In a belated attempt to quell a 40-year high in inflation, the Federal Reserve is raising interest rates at the fastest pace in nearly three decades.

The VIX index — a gauge of market volatility — has calmed, dropping 22.3% lower than the preceding week’s highest point.

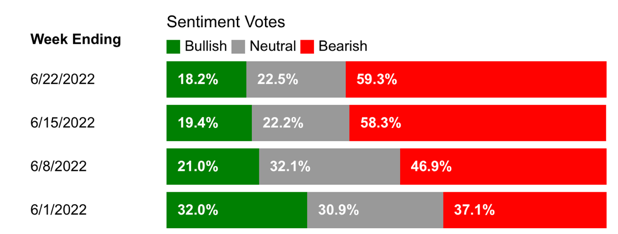

But investor sentiment remains solidly in bearish territory. For the week ending June 22, the American Association of Individual Investors reported 59.3% of respondents were bearish — the fourth consecutive weekly increase.

So, as bear-market fears continue to spread, where should you turn to find sound investments in an increasingly unpredictable market? Our edits and analysts have the answers. Here are this week’s top stories from your favorite Weiss Ratings experts.

VIDEO: A Prescription for Profits in a Bear Market

Soaring inflation, rising interest rates and the threat of a recession are among the crises weighing heavily on the markets. In this segment, Financial News Anchor Jessica Borg interviews Senior Analyst Sean Brodrick about high-performing stocks in a recession-resistant industry, and a prescription for profits in a bear market.

How to Strong-ARM Profits out of the Housing Market

Mortgage rates hit their highest level since 2008 but are still low by historical standards. Yet adjustable-rate mortgages (aka ARMs) have suddenly regained popularity. Senior Editor Tony Sagami reports on the housing market and how investors can take advantage of the ongoing home supply shortage.

Sauce Up Your Portfolio This Fourth

The Fourth of July is Monday, and cookouts are on Americans’ minds. This week, Editorial Director Dawn Pennington tapped into her Steel City roots and dove into the ratings to find out which sauce company — be it Heinz or another — makes for the safest investment this Independence Day.

What to Do in This Bear Market Rally

This week’s bounce has every hallmark of a bear-market rally. It came out of the blue. It can be extremely powerful. And it can easily lure investors into the wrong positions. According to Senior Analyst Mike Larson, it wasn’t high-quality stocks leading the way … and investors should take certain steps to help them capitalize.

Inflation recently surged to a 40-year high, many are bracing for worse to come. Despite that, what Senior Analyst Sean Brodrick thinks may shock you: The next thing we could very well see is inflation cooling off.

Until next week,

The Weiss Ratings Team