&P 500, which at the time of writing is up 14.26% since bottoming in mid-June.

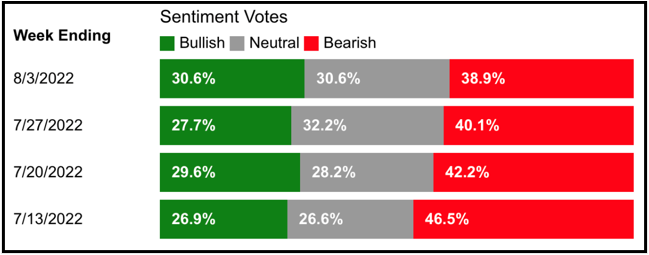

Investor sentiment is also on the rise, seeing its best week in months. According to the American Association of Individual Investors, bearish sentiment — which was nearly 47% in mid-July — is now reading 38.9%, and the bull-bear spread trend has shifted into neutral territory.

With market conditions turning bullish in the short term, our editors and analysts are reporting on arising opportunities in what has otherwise been a difficult market to navigate in 2022. Here are this week’s top stories from your favorite Weiss Ratings experts.

Harvest Profits as Food Demand Surges

Senior Editor Tony Sagami, the son of a vegetable farmer, knows a thing or two about global food demand. And right now, the indication is that companies involved in agribusiness are in the sweet spot of inflating food prices as the world’s population approaches 8 billion.

VIDEO: Behold the Dividend Raisers!

The Fed’s walking a tight rope by addressing runaway inflation while trying not to initiate a full-blown recession. In this segment, Financial News Anchor Jessica Borg speaks with Research Analyst Sam Blumenfeld about dividend-raising stocks investors can target to offset potential drops in share prices.

This Bank Stock Is Buffett Approved

When Warren Buffett makes a move, investors notice. That’s why his recent stake in a bank leveraged to auto loans for used vehicles should be on your radar. Editorial Director Dawn Pennington explains why the Oracle of Omaha is defying Wall Street’s take, and why you should consider doing the same.

VIDEO: Market Minute with Kenny Polcari

A range of data points arrived this week, but two indicators particularly captured the market’s attention: the Consumer Price Index and the Producer Price Index. Kenny Polcari, host of Wealth & Wisdom, discusses macroeconomics in this week’s Market Minute.

A Safe Haven to Weather the Market’s Turmoil

Considering how the Fed can't control major inputs of inflation, including oil prices, interest rates could rise for longer than Wall Street is anticipating. Senior Analyst Sean Brodrick shares a safe haven for investors as the second half of 2022 looks to be as tumultuous as the first.

Find Opportunity in This Lousy Market

Our Weiss Ratings data confirms the market is lousy. There are currently just 19 “Buy”-rated stocks. That’s a mere 5.8% of the more than 10,600 companies we rate. But according to Mike Larson, senior analyst and Weiss Ratings’ income-investing specialist, investors can still find gains if they look in the right places.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily